Throughout last month, ITS Logistics, a fulfillment and distribution company, relabeled millions of products before they reached consumers. Clothing and consumer goods saw price increases between 8% and 15% before reaching stores or individual customers.

|

A supervisor walks through the Peapod grocery distribution warehouse in Jersey City, New Jersey, USA, on 21/8/2018. *Photo: Reuters* |

"These increases will contribute to inflation," said Ryan Martin, president of ITS Logistics. He added that the last time the company engaged in such widespread relabeling was during the pandemic, but the volume of goods requiring relabeling then was much higher.

US goods prices are rising. According to data released by the US Department of Commerce on 27/6, the personal consumption expenditures (PCE) price index rose 2.3% year-on-year in May, exceeding the Federal Reserve's (Fed) 2% target.

A day earlier, Nike reported a $1 billion loss due to tariffs in its 2026 fiscal year (beginning 1/6). They anticipate this loss will decrease as they raise retail prices and reduce reliance on Chinese manufacturing.

In a second-quarter survey by the Footwear Distributors and Retailers of America, 55% of businesses surveyed expect to increase retail prices by an average of 6% to 10% this year.

Beyond impacting final prices, tariffs are affecting inventory management strategies for retailers and manufacturers. Due to concerns about trade uncertainty and weak consumer demand, businesses are reducing the number of SKUs (stock keeping units) in warehouses and imports.

Storage duration is also being reconsidered. Instead of importing a 6-month supply, businesses are considering reducing this to 3 months, according to Martin.

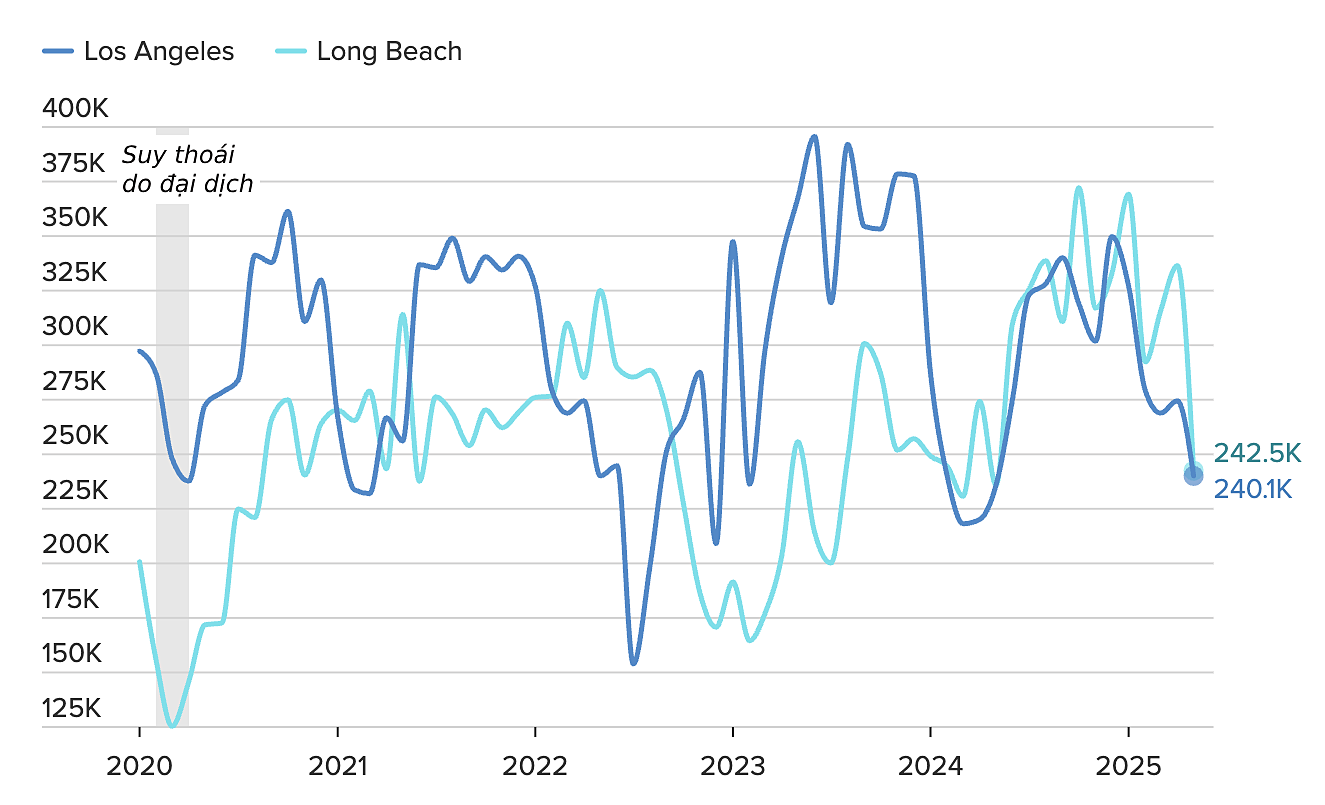

The Port of Los Angeles Optimizer, a maritime trade tracker, forecasts lower imports next month into the ports of Los Angeles and Long Beach. July and August are typically peak import months for the back-to-school and holiday shopping seasons. Los Angeles and Long Beach are the two largest ports on the US West Coast and major gateways for goods from Asia.

Zachary Rogers, associate professor of supply chain management at Colorado State University, predicts that imports, especially manufacturing-related items, will be lower than expected due to tariffs. Oxford Economics previously forecast a further $4.3 billion decline in consumer goods imports, following a $33 billion drop in April.

A key indicator of future orders is the movement of empty containers, essential for maintaining export flows. During the pandemic, empty containers were prioritized for return to Asia for reloading and export back to the US. However, empty containers at the ports of Los Angeles and Long Beach haven't been rushed back.

|

Number of empty containers at the two largest ports on the US West Coast. Unit: TEU. *Source: CNBC, Port of LA and Long Beach* |

"The large number of empty containers sitting at the port suggests that importers are not expecting the typical August-September peak shopping season in the US," Rogers said.

From a business perspective, the president of ITS Logistics believes a low inventory strategy is appropriate given the unpredictable nature and difficulty in forecasting future goods costs.

Bao Bao (*via CNBC, compiled*)