Dau tu Thien Long An Thinh, the largest shareholder owning 46,82% of Thien Long Group (TLG), is in negotiations with Kokuyo Group to transfer its entire stake. Additionally, Kokuyo plans to make a public offer to acquire an additional 18,19% of TLG's shares. If successful, Kokuyo's ownership will reach 65,01%, making Thien Long a subsidiary.

Thien Long Group, established in 1981, was founded by Mr. Co Gia Tho, who transformed a small workshop into a leading enterprise in pens and stationery. Thien Long is renowned for its namesake ballpoint pens, alongside other brands like Flexoffice stationery, Bizner premium pens, and Colokit art supplies. The company boasts a product portfolio numbering in the thousands, primarily focusing on pens, office supplies, art supplies, and student supplies. Thanks to early engagement in exports, its products are present in over 70 countries and territories.

After more than four decades, TLG has established a complete supply chain, from manufacturing and distribution to consumers. The company operates two production facilities. The first, Nam Thien Long in TP HCM, spans 1,5 hectares with a design capacity of approximately 550 million stationery items and pens annually. Later, they built Thien Long Long Thanh in Dong Nai, covering nearly 3 hectares, with a design capacity of about 250 million student supplies, art supplies, and pens per year. As of 2024, the automation rates at these two factories reached 78,7% and 66,1% respectively.

|

Mr. Co Gia Tho, Chairman of Thien Long Group's Board of Directors, interviewed by VnExpress at his office in 3/2025. Photo: Thanh Nguyen |

Mr. Co Gia Tho, Chairman of Thien Long Group's Board of Directors, interviewed by VnExpress at his office in 3/2025. Photo: Thanh Nguyen

TLG holds the number one position in Vietnam's pen industry, capturing 60% of the market share, according to Forbes Vietnam. A survey by market research firm Ipsos, involving 1,200 parents and secondary school students, also indicated that Thien Long is the most favored stationery brand. Its brand recognition reached 99%, and the regular usage rate of its products was 61%, significantly surpassing many competitors. This demonstrates that Thien Long's brand strength extends beyond consumer awareness to generate actual sales.

Thien Long's revenue first surpassed one trillion VND in 2011, with profits exceeding one hundred billion VND the following year. Its business results have shown consistent growth, with exceptions only during the pandemic and in 2023. According to calculations by Phu Hung Securities (PHS), TLG maintained an annual compound growth rate (CAGR) of 9,6% for domestic revenue between 2010 and 2024, excluding the pandemic period. Citing data from research firm Plimsoll, Thien Long reported that it ranked 18th globally in profitability within the stationery industry.

One primary reason for the company's sustainable business performance is its extensive and deep distribution system. The traditional channel (GT) originated in the 70s when Mr. Co Gia Tho pedaled his "old bicycle" to wholesale products to market traders. This channel later expanded and remains a cornerstone, with over 126 major distributors and 55.000 retail points.

Thien Long also maintains a dominant presence in the modern channel (MT), with nearly 3.800 sales points across supermarket chains, bookstores, and convenience stores nationwide. Concurrently, it holds direct supply contracts with banks, companies, factories, and hospitals. In recent years, TLG has ventured into e-commerce, developing its own sales website and listing products on major platforms.

In 5/2025, Thien Long acquired Phuong Nam Bookstore (PNC), leveraging its nearly 50 sales points nationwide. The company is preparing for an O2O (online-to-offline) model and accelerating the development of its toy and lifestyle product segments.

|

Thien Long ballpoint pens on a supermarket shelf. Photo: Quynh Tran |

Thien Long ballpoint pens on a supermarket shelf. Photo: Quynh Tran

However, for the first nine months of 2025, TLG reported an 11% decrease in after-tax profit, reaching nearly 376 billion VND, despite an almost 11% increase in revenue to nearly 3,225 billion VND. The main reason for this decline was the increase in recurring costs, particularly marketing and exhibition expenses. Management stated that the company had to invest heavily in sales and demand stimulation due to intense competition from industry rivals.

Phu Hung Securities also suggested that in the long term, price competition from cheap Chinese products flooding the market will challenge the company's profitability. Expanding into private labels and new product lines with distinct, highly competitive features is key to TLG's sustainable growth.

Concurrently, Thien Long aims for diversification by expanding its market reach. In 2024, international revenue recorded one trillion VND for the first time. The company targets a position within the top 5 in the Southeast Asian pen and stationery industry through a glocalization strategy, which involves leveraging domestic market strengths and adapting them for international application.

Regarding the share sale to Kokuyo Group, TLG's leadership expressed their expectation that the Japanese partner's involvement will create opportunities for cooperation in research and design, aligning with their global strategic direction. Kokuyo is a group with over a one hundred-year history in stationery and business solutions, known for its Campus brand.

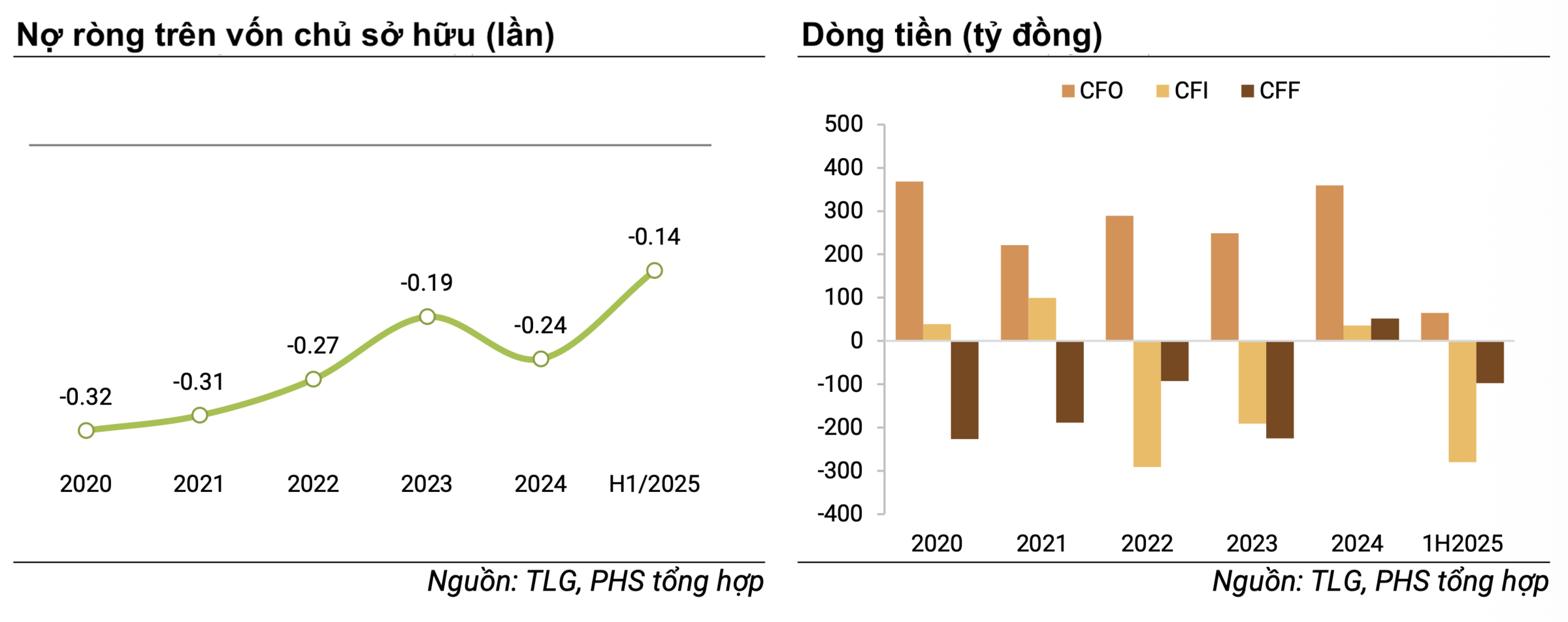

The company's greatest financial strength stems from a healthy asset structure, characterized by continuously negative net debt for many years. Cash and equivalents, along with short-term investments (entirely deposits), accounted for 30% of the total asset structure by the end of 9/2025. The company's cash flow also remains robust, with positive cash flow from operating activities in recent years, even during the two years of the pandemic.

According to PHS, healthy financial capacity combined with a relatively stable business model allows TLG to withstand external shocks and provides the company with the ability to invest in potential production projects and mergers and acquisitions (M&A).

|

Some financial health criteria for Thien Long Group, as of mid-2025. Photo: PHS |

Some financial health criteria for Thien Long Group, as of mid-2025. Photo: PHS

This is not the first time Thien Long has engaged with foreign capital. In 2019, Newell Brands—a leading US consumer and household goods brand—became a strategic shareholder. At that time, it held just over 7% and secured distribution rights for Flexoffice, TLG's stationery brand, in the Americas and Europe. Both parties had promised deeper future cooperation, but Newell Brands divested its entire stake approximately five years later.

During a conversation with VnExpress in 3/2025, Chairman Co Gia Tho recalled this deal, asserting that they only cooperated, did not form a joint venture, and "did not lose the essence of a Vietnamese brand". According to him, investment should involve mutually beneficial cooperation mechanisms that expand the market share "pie" and create synergies in technology and markets.

"This is an open era, a flat world, so whether a company is acquired depends on its own policies", Mr. Tho said.

Tat Dat