As small and medium-sized enterprises (SMEs) increasingly prioritize financial flexibility and efficiency, establishing a robust cash flow management system is crucial, according to a VIB representative. The VIB Business app addresses this need by offering 100% online account opening and integrated tools for automated and transparent financial management.

|

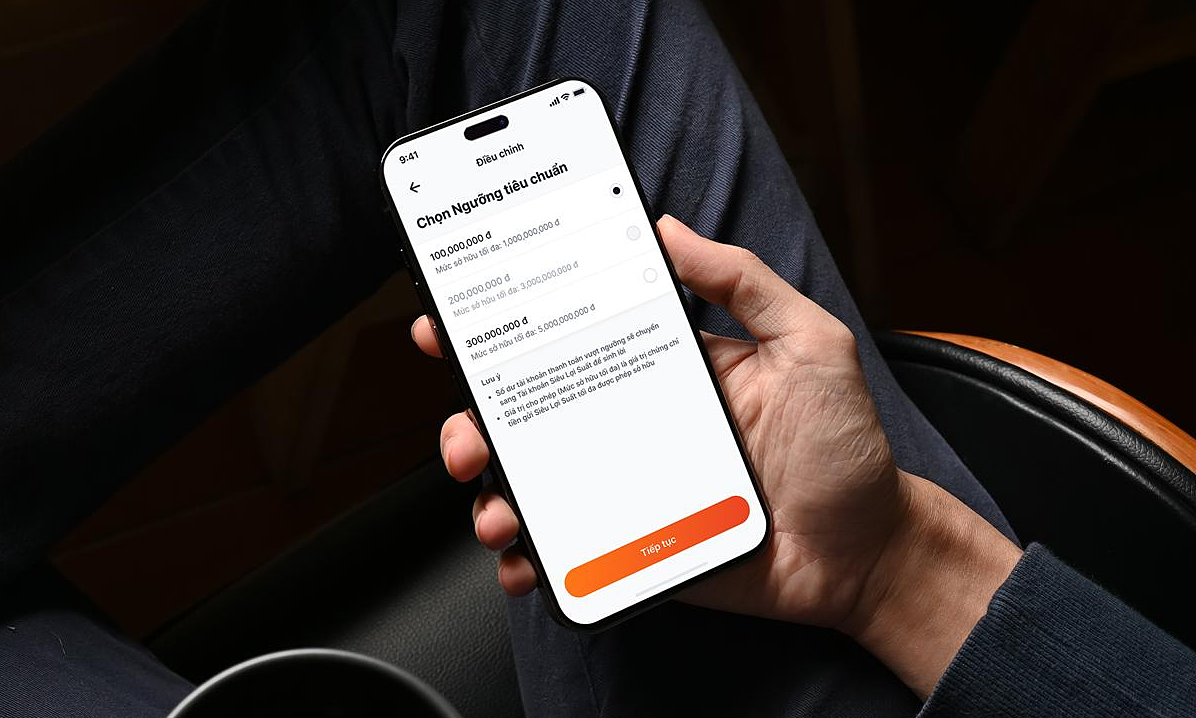

Businesses experience the Super Interest Account on VIB Business. Photo: VIB |

Businesses experience the Super Interest Account on VIB Business. Photo: VIB

Traditionally, opening a business account involved complex procedures such as document preparation, branch visits, and processing delays. VIB Business streamlines this process, enabling businesses to open accounts online in a few simple steps, saving time and increasing operational efficiency. Users download the app from the Apple Store or Play Store, register business information and legal representative details, select an account number, and complete digital signature verification. The account is activated immediately upon completion.

Beyond convenient registration, VIB Business offers various financial tools. The VIB Business Card provides unsecured credit limits up to 1 billion VND, up to 58 interest-free days, and unlimited cashback on all spending. Businesses can also access working capital loans of up to 150 billion VND, disbursed within 24 hours, with loan-to-value ratios of up to 90% and interest rates starting from 6.7% per year.

The app features tools like SoftPOS (turning phones into POS terminals), QR code payments, voice alerts, VNPAY Invoice, VNeDOC, and VNPAYB2B, facilitating transactions, managing risks, and improving financial efficiency.

Nguyen Van Cuong, owner of a jam and confectionery business in Hanoi, attended the "Elevating Vietnamese Businesses" talkshow co-hosted by CafeF and VIB. Inspired by the program's solutions for business transformation, he opened an online account on VIB Business in just 5 minutes.

|

The Super Interest Account helps businesses earn up to 4.5% annually on idle capital. Photo: VIB |

The Super Interest Account helps businesses earn up to 4.5% annually on idle capital. Photo: VIB

Upon account activation, SMEs can immediately enable the Super Interest feature. Any balance exceeding the minimum threshold automatically accrues interest daily, up to 4.5% per year. Users avoid separate savings accounts and payment limitations, ensuring working capital remains available for scheduled or unexpected expenses.

Super Interest automates value generation from unused funds, such as contingency reserves, pending payments, or idle cash flow during projects.

Tran Hong Minh, director of a design company in Da Nang, explains that her company often holds funds for pending payments or new projects. Previously, these funds remained idle. "With the Super Interest Account, we have financial flexibility while earning interest. It's a smart money management solution," she says.

According to Tuong Nguyen, VIB's Deputy General Director, the Super Interest Account aims to create a next-generation financial product where every idle VND earns returns. It's part of VIB's suite of digital financial solutions empowering SMEs with proactive cash flow management.

Tuong Nguyen believes the Super Interest Account will reshape financial management habits within the Vietnamese business community. This shift is essential as businesses face fluctuating costs and increasing cash flow demands. "While idle funds may seem insignificant individually, when utilized effectively, they can generate sustainable profits," she says.

Hoang Dan

SMEs can learn more about the Super Interest Account here.