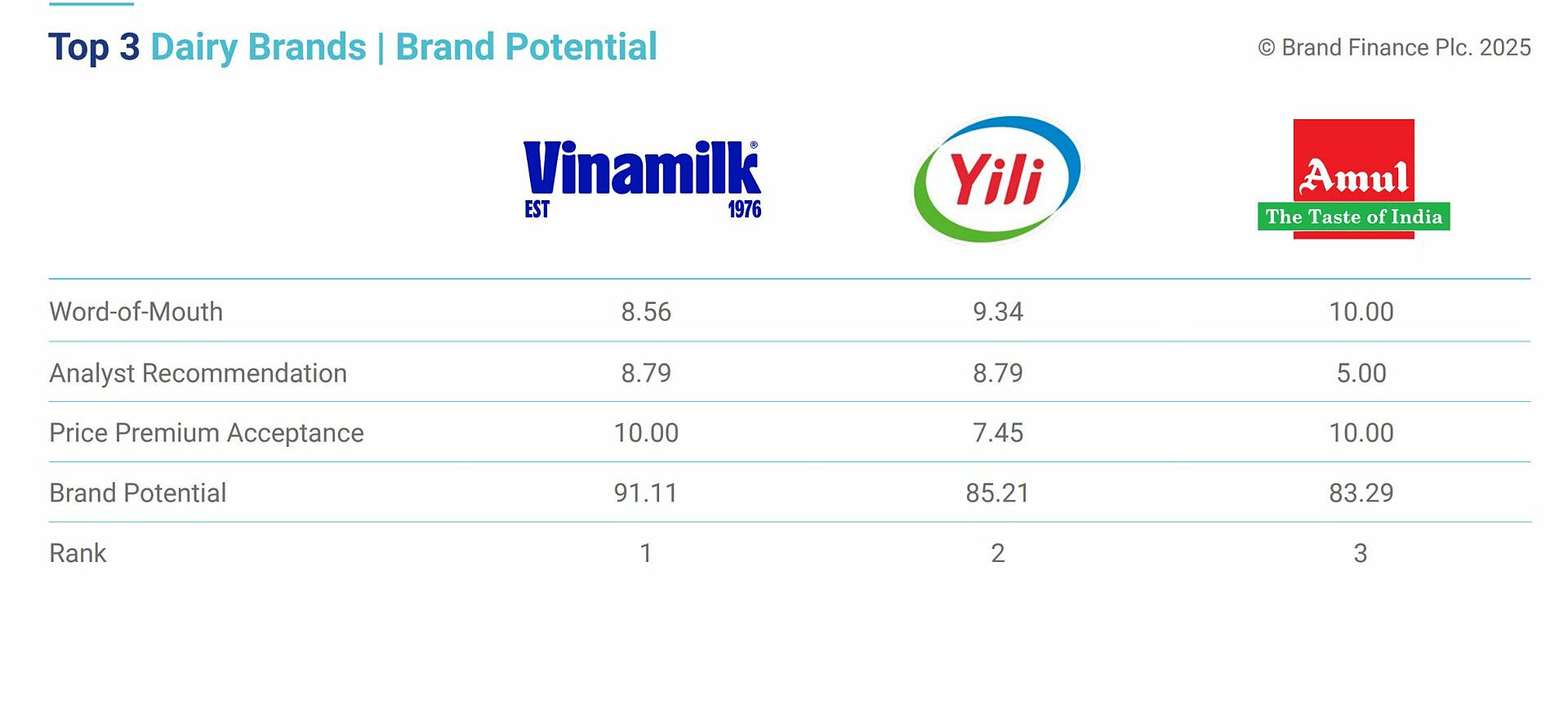

This information was revealed in the "Food & Drink 2025" report released by Brand Finance in mid-August. Brand potential was assessed based on four indicators: customer willingness to recommend the brand, acceptance of higher prices, trust from financial experts, and long-term growth potential.

With the highest overall score, Vinamilk leads the list of the world's most potential dairy brands. This is the 4th year the Vietnamese dairy company has been in the top 3 since the ranking's inception.

|

Vinamilk’s scores in the four categories. Photo: Brand Finance |

Vinamilk’s scores in the four categories. Photo: Brand Finance

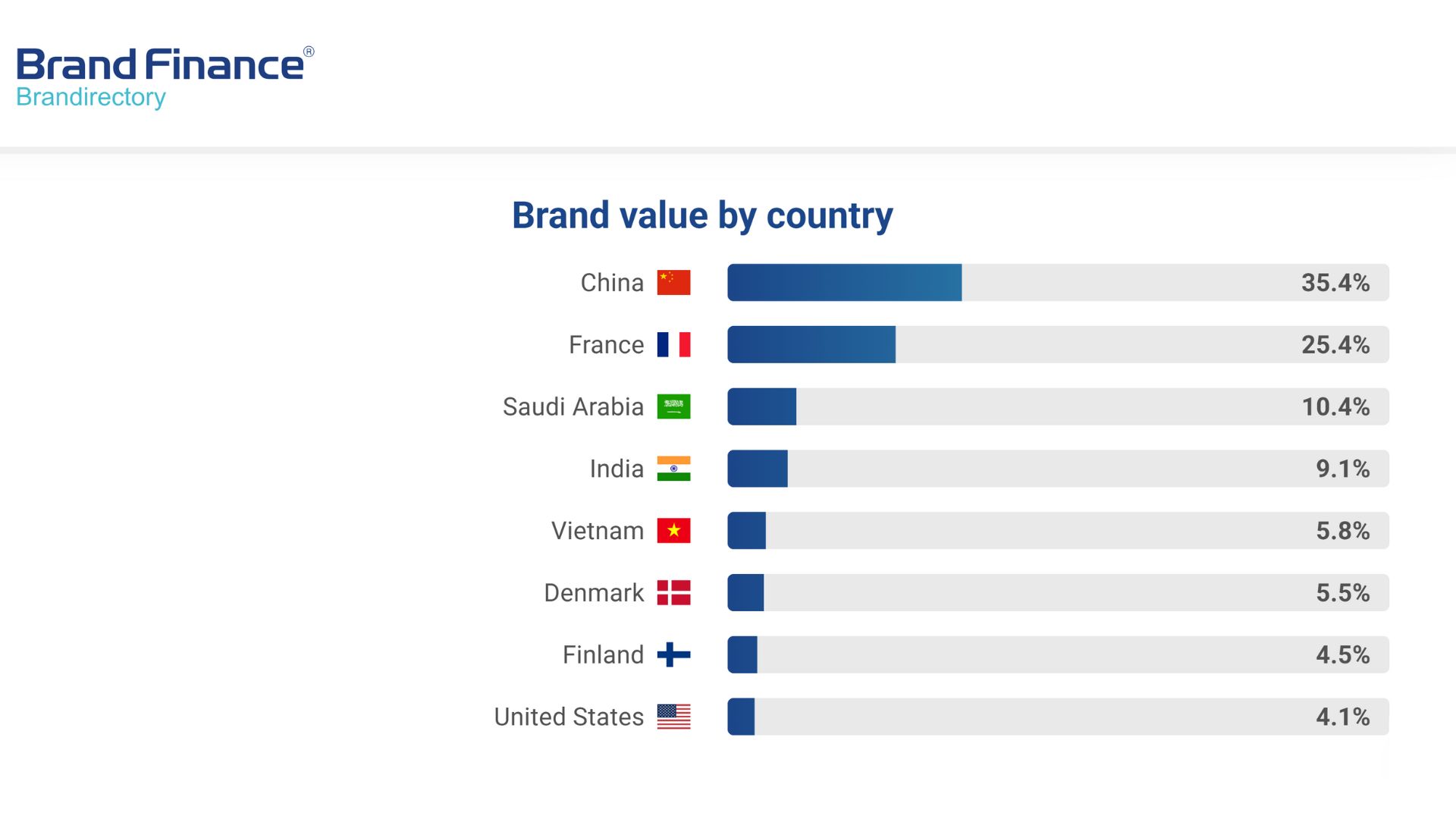

Vinamilk is also the only Southeast Asian company to remain among the top 10 most valuable dairy brands globally. The company's achievement helps Vietnam rank 5th in terms of global dairy brand value share, reaching 5.8%, surpassing the US (4.1%) and Finland (4.5%).

|

Vinamilk’s farm system. Photo: Minh Anh |

Vinamilk’s farm system. Photo: Minh Anh

This is also the first year Vinamilk has received the AAA+ rating, the highest on the Brand Strength scale, demonstrating exceptional brand strength, market share maintenance and expansion capabilities, brand awareness, trust, and superior profitability compared to competitors. This rating is on par with major dairy companies in India and Finland, and higher than many leading brands from Europe and the US. This has helped Vinamilk significantly elevate its position on the global food map, becoming the only Vietnamese representative among the top 30 most valuable brands.

Regarding the Brand Strength Index (BSI), the fundamental indicator for calculating brand value according to Brand Finance's methodology, Vinamilk is recognized as one of the top 5 food brands with the highest brand strength index globally in 2025.

|

Vietnam among the top 5 countries contributing the most to the global dairy industry’s value. Photo: Brand Finance |

Vietnam among the top 5 countries contributing the most to the global dairy industry’s value. Photo: Brand Finance

According to David Haigh, Chairman and CEO of Brand Finance, a well-managed brand not only brings measurable value from attracting and retaining customers, but also enhances the ability to attract talent, reinforces investor confidence, and increases organizational flexibility. "In today's market, a strong brand is not just an asset—it's a survival strategy," he said.

A Vinamilk representative stated that, for top global brands, ranking positions do not depend on short-term communication campaigns. In Vinamilk's case, the core factor lies in the consistent philosophy of "never compromising on quality" for nearly five decades. In the past two years, this philosophy has been elevated to a comprehensive strategy of "constantly raising standards."

Earlier, at the beginning of the 1990s, the company launched a "white revolution" and oriented the development of its farm system towards international standards, aiming for self-sufficiency in fresh milk sources. Currently, Vinamilk manages a herd of over 130,000 dairy cows, cared for according to European Organic and Global S.L.P. standards. This system ensures the quality of input milk while maintaining a stable supply with a daily output of over 1.1 million liters of high-quality fresh milk.

In 2023, along with the brand repositioning, Vinamilk aimed to establish unprecedented standards in Vietnam. Key product lines were improved with leading global technologies. Examples include the dual vacuum suction technology for the "fresh-lock" milk product Vinamilk Green Farm (which retains the original fresh taste), ultrafiltration technology to create high-protein, high-calcium, low-fat, and lactose-free products, and the first infant formula with 6 HMOs in Vietnam.

According to a Vinamilk representative, this is not only product innovation but also contributes to raising nutritional standards in the market and creating competitive momentum within the industry.

|

Parents choose Vinamilk products. Photo: Minh Anh |

Parents choose Vinamilk products. Photo: Minh Anh

Recent market developments have strengthened Vinamilk's advantage. As consumer confidence is affected by counterfeit and low-quality goods, brands with strict control processes, from farms and factories to distribution, along with verification from international organizations, become preferred choices. This is one of the factors that helps the company maintain customer trust and loyalty, highly valued by Brand Finance in its BSI scoring.

Besides core quality, Vinamilk also adapts flexibly to new consumption trends, particularly personalization. The product portfolio has been expanded to serve diverse customer groups: from gelato for the premium segment, high-protein Greek yogurt, and sparkling kombucha for health-conscious young people, to 9-seed milk and high-calcium soy milk for health-focused consumers.

Financially, the company maintains stable growth, consolidating its domestic position and expanding internationally. Presence on major retail platforms like Amazon in the US helps generate revenue and increase brand coverage in demanding markets.

Furthermore, the sustainable development strategy is considered Vinamilk's "long-term lever." The company invests in a circular economy, uses environmentally friendly packaging, and expands "carbon sinks." These activities reinforce the image of a responsible brand, creating sustainable connections with environmentally conscious customers, a rapidly growing global trend.

Brand Finance, headquartered in London (UK), is a leading independent brand valuation consultancy with a presence in 27 countries and territories. With its global network and deep expertise, the organization plays a pioneering role in setting international standards for brand valuation, trusted by many businesses, investors, and management organizations.

Hoang Dan