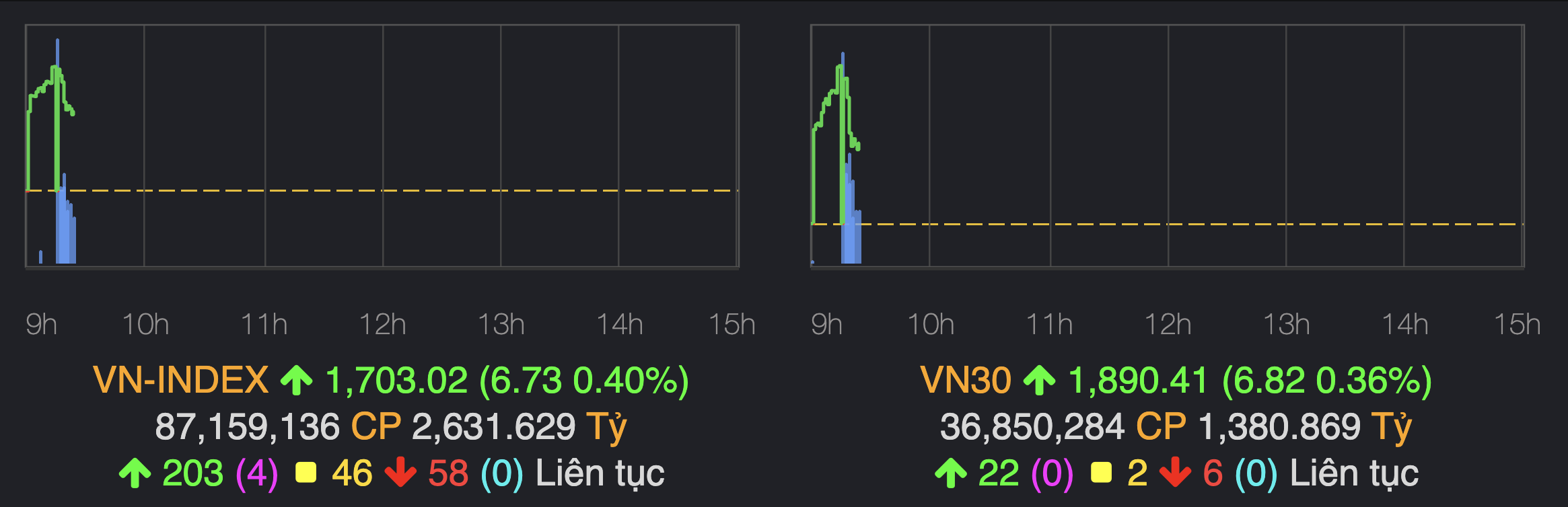

Immediately following the opening auction (ATO), the benchmark index for the Ho Chi Minh City Stock Exchange jumped to nearly 1,707 points. The market was awash in green, with over 200 stocks gaining value, twice the number of declining stocks. The large-cap index, VN30, also saw 20 stocks rise and approached the 1,900-point mark.

|

VN-Index and VN30 charts 30 minutes after the opening bell on 5/9. Screenshot. |

The VN-Index exceeding 1,700 points was largely unforeseen by securities companies at the start of this year. However, since the strong upward trend began in mid-April, some analysts have suggested the index could surpass this level, reaching 1,800-1,850 points in the final months of the year.

Experts attribute the growth momentum to improved profits of domestic businesses, the potential upgrade of the Vietnamese stock market in early October, and the prospect of the US Federal Reserve (Fed) easing monetary policy.

Vingroup's VIC stock was the primary driver in the VN-Index's first ascent past 1,700 points. This stock rose 1% from its reference price to 126,000 VND and contributed almost one point to the overall index.

Banking stocks also positively influenced market sentiment. Leading stocks such as VCB, CTG, VPB, MBB, and SHB all traded higher, with increases ranging from 0.5% to 1%.

The securities sector was also largely positive. SSI led the gains, rising 1.5% to 43,000 VND, while VND, HCM, and VCI fluctuated between 0.5% and 1.4%. VIX was one of the few stocks in this sector bucking the trend, trading down 1%.

In the real estate sector, with the exception of VHM which faced selling pressure, component stocks showed strong performance. PDR, DIG, and CII all rose over 3%, while mid-cap stocks such as NLG, KDH, and NVL gained between 0.5% and 1%.

Despite the rising index, cash flow into the market was not as substantial as in previous sessions. After one hour of trading, over 263 million shares were traded on the Ho Chi Minh City Stock Exchange, equivalent to almost 8 trillion VND. The most actively traded stocks were SHB, HPG, SSI, and MSN.

Phuong Dong