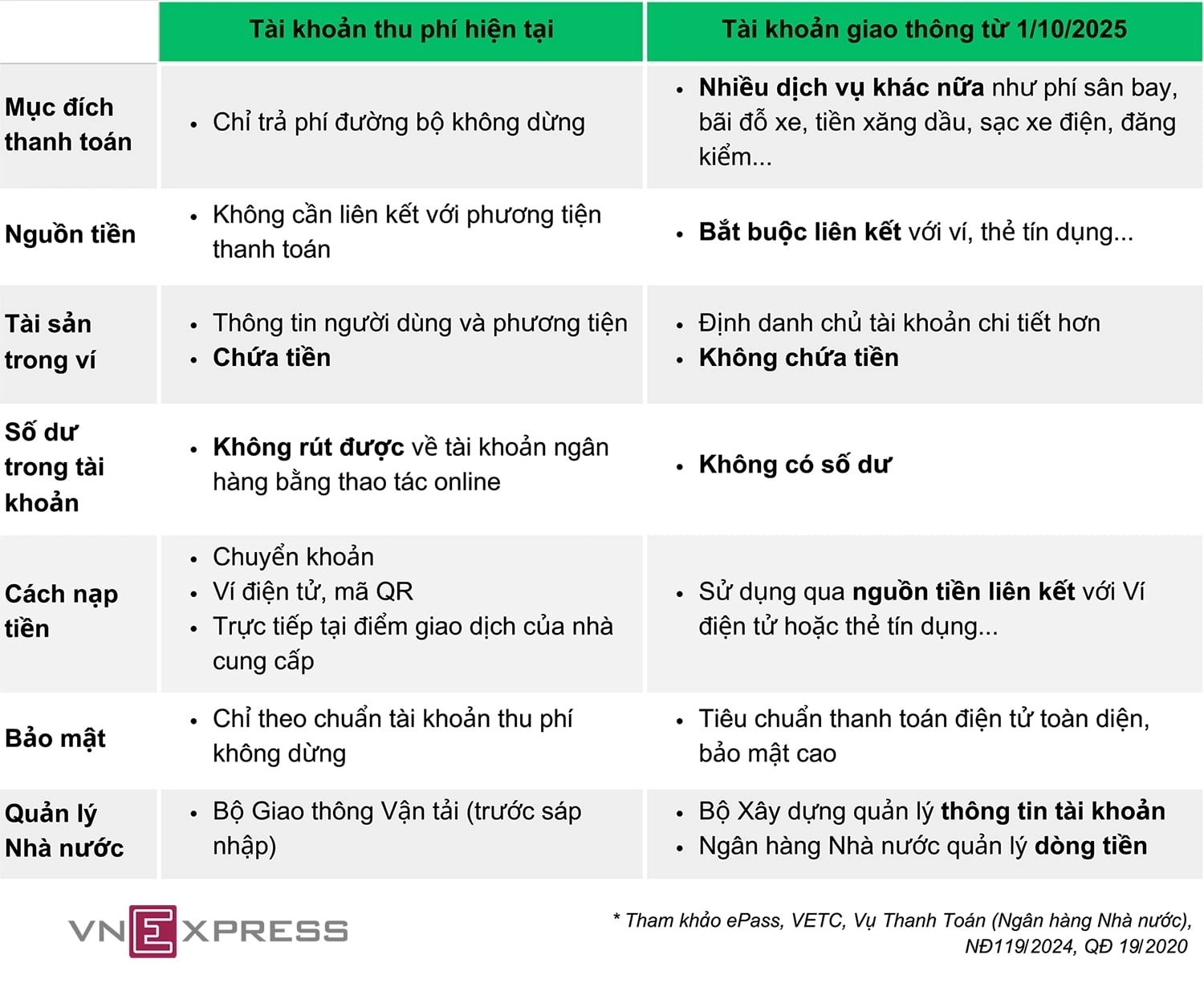

Vehicle owners in Vietnam are required to switch from toll collection accounts to transportation accounts before 1/10. Failure to do so will prevent passage through ETC lanes.

These transportation accounts must be registered with owner and vehicle information and linked to a payment method like an e-wallet or credit card. The two main ETC service providers, VETC and VDTC (ePass app), prioritize linking transportation accounts with their own ecosystem's e-wallets. Users then link their bank accounts to these e-wallets for top-ups.

However, direct links between transportation accounts and bank accounts for toll payments are not yet possible. At a seminar on 14/8 titled "Why do drivers need transportation accounts from 1/10?", To Nam Toan, Head of the Environmental Science, Technology and International Cooperation Department (Vietnam Road Administration), explained that bank accounts are not inherently cashless payment instruments.

He analyzed that under Decree 52/2024, payment instruments include checks, payment orders, debit authorizations, collection requests, collection authorizations, bank cards, and other instruments stipulated by the State Bank of Vietnam. Therefore, Toan stated that a debit authorization is necessary for automatic payments from bank accounts.

|

An ETC gantry on the Hanoi - Hai Phong expressway. Photo: Anh Duy |

An ETC gantry on the Hanoi - Hai Phong expressway. Photo: Anh Duy

A debit authorization (payment order) is a payment method where the payer instructs their bank, typically using a standardized form, to deduct funds from their account and transfer them to the recipient. In essence, the payer authorizes the bank to carry out the transfer.

Direct toll deductions from bank accounts via debit authorization are currently impossible due to technical constraints. The ETC system requires real-time transaction processing within 200 ms with a 99.7% success rate. Bank account connections are slower, achieving only about 50%, thus failing to meet the requirement.

Due to this connection speed barrier, Nguyen Thi Ngoc Trang, Deputy General Director of VDTC, stated that ePass lacks a solution for instant, direct deductions from bank accounts. She expressed hope for future implementation, similar to payment systems used by apps like Grab.

Guide to switching from toll collection accounts to Epass transportation accounts. Video: Epass

Similarly, Nguyen Le Thang, General Director of VETC, pointed out that banks also have system maintenance periods. Therefore, direct linking might not ensure continuous transaction processing for vehicles.

"Direct bank transfers are not currently feasible, but post-paid mechanisms could be implemented in the future," Thang said.

To Nam Toan affirmed that the goal of ETC is multi-lane free flow tolling (without barriers) or post-paid systems, both technically achievable. However, he noted that post-paid systems face policy obstacles, lacking solutions for monitoring vehicle entry and exit without barriers or for untagged vehicles passing through toll stations.

Current laws also lack penalties for non-payment under a post-paid system. Additionally, switching to post-paid could lead to bad debt.

"Bad debt could account for approximately 1-2% of total revenue or potentially higher, posing challenges for build-operate-transfer (BOT) companies," Toan added.

|

However, companies are prepared for more convenient payment solutions in the next phase. A representative from Momo e-wallet stated they will provide higher credit limits based on a "spend now, pay later" model for customers linked to transportation accounts.

Meanwhile, a VNPAY representative said they will assess financial risks to offer specific, reasonable solutions for customers.

Regarding service providers, Ngoc Trang stated that ePass is considering collaborating with financial companies for a "pay later" solution. The company is currently in discussions with partners and hopes to offer this service soon.

Similarly, a VETC representative reported their preparations for a post-paid option, having negotiated and analyzed business models with several banks and exploring credit card integration.

Le Phuong Hoai, Head of Retail Banking at BIDV, expressed a desire for standardized guidelines from service providers for banks to facilitate seamless integration and user convenience.

According to the Vietnam Road Administration, about 6.3 million vehicles, nearly 100% of the total, use ETC services. However, the conversion rate to transportation accounts is only around 30% due to drivers' unfamiliarity with the new regulations, meaning about 70%, or over 4 million people, haven't yet switched.

Anh Tu - Doan Loan