In response to the fact that many business households and individual businesses still manage finances manually, using handwritten records and lacking specialized tracking tools, VPBank has launched Shop Thinh Vuong. This integrated digital financial solution helps shop owners control cash flow, track revenue, analyze growth, and optimize profits.

With this solution, users can separate revenue streams by store, receive audio notifications of balance changes, track revenue charts over time, and allocate expenses by category, such as salaries, supplier payments, and fixed costs.

|

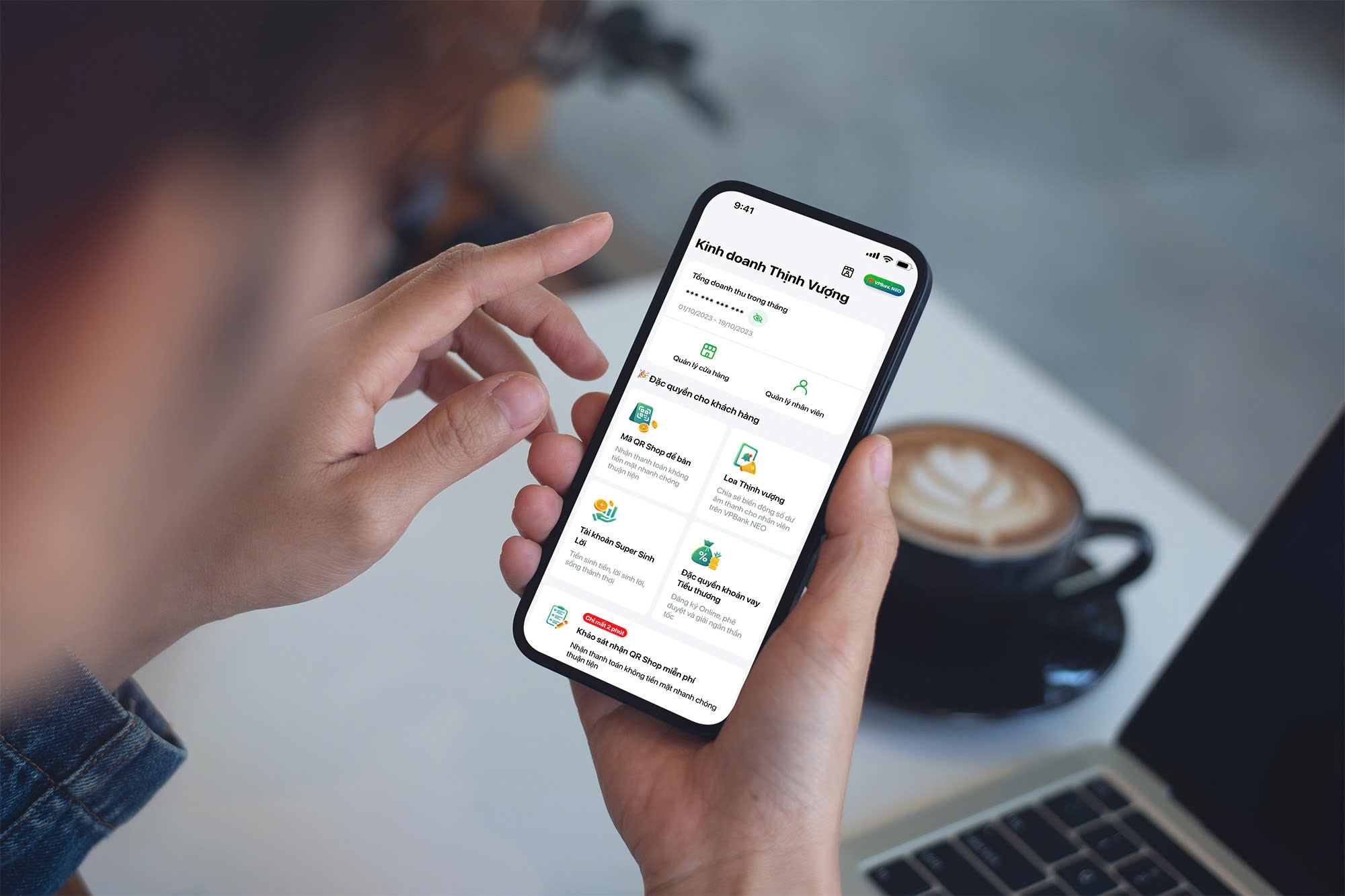

Customers can easily access this feature on their mobile phones. Photo: VPBank |

Customers can easily access this feature on their mobile phones. Photo: VPBank

One of the highlights is the Loa Thinh Vuong feature, which provides audio notifications of account transactions. This allows both shop owners and staff to stay informed without constantly checking their phones. This feature is particularly suitable for small business models with multiple operators.

Besides supporting cash flow management, Shop Thinh Vuong also helps business households generate returns from idle funds without interrupting transactions. Through the Super Sinh Loi account, users can choose from three flexible options. Super Tu Dong automatically transfers funds into an interest-bearing status, with interest accrued daily and no manual action required. Super Thong Minh applies an interest rate of up to 3.5% per year on all balances, regardless of size. Super Nhanh allows for one-time registration on VPBank NEO, with daily accrual and no impact on transactions. This mechanism not only helps the money in the account "grow" every day but also allows shop owners to optimize cash flow and focus on their business.

In addition, the solution also provides specialized store and staff management tools. Business owners can track revenue at each point of sale and the performance of each employee and sales channel. Shop Thinh Vuong also features intuitive chart-based growth analysis, which helps users grasp revenue fluctuations over time and compare performance between periods to make data-driven business decisions.

The multi-platform solution can operate flexibly on phones, tablets, and desktops, suitable for the characteristics of small shops or micro-enterprises.

According to a VPBank representative, the synchronized integration of cash flow tracking, financial reporting, and business management tools helps business households form a transparent data platform. This is a crucial factor in gradually accessing formal capital sources and expanding their scale in the future.

"In an increasingly competitive economic landscape demanding high professionalism, Shop Thinh Vuong is expected to support millions of business households to operate more efficiently, while promoting the modernization of the private economic sector," the VPBank representative shared.

(Source: VPBank)