The "sweep accounts" model, which allows funds in checking accounts to automatically accrue interest, is well-established in developed markets like Singapore, the US, and China. Its popularity stems from customer benefits and robust legal frameworks, such as the FDIC in the US and the DGS program in Europe.

In Vietnam, the Deposit Insurance Law (effective since 2013) and Decision 32/2021 by the Prime Minister stipulate that each individual is insured up to 125 million VND at a single credit institution, under the supervision of the Vietnam Deposit Insurance Corporation and the State Bank of Vietnam (SBV). The SBV also mandates banks to maintain a minimum capital adequacy ratio (CAR) of 8% and undergo regular audits for compliance. These regulations protect depositors and contribute to financial system stability.

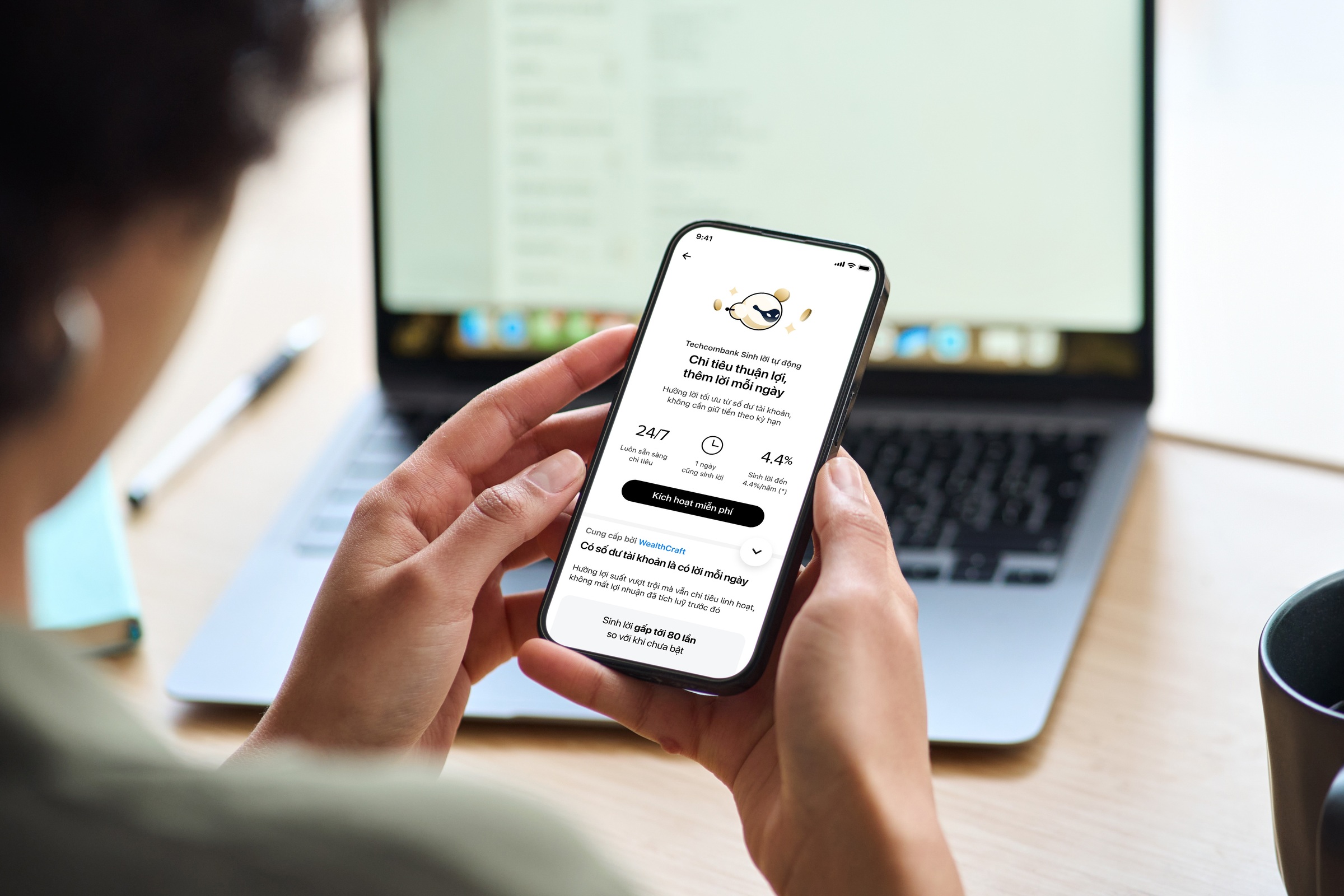

Building on this legal foundation, Techcombank pioneered its automatic savings program in 2024, offering interest on idle funds in checking accounts.

|

Customers can activate automatic savings on the Techcombank Mobile app. Photo: Techcombank |

Customers can activate automatic savings on the Techcombank Mobile app. Photo: Techcombank

This program allows account balances to earn interest while maintaining 24/7 transaction availability. Customers can transfer funds, make payments, and withdraw money anytime while still earning interest on the maintained balance, even for a single day, with a maximum annual interest rate of 4.4%.

The program also integrates with Techcombank Rewards, enabling customers to redeem U-points for additional benefits. The Techcombank Mobile app serves as a central personal finance hub, allowing users to track daily returns, check balances, and manage accounts anytime, anywhere.

Techcombank integrates AI, GenAI, and data platforms into the automatic savings program to ensure a transparent, secure, and efficient operating system. Jens Lottner, CEO of Techcombank, stated that launching this product required significant investment in technology, AI, and the integration of various products and features. These platforms analyze user financial behavior to automatically allocate balances into secure channels, optimizing returns without customer intervention.

"The bank has invested heavily in AI, GenAI, data platforms, and especially in our comprehensive financial ecosystem model. We will also continue to improve the automatic savings program based on customer feedback," Lottner said.

|

Jens Lottner, CEO of Techcombank. Photo: Techcombank |

Jens Lottner, CEO of Techcombank. Photo: Techcombank

Digitalization and intelligent data also deliver a seamless experience, contributing to Techcombank's 91% customer satisfaction (CSAT) score in Quarter I/2025. This has led to Techcombank being recognized as the "Best Digital Bank in Vietnam" and "Best Mobile Banking App in Vietnam" by The Asset Triple A Digital Awards for three consecutive years (2023-2025).

For years, Techcombank has maintained a stable financial foundation with strong profit growth and a high CASA ratio. In Quarter II/2025, the bank's total assets reached 1 quadrillion VND, with quarterly pre-tax profit reaching an all-time high. The CASA ratio exceeded 41%, the net interest margin (NIM) reached 3.8%, and the CAR under Basel II stood at 15%.

Beyond financial results, Techcombank has earned recognition from prestigious domestic and international organizations. In 2024, it was named "Best Bank in Vietnam" by Euromoney, FinanceAsia, and Global Finance, becoming the first Vietnamese bank to receive all three awards in a single year. Techcombank also received "Best Transaction Bank in Vietnam" and "Best Cash Management Bank in Vietnam" from The Asian Banker in 2024.

The automatic savings program itself garnered three international Stevie Awards, including one gold and two bronze, with Techcombank being the only Vietnamese bank recognized at the 22nd International Business Awards.

Minh Ngoc