Asia is a net food importer, with rising populations and incomes driving increasing demand. The region accounts for approximately 30% of the world's wheat, corn, and soybean meal imports, according to the US Department of Agriculture.

This makes Asia a crucial market for global agricultural suppliers, from the US, Australia, and Canada to the Black Sea region and Latin America. Over the past decade, however, supplies from the Black Sea and South America have gained market share in Asia, surpassing the US.

Trump's tariff policies may reshape this agricultural landscape. In recent trade negotiations, several Asian countries have committed to increasing purchases of US agricultural products.

"US agricultural exports will clearly gain market share in Asia," said Ole Houe, director of advisory services at IKON Commodities in Sydney.

|

Soybean harvest in Roachdale, Indiana, US on 8/11/2019. Photo: Reuters |

Soybean harvest in Roachdale, Indiana, US on 8/11/2019. Photo: Reuters

Indonesia and Bangladesh have already taken action. Reuters sources from two grain traders in Singapore indicate that Indonesian flour mills have purchased roughly 250,000 tons of US wheat since July. The Indonesian Wheat Association signed a memorandum of understanding to purchase 1 million tons annually from Washington as part of trade negotiations for lower tariffs. Last year, the US sold 693,000 tons to Indonesia.

"Price plays a key role as these are private agreements between mills, but buying 1 million tons of US wheat won't be a problem for us," an association official stated.

Bangladesh has approved the import of about 220,000 tons of US wheat. On 20/7, the country committed to purchasing 700,000 tons annually to boost trade relations.

Several other Southeast Asian countries have outlined similar plans. In early June, Vietnamese businesses signed memorandums of understanding worth nearly 3 billion USD to purchase US agricultural, forestry, and fishery products.

Meanwhile, traders estimate that Thailand will purchase over 1 million tons of corn for animal feed, replacing current supplies from the Black Sea and other Asian countries. The Philippines' demand could be even higher, reaching up to 3.3 million tons.

Furthermore, following the announcement of a trade agreement on 1/8, Thailand's Ministry of Finance stated the country would import up to 2 million tons of soybeans from the US. However, detailed plans have yet to be revealed.

Observers are closely watching agricultural agreements between Washington and Beijing. This is a critical test of whether the US can reclaim its agricultural standing in Asia.

China is the largest market, spending 29.25 billion USD on agricultural products from the US last year. This figure is down over 25% from its peak of 40 billion USD in 2022, due to Beijing's tariffs on US soybeans and other agricultural goods.

Recently, Trump urged China to quadruple its soybean purchases. Last year, China spent 12.8 billion USD on US soybeans, representing about half of total US soybean exports.

China's top trade negotiator, Li Chenggang, will visit Washington this week to hold talks with US officials. It's possible China will increase its spending on US agricultural products compared to last year's figures.

|

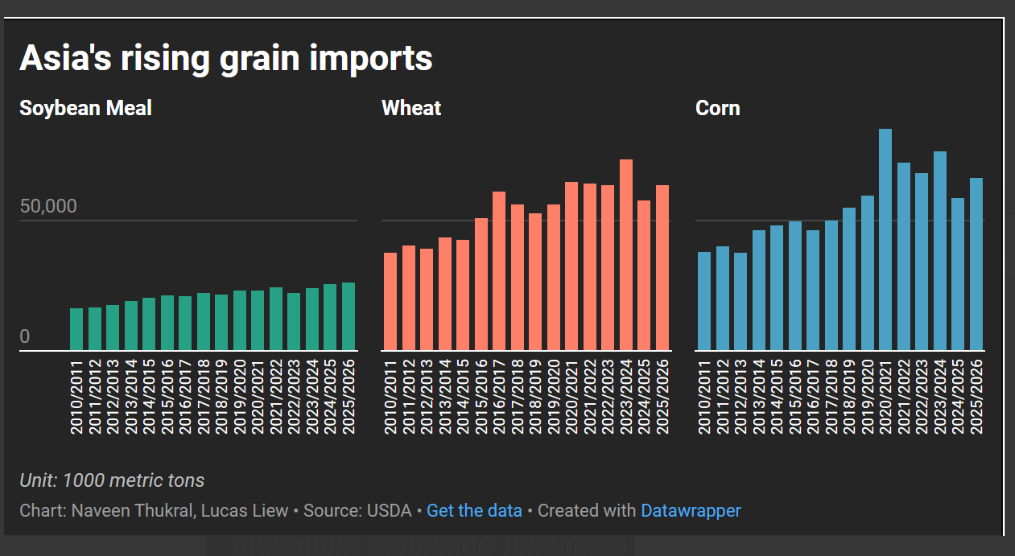

Asian imports of soybean meal (green), wheat (orange), and corn (blue) from the US over the past 15 years, Unit: 1000 tons. Source: Reuters |

Asian imports of soybean meal (green), wheat (orange), and corn (blue) from the US over the past 15 years, Unit: 1000 tons. Source: Reuters

Overall, US agricultural products are not only benefiting from Trump's tariff pressure but are also competitively priced. "Equally important is that US wheat, corn, and soybean meal prices are cheaper than supplies from competing exporters," noted Ole Houe of IKON Commodities.

Three Australian traders estimate they could lose several hundred thousand tons of grain sales in the Indonesian market as the archipelago nation shifts to buying more US goods. The Australian Bureau of Statistics reported that Australia exported 3 million tons of wheat to Indonesia in 2024.

"If sales to Indonesia or Bangladesh decline, that wheat will likely be diverted to more distant locations," explained Tobin Gorey, founder of the commodity consultancy Cornucopia in Australia.

Competition in China is more challenging, as the country is increasingly purchasing agricultural products from Latin America. The US agricultural market share of China's total imports has decreased from 20% in 2016 to 12% last year. Meanwhile, Brazil's share has increased from 14% to 22%.

Additionally, the world's second-largest economy is striving to reduce its reliance on imports. In April, Beijing announced plans to reduce the amount of soybean meal in animal feed by 10% by 2030. This move could cut approximately 10 million tons of annual imports, equivalent to nearly half of US soybean exports to China last year.

Phien An (Reuters)