Founded in 1785, DuBois et fils sells watches directly to US consumers, which accounts for about 15% of its global revenue. In the days leading up to the implementation of Trump's 39% import tariff on Swiss goods, the company rushed five high-end watches, each worth thousands of USD, to the US.

On 6/8, they stopped taking orders on their US website. CEO Thomas Steinemann is calculating the necessary price increases. He gave the example of the DuBois DBF008, which could increase from 10,800 USD to 14,500 USD. According to Steinemann, the US market has been a major driver for the industry for the past two years, but the tariffs will cripple many businesses. "This is a major disaster," he said.

In Geneva, Sacha Davidoff, owner of a vintage watch shop, said many in the industry are shocked. They had hoped for a deal similar to, or better than, the 15% tariff Trump imposed on most goods from the European Union. Switzerland is not part of the EU.

"We are living a nightmare that we had hoped wouldn't come true. Every morning I wake up and ask myself, 'Is this really happening?'", Davidoff said. He believes the 39% tariff is a "game over" figure for exports to the US.

|

DuBois et fils watches at a shop in Muttenz, Switzerland. Photo: Reuters |

DuBois et fils watches at a shop in Muttenz, Switzerland. Photo: Reuters

Watches are Switzerland's third-largest export, after chemicals and pharmaceuticals and machinery, accounting for 9% of the country's total exports in 2024. It is home to brands like Rolex, Patek Philippe, Tag Heuer (part of LVMH), Omega (part of Swatch Group) and IWC Schaffhausen (part of Richemont).

Last year, the US accounted for 17% of Switzerland's total watch exports of 26 billion Swiss francs (32 billion USD), according to the Federation of the Swiss Watch Industry. Reuters reported that the industry is facing significant pressure after US President Donald Trump unexpectedly announced the updated 39% tariff on Swiss imports on 31/7.

The tariff took effect on Thursday (7/8), after the Swiss president returned from an emergency trip to Washington without reaching an agreement. Now, many brands are starting to plan price increases, suspend US orders, and seek alternative markets for these expensive handcrafted items.

According to Amarildo Pilo, owner of watch brand Pilo & Co and founder of the Swiss Independent Watchmakers Pavilion, which represents 28 independent watch brands, the combination of the 39% tariff and a weaker USD against the Swiss franc will make Swiss watches about 65% more expensive for American consumers.

Swatch Group, Switzerland's largest watchmaker by volume and owner of brands like Omega, Tissot and Longines, increased prices by 5% after Trump's initial round of tariffs in April. Swatch Group CEO Nick Hayek said they had increased shipments to the US in advance and raised product prices.

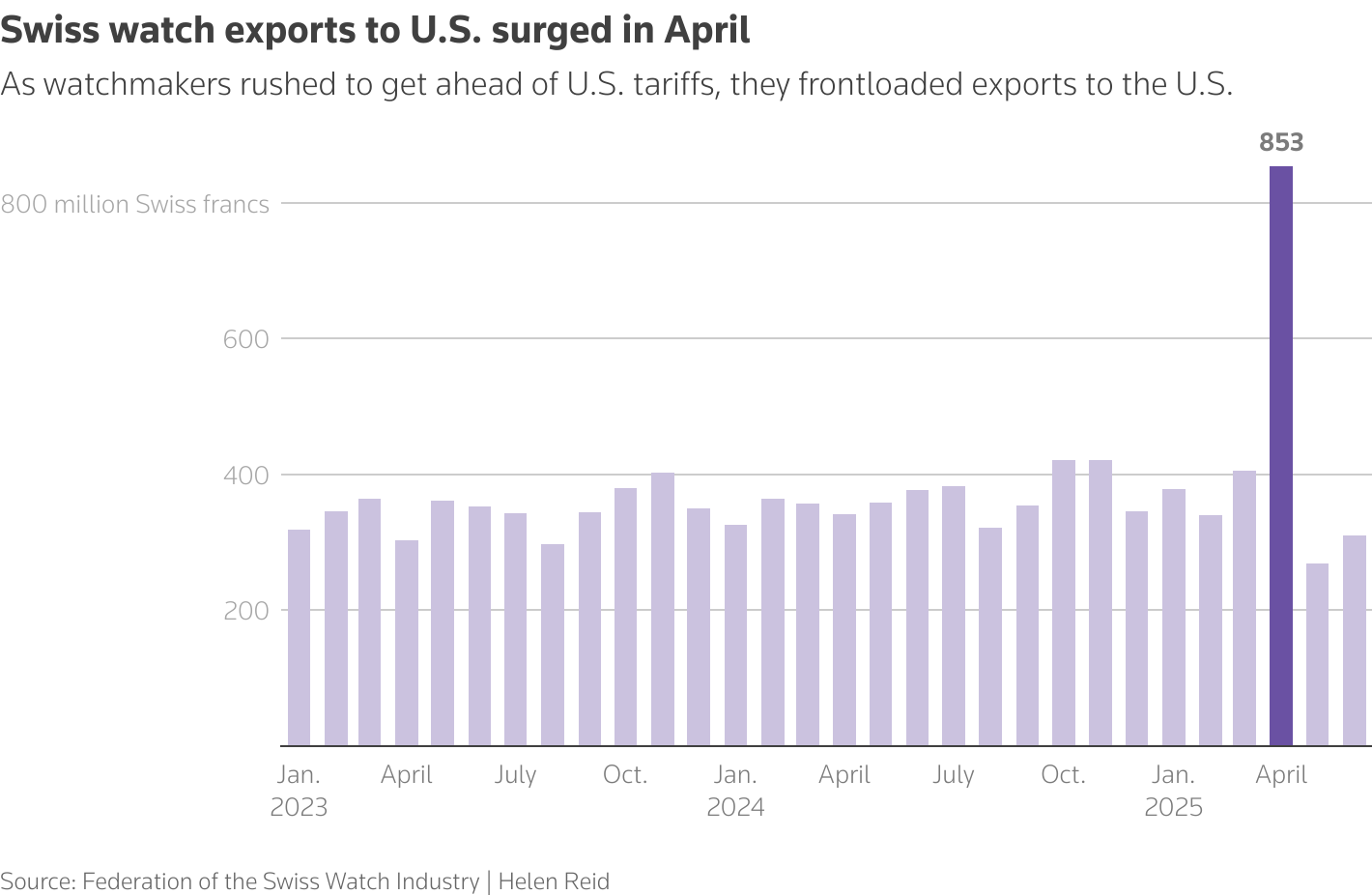

"We've shipped a lot of goods to the US, so we haven't been immediately affected," he said. Swatch currently has three to six months' worth of inventory in the US. The Federation of the Swiss Watch Industry confirmed that exports to the US generally surged in April, as watchmakers rushed to ship their goods.

|

Swiss watch exports to the US by month. Unit: million Swiss francs. Source: Reuters |

Swiss watch exports to the US by month. Unit: million Swiss francs. Source: Reuters

However, Amarildo Pilo believes that pre-shipping is not a sustainable solution. Jean-Philippe Bertschy, an analyst at private bank Vontobel (Zurich), also said that high inventory levels are only a short-term fix. "If the 39% rate remains, it will be a disaster," Bertschy said.

Another challenge for the Swiss watch industry is that to be labeled "Swiss Made," a product must have at least 60% of its components manufactured domestically, making it difficult to relocate factories.

"We manufacture entirely in Switzerland, not in China. Costs are already high, and if we add the 39% tariff, we cannot bear it. So, prices will definitely have to increase," the Swatch CEO said.

The only bright spot for watchmakers is the flexibility of their distribution channels. For example, Swatch can still reach US consumers while they travel abroad. "Customers now travel everywhere," Hayek said.

He gave the example of when China imposed luxury taxes, Chinese consumers shifted to buying in Macau and Hong Kong. "Americans have a lot of choices. They travel the world," he said, mentioning shops on cruise ships.

Similarly, Amarildo Pilo of the Swiss Independent Watchmakers Pavilion predicts that Americans will no longer buy Swiss watches in the US. "Those who really want to own and love them will find them elsewhere. Honestly, this is a loss for the US," he commented.

In addition, expert Jean-Philippe Bertschy believes that ultra-high-end watch lines will be able to pass on the tariff costs to consumers more easily than mid-range and popular segments.

As negotiations between Switzerland and the US continue, Sacha Davidoff hopes the situation will eventually be resolved. "I think this will be a difficult period when we will basically have to pause the US market and focus on domestic sales," he said.

Phien An (according to Reuters)