According to VPBank, SMEs were one of the main growth drivers in the first 6 months of 2025, contributing to the bank's total consolidated outstanding loans exceeding 842,000 trillion VND. This represents an 18.6% increase compared to the beginning of the year and a 30.3% increase year-over-year. The bank currently serves over 170,000 SMEs nationwide, nearly 85% of which are micro-enterprises.

|

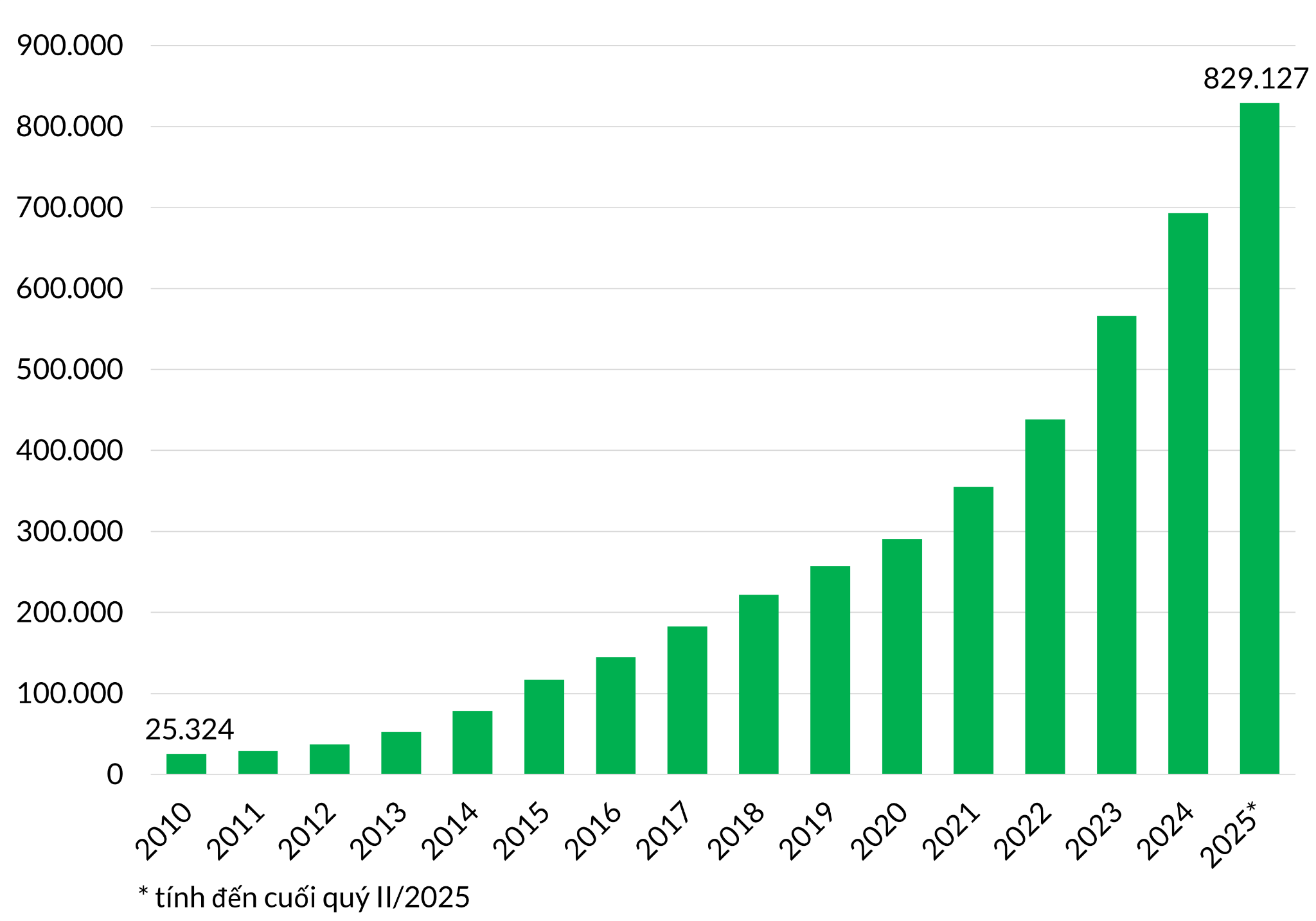

VPBank's consolidated outstanding loans to customers have increased nearly 33 times compared to 2010. Photo: *VPBank* |

VPBank stated that the recent SME lending growth is a result of the long-term strategy it has pursued since 2013. This strategy included establishing a dedicated SME Division and developing the VPBankSME brand to support businesses in accessing capital and enhancing their competitiveness.

Early on, recognizing the challenges faced by SMEs, the bank developed a diverse portfolio of financial products, including both unsecured and secured loans, with simplified procedures and faster processing times. Services such as trade finance, guarantees, business credit cards, QR payments, digital accounts, and flexible deposits are tailored to the specific needs of each business group.

In addition to its industry-specific lending strategy, VPBank has been actively implementing specialized programs: VSME10K, Touching Prosperity, and the Launchpad for Women-Owned Businesses. These programs are designed to suit different stages of SME development, from start-up to growth.

Simultaneously, the bank has focused on investing in its technology platform and developing solutions such as VPBank QR Payment and the SmartSME app. These help businesses manage their finances, optimize cash flow, and quickly connect with digital banking services.

Besides its positive business results, VPBank's SME segment has also won numerous international awards. For the second consecutive year, VPBank NEOBiz was named "Best Banking App for Micro, Small and Medium Enterprises" by Global Banking & Finance Review. In 2025, VPBankSME also received the "Best Bank for Women Entrepreneurs" award from Asian Banking & Finance.

|

VPBankSME has received numerous international awards in the first half of 2025. Photo: *VPBank* |

The growth of SME lending at VPBank has also been supported by the positive impact of Resolution 68, issued by the Politburo in early 5/2025. This resolution introduced a series of support policies for small businesses, such as a three-year income tax exemption and the elimination of license fees. It also promotes unsecured lending based on cash flow and business plans rather than solely relying on collateral.

At the "Data Talk - The Catalyst" seminar, Le Hoai An, CFA, a banking strategy research expert, stated that Resolution 68 will create momentum for economic growth. It also creates opportunities for credit institutions to expand SME lending in a more transparent and effective manner. With the advantage of digitized population data and the 2025-2026 roadmap for business digitization, banks can conduct credit appraisals more quickly and accurately. An also noted that with its strengths in technology and experience serving SMEs, VPBank is one of the banks that will benefit most from this resolution.

Sharing the same view, the QII/2025 industry report by BIDV Securities Company (BSC) also emphasized that VPBank is among the credit institutions that will greatly benefit from Resolution 68. This is due to the bank's extensive SME customer base, its modern technology platform, and its ability to implement preferential credit programs closely aligned with policy directions.

(Source: VPBank)