According to 2023 data from the General Statistics Office, Vietnam has approximately 5 million household businesses, contributing nearly 30% to the nation's GDP. However, over 70% of these businesses struggle to access bank loans due to a lack of collateral, complex procedures, and limited financial management capabilities. This situation often leads to capital shortages during the startup phase, hindering expansion and increasing operational risks.

Resolution 68 of the Politburo on private sector development and Government Decree 70 on vouchers, accounting, and tax reporting have introduced new management requirements for private businesses. Many household businesses face difficulties transitioning to enterprise status due to limited technology skills, complex procedures, and time constraints. Traditional manual management practices also make it challenging to separate personal and business finances, track cash flow, and reconcile transactions with suppliers and customers accurately and promptly.

In response to these challenges, VPBank developed CommCredit, a specialized financial ecosystem for household businesses and individual entrepreneurs. CommCredit provides transparent access to capital, management tools, and a digital platform to support efficient business operations, mitigate risks, and optimize costs.

To address capital needs, VPBank CommCredit offers the V20000 loan package for customers with collateral. The bank provides secured loans of up to 20 billion VND with interest rates starting at 3.99% and a streamlined approval process. Additionally, VPBank offers unsecured supplementary loans of up to 400 million VND through unsecured loans, overdrafts, or credit cards, providing flexibility to meet customer needs and maintain business cash flow.

For customers without collateral, VPBank CommCredit offers a separate unsecured loan package with a limit of up to 1 billion VND, a 2% interest rate discount throughout the loan term, and flexible repayment options. Notably, the bank also provides 70,000 free sales management software packages integrated with electronic invoices, digital signatures, and tax declaration features, helping household businesses comply with Decree 70.

|

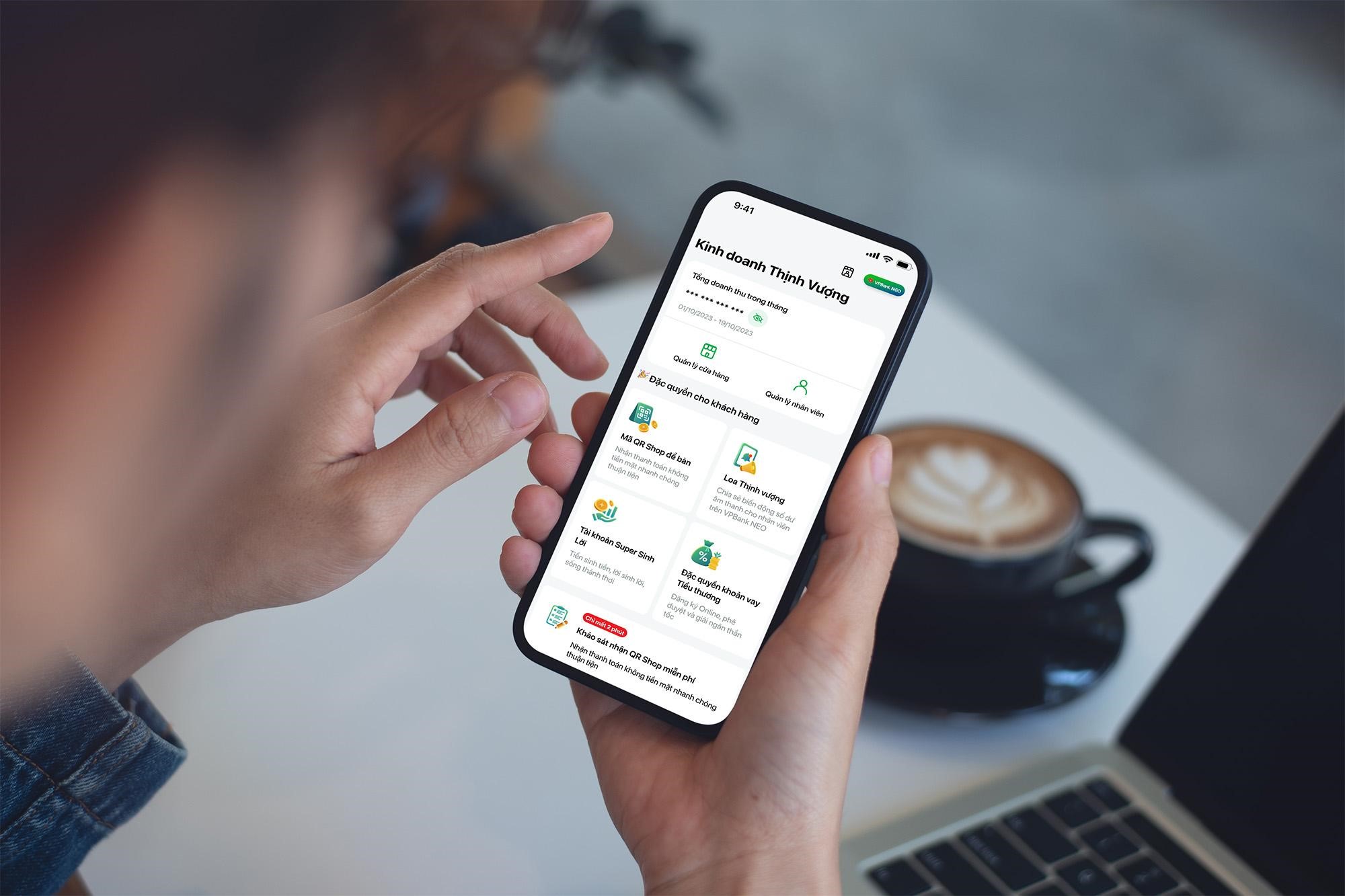

"Shop Thinh Vuong" offers various solutions to support household businesses in managing their cash flow. Photo: VPBank |

"Shop Thinh Vuong" offers various solutions to support household businesses in managing their cash flow. Photo: VPBank

For management support, the "Shop Thinh Vuong" solution enables intelligent cash flow management. It separates revenue from multiple points of sale, tracks balance fluctuations through Loa Thinh Vuong, and analyzes growth with intuitive charts. Business owners can optimize cash flow through the Super Sinh Loi account with a 3.5% annual interest rate, easily accessible across various devices.

To help control expenses, the VPBank CommCredit business credit card offers cashback of up to 1.5 million VND per statement cycle, interest-free periods of up to 58 days, and a 1% foreign transaction fee. Cardholders can access installment plans with over 150 major partners and enjoy discounts at thousands of shopping locations. Additional features such as free iNICK accounts, eSodep, and real-time balance notification speakers help businesses manage transactions effectively, especially those operating multiple points of sale.

"Our goal is to assist customers with their core needs during the foundational phase, providing transparent access to capital and professional business management tools from the outset using user-friendly digital tools. This enables smooth operations, risk mitigation, cost optimization, and sustainable growth in the future," a VPBank representative shared.

After over a decade of implementing the CommCredit model, VPBank has established a robust financial services ecosystem for household businesses and individual entrepreneurs. The bank anticipates that these capital solutions, management tools, and digital platforms will contribute to greater transparency, cost control, and enhanced sustainable development for this customer segment in the coming period.

(Source: VPBank)