On 30/7, the Federal Reserve (Fed) decided to hold its benchmark interest rate steady at 4.25-4.5%. In its post-meeting statement, the Fed noted that "the unemployment rate remains low, the labor market is robust, and inflation is rising."

This is the fifth consecutive time the Fed has held rates steady, despite months of pressure from former President Donald Trump. Before the Fed's announcement, Trump took to Truth Social, praising better-than-expected GDP growth, claiming the US has no inflation, and urging the "slow-moving Powell" to cut rates.

However, analysts suggest that interest rate decisions sometimes rely on intuition and experience rather than rigid formulas and rules, particularly given the US economy's unpredictable behavior, which has complicated the Fed's task.

Experts believe the US faces two economic scenarios, and Fed officials seem uncertain about the coming months. One scenario sees underlying economic weaknesses, currently masked by positive data, becoming more apparent. The other anticipates rising household assets and artificial intelligence investments helping the economy weather trade tensions.

|

Fed Chair Jerome Powell at the press conference on 30/7. _Photo: Reuters_ |

Powell is keeping all options open for the September meeting. He made no promises but ruled nothing out. "We haven't made any decisions about September", he said at the 30/7 press conference, emphasizing more data will be released before the next meeting.

Powell reiterated his desire to preserve the soft landing the economy achieved earlier this year, meaning cooling inflation without significant damage to the labor market. However, tariffs could push up prices, creating headwinds that could disrupt the Fed's calculations.

Fed officials are betting they can wait at least two more months to see whether tariffs will significantly drag down economic activity and ignite inflation or have a negligible impact. This wait, however, comes with risks.

Five years ago, the Fed implemented record monetary easing to mitigate the impact of Covid-19. However, they were slow to withdraw these policies, leading to soaring inflation. The Fed then had to raise interest rates repeatedly in 2022 and 2023 to address the situation.

On 30/7, Powell reiterated the Fed's commitment to ensuring inflation doesn't become entrenched. "We want to do that effectively. Cutting rates too soon will force us to raise them again later. That's not effective", Powell explained. Waiting too long, however, could cause unnecessary damage to the labor market.

|

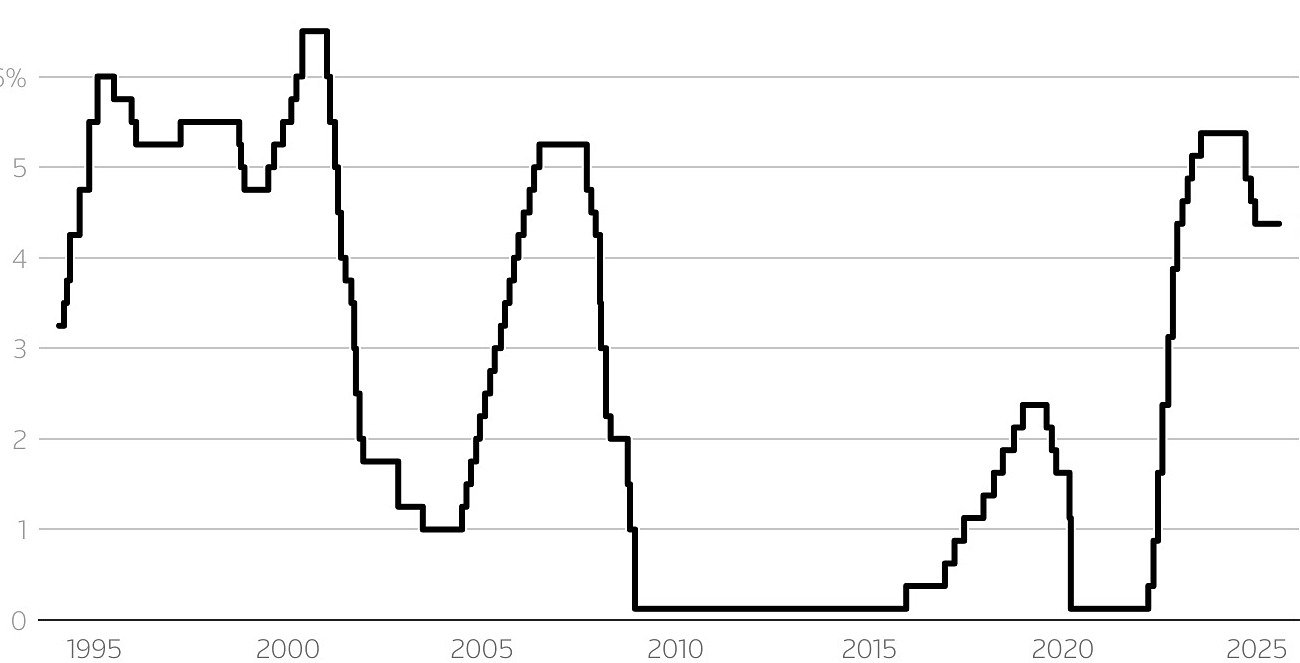

Chart of the Fed's benchmark interest rate (average) from 1995-2025. _Chart: Reuters_ |

In the first scenario, the steadily low unemployment rate masks underlying labor market weakness. "The 4.1% unemployment rate creates a false sense of security about the labor market's true state", said Neil Dutta, head of research at Renaissance Macro Research.

He explained that many people are not participating in the labor market but still want jobs. Additionally, many workers are not receiving raises, and almost half of all industries are not hiring. Two weeks prior, Fed Governor Christopher Waller raised similar concerns.

If the US labor market deteriorates, Powell's critics will have more reason to argue the Fed should have cut rates this week, if not earlier this year.

Waller believes the economy is not as strong as the headline numbers suggest. He was one of two governors who voted against holding rates steady. The Fed's statement indicated that Waller and Michelle Bowman wanted a 25 basis point (0.25%) rate cut at this meeting.

Powell didn't deny these concerns. He said the unemployment rate is stable because both labor supply and demand are declining at similar rates. "That's why we see downside risks in the labor market", he stated on 30/7.

Consumption is also showing signs of weakness. Recent data from the Bank of America Institute reveals that American spending on services like hotels, airfare, and dining out has declined for three consecutive months, a first since 2008. For low-income households, credit card spending has also fallen for three straight months, the first time in a year.

This suggests consumers are tightening discretionary spending as rent and insurance costs continue to rise. "If you want to know the state of the consumer, I'd say they're cutting back, but not frozen", said Liz Everett Krisberg, head of the Bank of America Institute.

The housing market presents another challenge, potentially exacerbating labor market weaknesses. Housing investment is declining, and the number of homes for sale is increasing, indicating that people are struggling to buy homes with mortgage rates above 6.5%.

However, in the second scenario, these data points could be mere noise. The US economy might continue to defy expectations if underlying strengths outweigh emerging weaknesses.

Ajay Rajadhyaksha, head of research at Barclays, noted that the US economy weathered aggressive rate hikes in 2022, a regional banking crisis in 2023, and now trade disruptions in 2025.

He believes two factors could support the economy: the AI investment boom, potentially offsetting weakness in interest-rate-sensitive sectors, and rising household assets, thanks to higher home prices and a strong stock market. Wall Street recently hit new highs as the US announced trade deals with partners and companies reported better-than-expected earnings.

"Every time I go to Asia or Europe, I see people misjudging the increase in US household assets over the past 4 years compared to the rest of the world", he said. Barring an unexpected shock like a spike in long-term government bond yields, "it's very difficult for the US to fall into a full-blown recession", Rajadhyaksha stated.

In this scenario, the Fed will have little reason to cut rates this year, according to Michael Gapen, chief economist at Morgan Stanley. Even if tariff-driven price increases are temporary, as Waller predicts, risks remain, especially if Republicans pass measures like tax cuts or consumer rebates to stimulate spending.

Rajadhyaksha believes the tariff-induced price increases will be a one-time event. However, he predicts the Fed will be unlikely to cut rates in September, as inflation data for July and August will reflect those price hikes.

Claudio Irigoyen, head of global economics research at Bank of America, believes it's risky to assume the full impact of tariffs will be felt within just a few months. "The pandemic was also such a temporary shock, and the Fed decided to ignore it. That was their mistake. Because that 'temporary' lasted two years – long enough not to be ignored", he explained.

He also pointed to other financial risks that make rate cuts unlikely. "If rate cuts are urgent, why is the stock market rising every day, and why is private credit booming?", Irigoyen asked.

Powell isn't rushing to find answers. "I think we're still in the early stages of assessing the impact of tariffs on the economy. All we need to do is watch and learn", he said.

Ha Thu (_via Reuters, WSJ_)