Vietnam aims to upgrade from a frontier to a secondary emerging market under the FTSE Russell classification this year, according to a newly approved government plan. Finance Minister Nguyen Van Thang stated earlier this month that Vietnam "has strived to meet FTSE's upgrade criteria". The results of FTSE's assessment will be announced on 7/10.

Many domestic analysts believe a market upgrade would support the VN-Index's growth in the final months of the year. This event could also open the door for increased foreign investment into Vietnamese stocks.

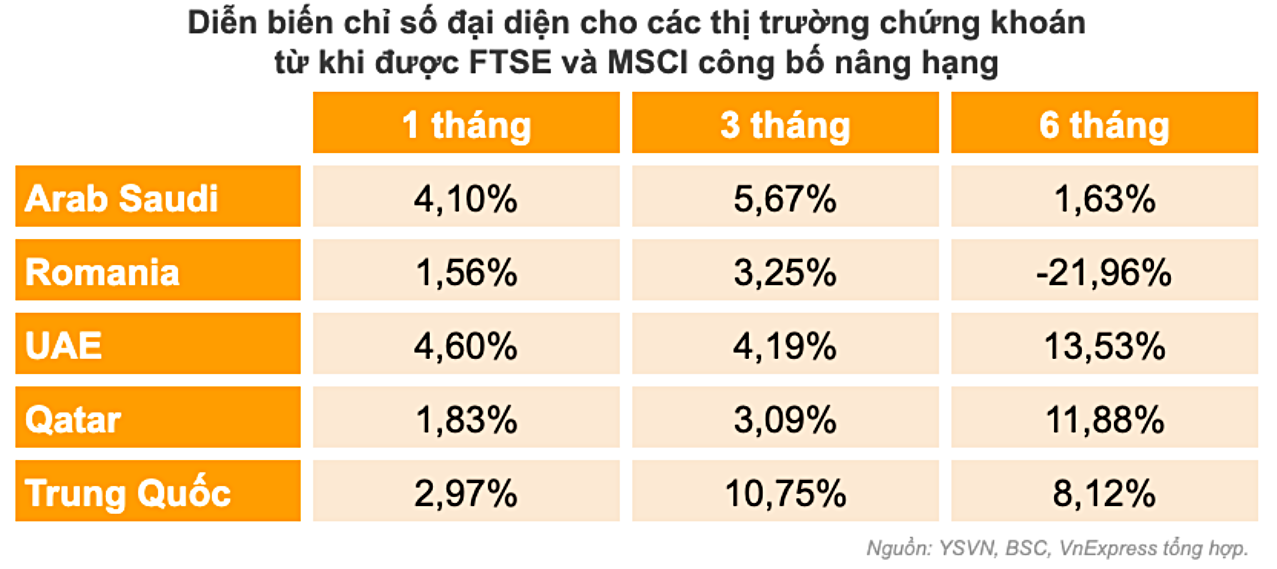

However, data from other global markets show that indices and liquidity can fluctuate in various directions during and after an upgrade. An upgrade doesn't guarantee an immediate market boom.

The United Arab Emirates (UAE), upgraded by MSCI in 9/2010, is a prime example. The market's representative index rose 4.6% one month after the upgrade and gained another 3.4% the following month. However, weakening liquidity stalled growth for the next three months. Average trading value plummeted and only rebounded strongly six months after the announcement.

Similarly, Qatar's stock market upgrade in 6/2013 had a short-term positive effect. The Qatar Exchange index rose 1.83% in the first month and 4.1% in the second. Six months later, the index had climbed nearly 12%. Conversely, liquidity remained low for four months before slowly recovering.

|

Yuanta Securities Vietnam's analysis of other markets reveals similar trends. In the first quarter after FTSE upgraded Kuwait in 3/2018, the market's index rose by nearly 5.7%. After a year, it reached 8.8% before plummeting due to the oil price crisis and Covid-19.

In Romania, upgraded by FTSE in 9/2019, the index increased by roughly 3.3% in the first quarter. The market then fell sharply, losing 25% at one point due to the pandemic, but recovered quickly. A year after the upgrade, the index had risen by 27.6%.

"Market upgrades often bring short-term positive effects, but long-term trends depend on various factors such as macroeconomic conditions like political changes, monetary policy, and pandemics, as well as the market's internal strength," said Nguyen The Minh, Director of Yuanta Securities Vietnam's Retail Research and Development Division.

According to BSC experts, markets upgraded by FTSE or MSCI typically see increased liquidity four months before the official announcement. Foreign investors buy more in the month of the result, then gradually reduce or shift to net selling.

However, analysts agree that in the medium and long term, most upgraded markets experience significantly higher trading value due to increased foreign investment.

"This influx is typically five to seven times higher than the average before the upgrade," said Tran Hoang Son, Market Strategy Director at VPBank Securities (VPBankS).

Son predicts an inflow of 3 to 7 billion USD into the Vietnamese market once the upgrade takes effect, while Vietcap Securities estimates 6 to 8 billion USD.

HSBC is more optimistic, suggesting FTSE's upgrade could attract up to 10.4 billion USD. However, HSBC notes the actual inflow will be smaller and distributed over time, as FTSE typically announces market reclassifications six months in advance.

For an upgrade, Vietnam must meet nine mandatory and two non-mandatory criteria. These are assessed based on practical experience and feedback from foreign investors.

Some analysts predict a 90% chance of FTSE Russell announcing Vietnam as an emerging market in October. Others are more cautious, suggesting a 70% chance this year and a 30% chance in 3/2026 if further monitoring is needed on payment and settlement cycles, securities lending, and failed trade handling.

Phuong Dong