According to Vietnam International Bank (VIB), total assets increased by 8% compared to the beginning of the year. Outstanding credit balance surpassed 356 trillion VND, a 10% rise, with balanced growth from retail, SME, corporate, and financial institution segments. The retail segment continued to lead, notably with a 45 trillion VND home loan package featuring a fixed interest rate from 5.9% per year, quick AI-powered approval, and flexible repayment options.

"In the SME and corporate segments, VIB continues to expand credit selectively, focusing on supporting working capital flows and customers' production and business needs in a low interest rate environment," the bank stated.

Customer deposits increased by 10%, reaching over 304 trillion VND. CASA and high-yield accounts grew by 51% compared to the beginning of the year. Launched in early 2025, this account has attracted over 500,000 activated customers, expanding the bank's potential customer base. VIB continues to promote digitalization and develop flexible solutions to optimize services and maintain sustainable deposit growth.

|

Customers transacting at VIB. Photo: VIB |

Customers transacting at VIB. Photo: VIB

Asset quality improved, with the non-performing loan ratio decreasing to 2.54%, down 0.14 percentage points compared to the end of Quarter I. Over 75% of outstanding loans are in the retail and SME segments, of which 90% of retail loans are secured by fully legal real estate. Group 2 debt continued its downward trend. The legalization of Resolution 42 helps the bank accelerate bad debt resolution and strengthen its financial foundation.

In Quarter II, the bank completed a 7% cash dividend payment as approved at the 2025 Annual General Meeting of Shareholders. Key safety indicators remain optimal, including a Capital Adequacy Ratio (CAR) under Basel II of 12.0% (regulation: above 8%), a Loan-to-Deposit Ratio (LDR) of 77% (regulation: below 85%), a short-term funding for medium and long-term loans ratio of 23% (regulation: below 30%), and a Net Stable Funding Ratio (NSFR) under Basel III of 111% (Basel III standard: above 100%).

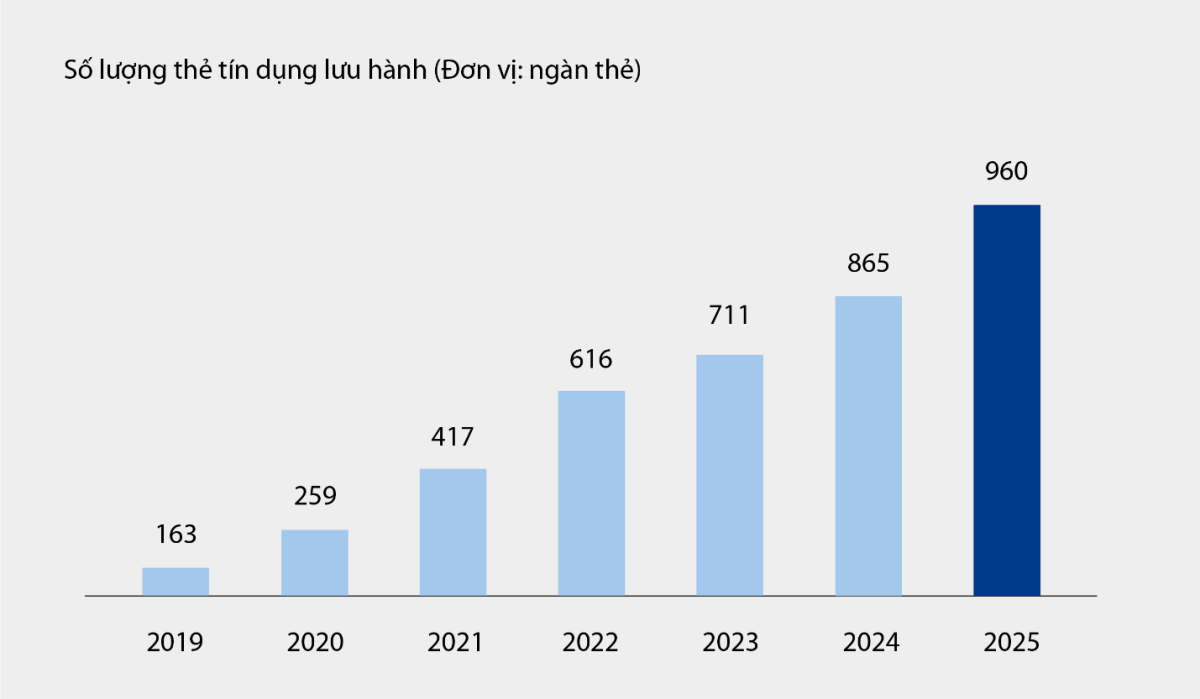

In the first 6 months of the year, VIB achieved total operating income of over 9.7 trillion VND and pre-tax profit of over 5 trillion VND, a 9% year-on-year increase. Net interest income reached 7.7 trillion VND, continuing to be the main contributor. Net interest margin (NIM) remained at 3.4%. Non-interest income accounted for about 21% of total income, primarily from service fees and credit cards. The number of credit cards in circulation is nearly 1 million, with total spending in the first half reaching over 67.9 trillion VND, a 15% increase compared to the same period last year.

"New products and services deployed on the digital banking platform, such as bill payment, international money transfer, tuition payment, and insurance, as well as solution packages and services for corporate customers, also contribute significantly to the bank's fee and service income," a VIB representative said.

|

Chart of the number of credit cards in circulation at VIB from 2019 - 6 months 2025. Source: VIB |

Chart of the number of credit cards in circulation at VIB from 2019 - 6 months 2025. Source: VIB

Operating expenses decreased by 1% year-on-year thanks to process optimization. Credit risk provision expenses decreased by 49% over the same period due to the solid provision foundation from previous quarters.

VIB said that in the future, it will continue to promote its digitalization strategy with two new products: Super Pay - a smart payment solution, and Super Cash - a flexible loan solution with a limit of up to 1 billion VND. Features such as PayFlex, PayEase, PaySafe, and the Max by VIB platform help customers manage their finances proactively, online, and transparently.

Along with Super Account and Super Card, VIB is completing a comprehensive digital financial ecosystem, aiming to empower users with maximum financial control.

"With a solid financial foundation, a quality credit portfolio, and digitalized services, VIB aims to accelerate in the second half of the year, continuing sustainable growth and increasing value for customers, shareholders, and the economy," a bank representative said.

Lan Anh