Dominic Scriven, CEO of Dragon Capital, emphasized the importance of upgrading Vietnam's bond market during a debt capital market forum hosted by FiinRatings, a credit rating agency under FiinGroup, on 22/8.

He shared an anecdote about his 15-year effort to attract foreign investors to Vietnamese bonds, resulting in only two successful cases. The challenge, he explained, wasn't the low interest rate, as their products offered an attractive average annual return of 8.5% in USD. The primary obstacle was Vietnam's bond market rating.

Vietnam's bond market hasn't yet achieved investment grade status, a designation indicating high creditworthiness, low default risk, and strong repayment capacity. Agencies like S&P, Moody's, and Fitch Ratings assign these ratings (AAA, AA, A, and BBB are considered investment grade). Last year, Vietnam received a BB+ rating from S&P and Fitch Ratings, and Ba2 from Moody's, placing it in the "stable" category.

The government aims to achieve investment grade status (Baa3 or higher) by 2030 through the National Credit Rating Improvement Project, approved in 2022. This goal seeks to attract foreign investment, reduce capital costs, and enhance national prestige. Achieving this requires improved information transparency, economic restructuring, and increased competitiveness.

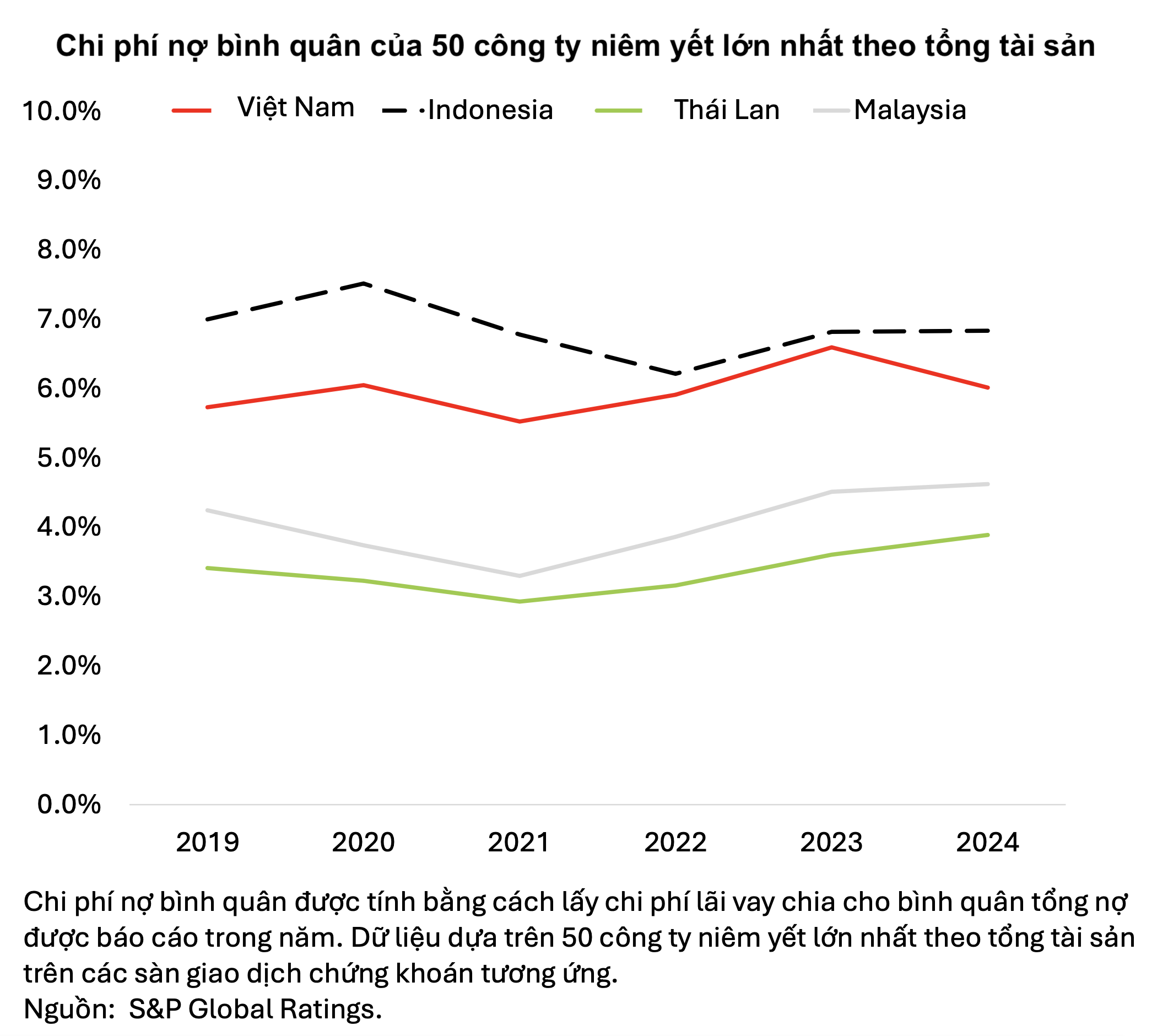

Nguyen Quang Thuan, CEO of FiinGroup and FiinRatings, agreed that the lack of an investment grade rating puts Vietnamese businesses at a disadvantage when raising capital, especially from foreign sources. He compared a leading Indonesian consumer goods company, which secured USD funding at a 5.5% annual interest rate for a 5-year term, with a similar Vietnamese company facing higher rates. He noted that almost no Vietnamese businesses successfully raise USD capital at interest rates below 7%.

"It's unfortunate that many Vietnamese businesses can't raise bonds in USD at competitive interest rates compared to their regional counterparts," Thuan stated.

|

Vietnamese businesses are bearing higher debt costs than others in the region. Photo: FiinRatings |

Vietnamese businesses are bearing higher debt costs than others in the region. Photo: FiinRatings

Upgrading the bond market is urgent, given the significant capital needs for public investment and business expansion. FiinGroup data shows that listed companies plan to raise 198,700 billion VND in equity this year, more than double the amount raised in 2024. In the first seven months, they raised only nearly 56,200 billion VND, leaving a substantial gap of nearly 142,600 billion VND.

Improving the national credit rating is complex, according to Thuan. He suggested focusing on enhancing institutional strength and managing foreign exchange flows, as Vietnam has a positive trade balance but also significant outward capital flows.

Thuan also highlighted the need to restructure the financial market. Vietnam's bank capital adequacy ratio (CAR) is currently around 12.5%, about half that of other regional markets, compared to 20% in Cambodia.

|

Dominic Scriven and Nguyen Quang Thuan discuss the bond market at the forum on 22/8. Photo: Uyen Nguyen |

Dominic Scriven and Nguyen Quang Thuan discuss the bond market at the forum on 22/8. Photo: Uyen Nguyen

For businesses seeking to improve their own creditworthiness, Scriven recommended focusing on information transparency and improving corporate governance. They should also ensure bond quality, particularly for long-term projects, and avoid failing to meet commitments.

"Liquidity, risk management, investment efficiency, and reputation are four key factors in attracting both domestic and foreign investment in bonds," Scriven emphasized.

Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), stated that the SSC is implementing comprehensive solutions to develop a safe, transparent, and efficient capital market. The SSC is exploring mechanisms for bond guarantees by capable financial institutions and expanding medium- and long-term capital mobilization channels. They are also reviewing regulations on asset allocation by financial institutions in corporate bonds to ensure both safety and market development.

Furthermore, the SSC is continuing to promote the upgrade of the Vietnamese stock market by improving IPO and listing standards, and aligning stock and bond issuance conditions with international practices.

Tat Dat