At the beginning of the year, many fund management companies assessed real estate stocks as having good growth potential, with many undervalued stocks suitable for investment. However, many mutual fund portfolios currently hold a relatively low proportion of real estate stocks.

VnExpress's statistics, based on the latest report at the end of May, show 27 stock mutual funds holding an average of approximately 10.13% of their portfolios in real estate. This figure is only about one-third of the allocation to bank stocks. Among them, eight funds hold less than 5% in real estate stocks, with GFM-VIF and NTPPF holding no real estate stocks in their portfolios.

Funds with fewer real estate holdings generally had low performance in the first six months, with many reporting negative returns. Funds outperforming the VN-Index hold about 17.26% in real estate stocks, while underperforming funds hold only 13.27%. For funds that declined in the first six months, the figure is just above 6%.

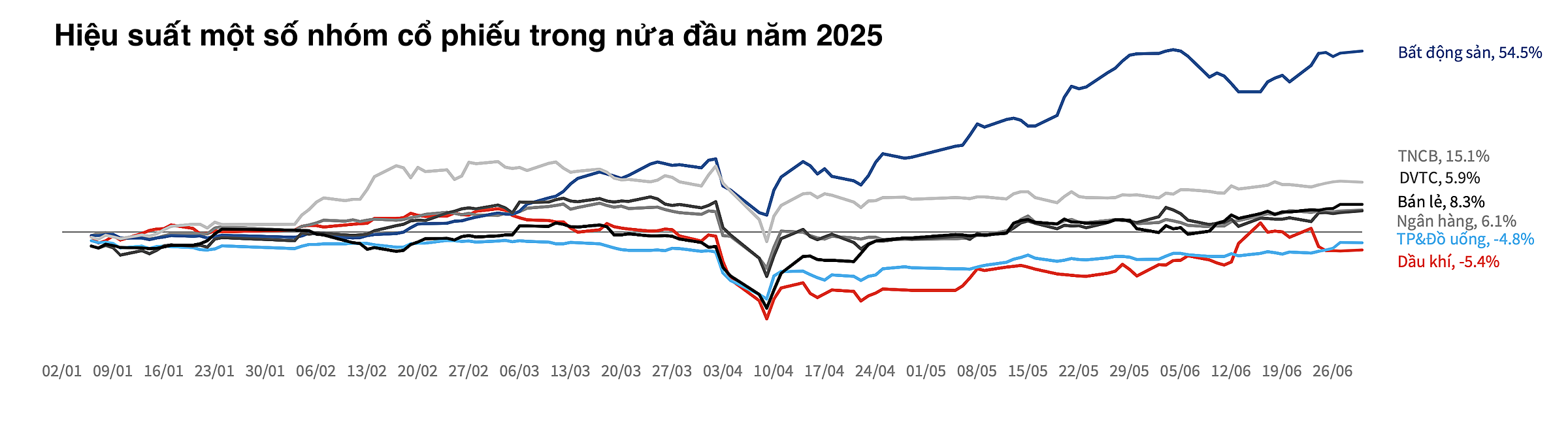

TVS Research statistics also show that real estate stocks were among the best-performing sectors in the first half of the year, increasing by nearly 55%. Fiintrade data indicates that VNREAL, the index representing real estate stocks on the HoSE, accumulated over 46%.

Nguyen Thi Bich Thao, Chief Investment Officer of Manulife Investment Management (Vietnam), told VnExpress that real estate stocks have seen significant gains compared to the general market since the beginning of the year. This is because the residential real estate market is showing signs of recovery, with several large projects being launched and long-delayed projects gradually being resolved.

Thao added that macroeconomic factors, including stable monetary policy, strong public investment disbursement, focused infrastructure investment, new land and housing laws put into practice, and administrative reforms, have also contributed to faster project approval processes.

"Some real estate stocks have seen rapid price increases recently. These are stocks with news about projects having legal hurdles cleared or permits granted, benefiting from government policies such as infrastructure investment and promotion of private investment," Thao said.

|

Real estate is one of the strongest performing stock groups in the first six months. Photo: TVS Research |

Real estate is one of the strongest performing stock groups in the first six months. Photo: TVS Research

As of the end of May, Manulife Investment Management (Vietnam)'s MAFEQI fund held only 8.82% in real estate stocks. Explaining this, Thao said they also recognized the positive signals in the sector and had increased their investment in this group since the beginning of the year.

However, she said the fund does not invest broadly in many stocks within the sector but applies clear selection criteria, including growth potential, good cash flow, good governance, and attractive valuations, to choose companies that can achieve sustainable growth and deliver long-term value. In addition to these general criteria, Manulife prioritizes investing in real estate companies with experience in project development, potential land banks, strong financial capacity, and good cash flow to enhance their position in the new context.

Nguyen Duy Anh, Portfolio Management Director of Vietcombank Fund Management (VCBF), said the strong increase in real estate stocks since the beginning of the year was mainly driven by VIC, VHM, and NVL. In the first six months, Vingroup's stock increased by 136%; Vinhomes' stock by 92%; and Novaland's stock also accumulated 48%.

VCBF still holds VIC and VHM in its mutual fund portfolio, but the allocation is not as high as their weighting in the VN-Index (around 12%). Anh stated that they have held these stocks for a relatively long time and did not buy them recently when the price increased. VCBF's investment strategy focuses on a company's fundamentals, portfolio diversification, long-term investment, and less attention to short-term market fluctuations.

"The sudden price surge of some stocks only reflects short-term market expectations. VCBF always closely monitors production and business activities, and the future growth potential of the industry and companies to assess and determine a reasonable price," he emphasized.

|

Investors are watching the electronic board at a securities company in TP HCM. Photo: An Khuong |

Investors are watching the electronic board at a securities company in TP HCM. Photo: An Khuong

Not only investment funds underperforming the VN-Index but also some outperforming funds are reducing their real estate holdings. For instance, Dragon Capital's DCDS increased by 8.65% in six months.

Vo Nguyen Khoa Tuan, Senior Director of Securities at DCDS, said that at the beginning of the year, the fund held a relatively high proportion of real estate stocks, generally much higher than the sector's weighting in the VN-Index.

By the end of June, he said DCDS held approximately 18% in residential and industrial real estate stocks. This allocation is kept lower than the banking sector, which accounts for almost 38% of the VN-Index, to comply with Dragon Capital's risk management principles and to allocate to potential companies like MWG, HPG, etc.

Tat Dat