Retail chain Bach Hoa Xanh (a subsidiary of The Gioi Di Dong) launched in 2015 with the expectation of achieving billions of USD in revenue and leading the domestic consumer goods retail sector.

Between 2019 and 2021, the company expanded rapidly, opening an average of 300-400 stores annually, aiming to break even in 2021. However, this aggressive expansion led to increased operating costs, with individual store performance falling short of targets. Bach Hoa Xanh incurred accumulated losses exceeding 8,300 billion VND (as of 9/2023), according to The Gioi Di Dong's financial reports.

The turning point came in early 2024 when the management board decided on a comprehensive restructuring, starting with scaling down operations, changing store layouts, and reforming the logistics system.

|

Bach Hoa Xanh staff member assists a customer. Photo: Bach Hoa Xanh |

Bach Hoa Xanh staff member assists a customer. Photo: Bach Hoa Xanh

Instead of a nationwide rollout, Bach Hoa Xanh shifted to a regional cluster expansion strategy, focusing on high-margin areas like the Central and Southwest regions, while also establishing central warehouses to manage supply and control costs.

The Central region served as a testing ground for the new model. Within three months, per-store revenue reached 1.2-1.5 billion VND, with operating costs 30% lower than in other regions.

As a result, in just the first 5 months of 2025, Bach Hoa Xanh opened 410 new stores, bringing the total to nearly 2,180, surpassing the entire year's target. Revenue reached nearly 18,900 billion VND, a 19% increase compared to the same period in 2024. The company aims for 48,100 billion VND in revenue and 500 billion VND in profit this year.

Dr. Dinh The Hien believes this model holds promise, given Bach Hoa Xanh's changes. The chain's shift aligns with Vietnam's urbanization. The transition from fresh food to chilled products caters to domestic and global consumer trends.

Yeah1 Group, operating in a different sector but with a similar approach, lost direction after a failed YouTube partnership in 2019, which wiped out billions of VND in market capitalization. After years of uncertainty, the company chose to return to its core competency: television content production, instead of continuing with diversified investments.

In 2024, Yeah1 launched two new entertainment programs: "Sisters Who Make Waves" and "Brothers Who Overcome Thorns". Both quickly achieved high viewership ratings on television and topped trending lists on YouTube and social media.

"Sisters Who Make Waves" recorded an average 5.1% rating during prime time on HTV7, ranking among the top 3 most-watched programs according to Kantar Media's QII/2024 report. "Brothers Who Overcome Thorns" achieved a 4.3% rating on VTV3, exceeding the average for its time slot (3.2%).

Beyond advertising revenue, the company organized concerts, exploited copyrights, sold character images, and expanded its content value chain. Thanks to this strategy, Yeah1's QIII/2024 advertising revenue reached 345 billion VND, the highest in 4 years. Quarterly profit reached 34 billion VND, 10 times higher than the same period in the previous year. For the full year 2024, revenue reached nearly 1,007 billion VND, with a net profit of nearly 127 billion VND, the highest since 2018. The gross profit margin also increased from 19.6% to 22.9%, demonstrating the effectiveness of focusing on the core model.

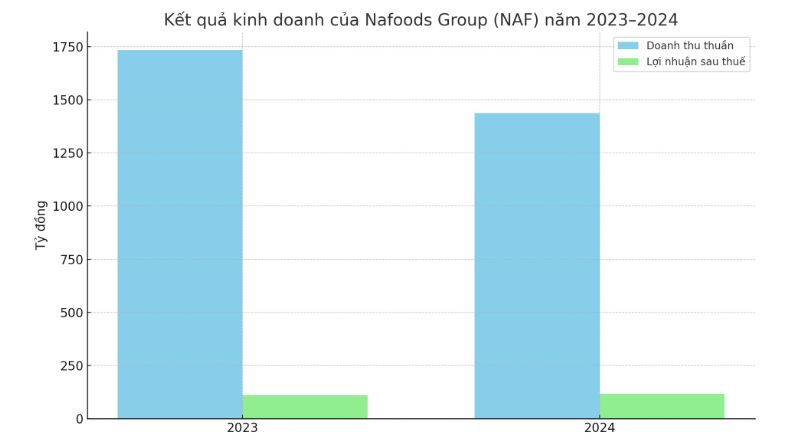

In the processed agricultural product sector, Nafoods (specializing in fruit and vegetable exports) faced significant challenges with stricter quarantine measures in China and declining demand from Europe. In 2023, orders dropped by almost 40%, leaving factories operating at about half capacity.

To adapt, Nafoods shifted from a "production-to-order" model to a "market-driven" one, promoting its own branded retail products. Simultaneously, the company invested in developing closed agricultural product chains in the Central Highlands and North Central Coast, applying IQF (individually quick frozen) technology to extend shelf life without nutrient loss.

As a result, in 2024, private label products accounted for nearly 30% of total revenue, double the pre-pandemic figure. Domestic customers also increased by 65% year-on-year, creating a sustainable revenue stream alongside exports.

In QI/2025, Nafoods' consolidated revenue reached nearly 359 billion VND, a 12% increase compared to the same period last year. This growth primarily stemmed from increased exports of processed fruits like passion fruit, pineapple, and mango in the form of concentrated juice, frozen, and dried products.

|

Experts believe that model innovation, from operational organization to product strategy, remains a viable path to stability and growth. Flexibility, proactive adaptation, and the courage to choose a new direction are becoming key differentiators between businesses that ride the waves and those that leave the game.

According to a 2024 VCCI survey, 92% of businesses in Vietnam have implemented or are exploring transformation solutions, focusing on digital transformation. Of these, 72% reported revenue increases of 10% or more, and over 50% reduced production costs, largely due to model adjustments, not simply technology application.

Thai Anh