According to the Vietnam Bank Card Association, as of 31/12/2024, VIB holds nearly 7% of the market share for cards in circulation and nearly 7% for newly opened cards. Along with this record number of cards, the bank ranks first in Mastercard spending and third overall in the market. VIB currently partners with three major international card organizations: Visa, Mastercard, and American Express, providing diverse solutions for users.

|

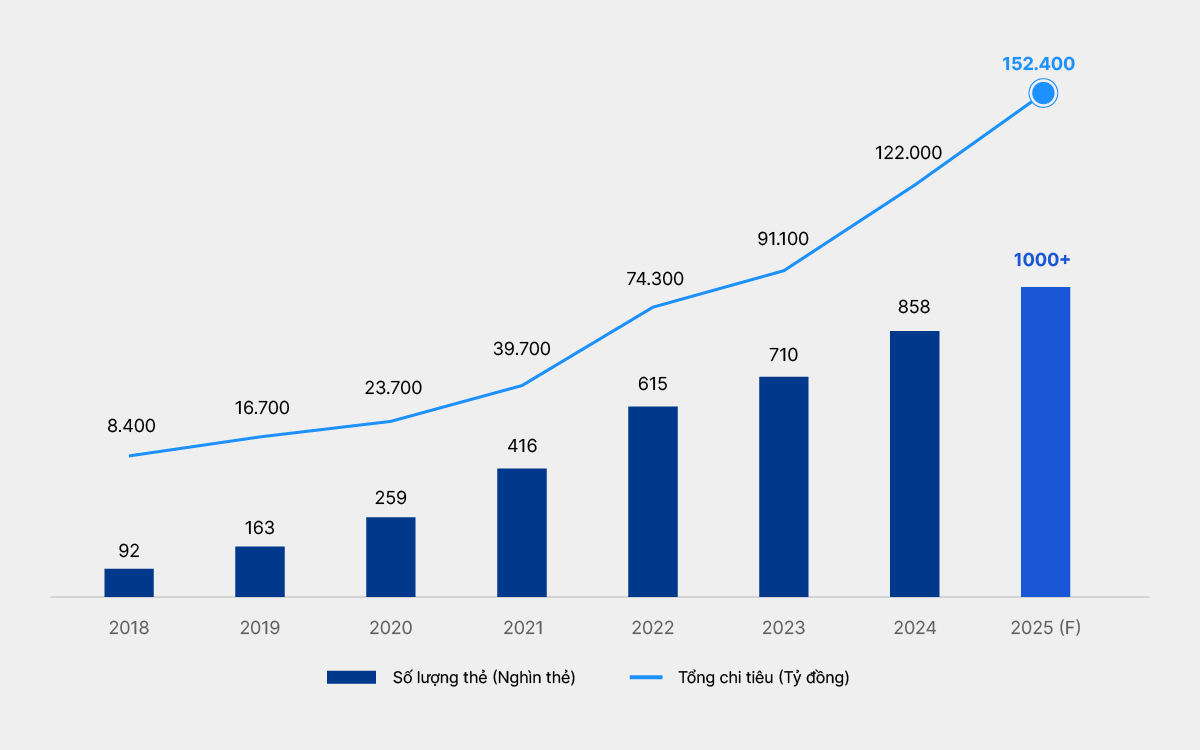

The bank's credit card volume and total spending from 2018 to the end of August. Photo: VIB |

The bank's credit card volume and total spending from 2018 to the end of August. Photo: VIB

Tuong Nguyen, VIB's deputy general director, stated that reaching one million credit cards validates the bank's customer-centric and digital-first strategy. VIB aims to continue leading the credit card market with innovative, personalized products and experiences driven by advanced technology.

As of the end of August, total spending via VIB cards increased by 80% compared to the end of 2024 and 18-fold compared to 2018. Approximately 31 million transactions were made via VIB cards in the first 9 months of the year. Average monthly spending per card reached 15.2 million dong, almost double the 7.6 million dong in 2018.

According to data from the Vietnam Bank Card Association as of 31/12/2024, VIB holds a 12% market share of card spending, with the average spending per card at VIB approximately 50% higher than the market average. Based on these results, at the end of 2024, Mastercard awarded VIB several titles, including: bank with the largest total card spending, fastest growth, leading e-commerce spending, leading international spending, and possessing the most outstanding Mastercard portfolio in Vietnam.

VIB currently offers 10 card lines designed for specific needs: high cashback cards (Cash Back, Online Plus 2in1), reward point cards (Rewards Unlimited), frequent flyer miles cards (Travel Elite, Premier Boundless), flexible feature cards (Super Card), and business cards (Business Card). These solutions incorporate high technology and are personalized based on individual customer spending habits.

|

Customers using the bank's credit cards. Photo: VIB |

Customers using the bank's credit cards. Photo: VIB

According to Tuong Nguyen, VIB began its transformation journey in 2019, identifying credit cards as a strategic business segment crucial for differentiation and leading the digital economy. Consequently, VIB developed a card strategy with specialized investment, integrating modern technology and continuous customer engagement to understand their needs.

"This strategy is built on three main pillars: leading technology, leading experience, and leading benefits," said Tuong Nguyen.

Regarding technology, VIB allows customers to open cards entirely online on various platforms such as MyVIB, Max by VIB, the website, and partner ecosystems. The approval process takes only 15-30 minutes, and customers can use virtual cards before receiving physical ones. VIB also integrates comprehensive card management tools on the MyVIB app, including spending tracking, repayment, point redemption, and card locking and unlocking. The bank offers a 360-degree card management function for customers on the mobile banking platform, MyVIB.

Advanced technologies like Duo Card, Chip EMV, 3D Secure, Tokenization, and connectivity with Apple Pay, Google Pay, Samsung Pay, and Garmin Pay have been implemented. VIB enables deep personalization of card features, from choosing statement dates and payment ratios to AI-powered card design. The newly launched Super Pay solution allows cardholders to choose their payment source (PayFlex). Customers can choose installment payments through PayEase and actively secure online transactions without OTP to avoid risks with PaySafe, all within the MyVIB app. The Super Cash flexible loan solution lets customers actively transfer credit limits up to 1 billion dong between their credit card and cash loans.

|

Staff introducing card products to customers. Photo: VIB |

Staff introducing card products to customers. Photo: VIB

The bank also offers competitive cashback, reward points, and frequent flyer miles programs, along with the VIB Privileges ecosystem of over 150 partners in travel, dining, shopping, and transportation. In addition, the 0% interest installment program, VIB Pay Ease, and foreign transaction fee incentives for premium cards help customers optimize their finances while enjoying a premium lifestyle.

These innovations have earned VIB numerous prestigious awards and recognition from international organizations such as Mastercard, Visa, International Finance Magazine, and Global Business Outlook.

Hoang Dan