In a message to his 190 employees, Will Etheridge, CEO of Southern Energy Management in Raleigh, North Carolina, warned that the deep subsidy cuts planned in the "big beautiful bill" (OBBBA) would severely damage the clean energy sector. "These changes will almost certainly lead to job losses within our team. While difficult to share, you deserve to know the truth," Etheridge wrote.

In recent years, businesses have announced over $20 billion in clean energy investments in North Carolina. Southern Energy Management specializes in solar panel installation and energy efficiency improvements for buildings.

They lobbied North Carolina Republican Senator Thom Tillis to amend the OBBBA. Ultimately, Tillis was one of three Republican senators, along with all Democratic senators, who voted against the bill.

However, the OBBBA narrowly passed 51-50 on 1/7. The bill is now under consideration in the House for final approval before being sent to President Trump to be signed into law.

|

Southern Energy Management CEO Will Etheridge examines a solar panel to be installed in Chapel Hill, North Carolina on 2/7. Photo: AP |

Southern Energy Management CEO Will Etheridge examines a solar panel to be installed in Chapel Hill, North Carolina on 2/7. Photo: AP

The OBBBA's spending cuts target renewable energy incentives. It would end the 30% tax credit for residential rooftop solar by the end of the year, a credit that the Biden administration's Inflation Reduction Act extended into the next decade.

President Trump views these subsidies as part of a "green new scam." He believes tax dollars are being misused to serve a global climate agenda and energy sources like wind and solar.

Some US businesses and analysts say the Republican-backed "big beautiful" bill will reverse the growth of the renewable energy sector and lead to job losses. "The residential solar industry will be crushed by this bill," warned Bob Keefe, executive director of E2, a business group that advocates for environmentally friendly policies.

The OBBBA not only targets residential solar but also plans to phase out tax credits for large-scale solar and wind projects. However, the residential sector will be the first and most affected.

Specifically, the Senate-approved version of the bill removed a tax on wind and solar projects that had been proposed in the earlier version. It also allows large-scale projects that begin construction within a certain timeframe to continue receiving tax credits before they are phased out.

|

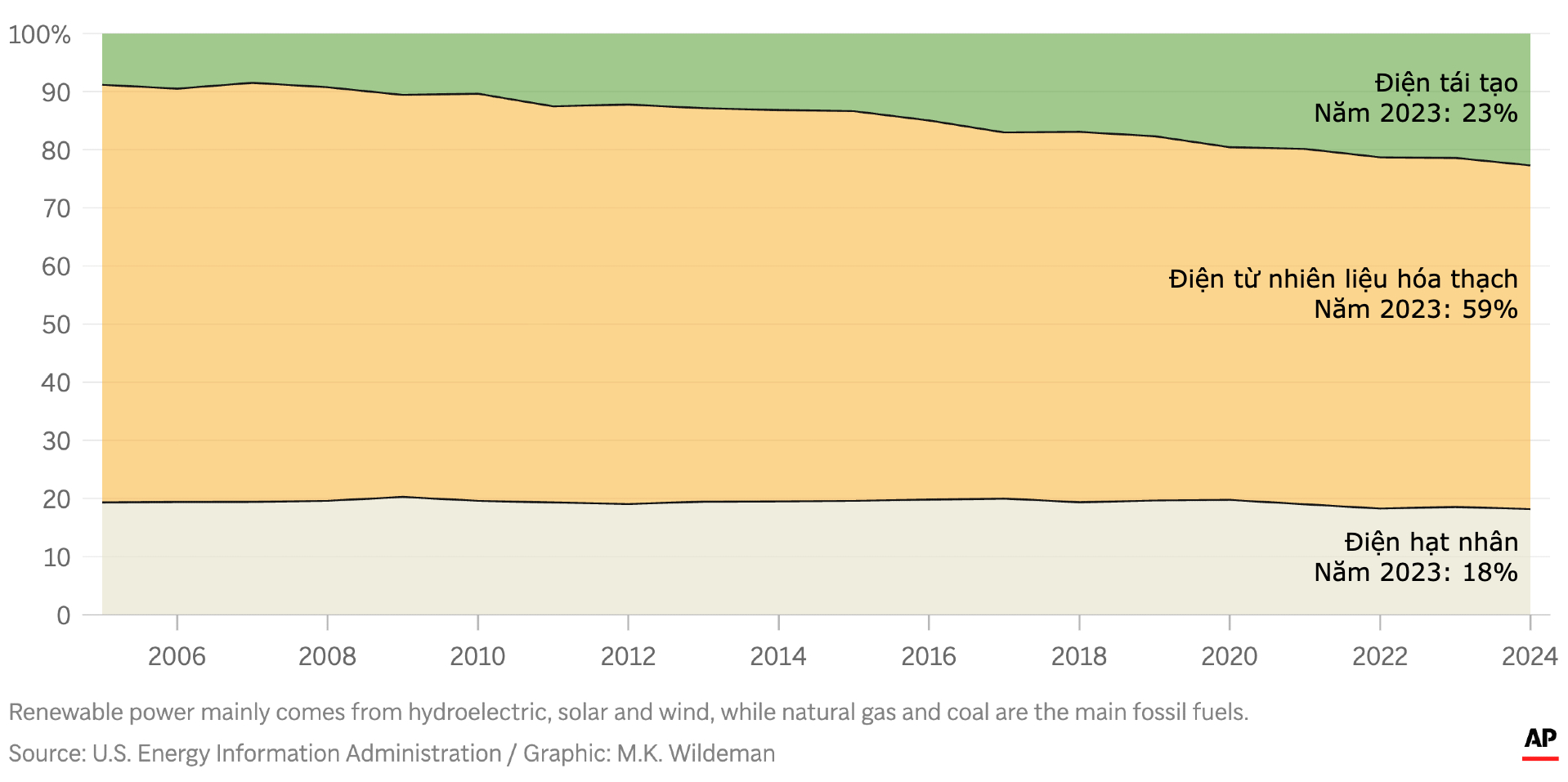

US electricity sources over the past two decades. Graphic: AP |

US electricity sources over the past two decades. Graphic: AP

Karl Stupka, president of NC Solar Now, a company with about 100 employees, said the bill partially impacts commercial solar projects, but for residential projects, it's a "complete destruction of incentives." "They've taken away the benefits from ordinary people and given them back to wealthy business owners," he said.

Residential solar accounts for about 85% of NC Solar Now's revenue. Stupka predicts that if the bill becomes law, companies will rush to complete as many solar projects as possible before the incentives expire. He anticipates laying off half his staff, and expects job losses to spread elsewhere. "This will cause a pretty serious shock," Stupka warned.

Southern Energy Management CEO Will Etheridge has also begun considering plans to lay off 50-55 employees. He called the elimination of tax credits for residential solar a "bait and switch." Trusting in the stability of this policy, he had decided to leave his job, borrow money from his grandmother, and mortgage his house to buy a stake in the company. Now, he's forced to find ways to diversify his business to survive.

Countering the concerns of Etheridge and other businesses, Adam Michel, director of tax policy studies at the Cato Institute, argued that if these businesses "rely on federal government cash flow, they shouldn't have existed in the first place." He predicted that the OBBBA would not cause a wave of bankruptcies in the renewable energy industry.

"They’ll have to downsize to fit the market, and the people who lose their jobs at those companies will eventually find better, more stable jobs in industries that are actually viable and don't require billions of dollars in government subsidies," Michel said.

Even before the bill was debated, E2 experts reported in May that about $14 billion in clean energy investments across the US had been postponed or canceled this year.

Phien An (AP)