According to VnExpress statistics, foreign investors have net bought 11,709 billion dong in the Vietnamese stock market since the beginning of July. Previously, in the first 6 months of the year, foreign investors net sold approximately 41,000 billion dong (equivalent to 1.5 billion USD). This group had a 15-month selling streak that ended in May of this year.

Foreign investors spent nearly 2,650 billion dong to acquire SSI Securities Corporation (SSI) shares. This was also the most purchased stock by foreign investors since the beginning of the month.

Following SSI, other stocks that also attracted foreign investment were FPT, SHB, HPG, and VPB. VIX and HCM are two securities stocks among the top 10 net bought stocks.

Nguyen The Minh, director of Yuanta Securities Vietnam's retail research and development division, told VnExpress that the recent foreign net buying streak is due to the emergence of "P-Notes" capital flows. Specific data on these transactions is not yet available.

P-Notes, or Participatory Notes, are derivative financial instruments issued specifically to foreign investors by investment institutions operating in emerging stock markets. To issue P-Notes, financial institutions often accumulate a sufficiently large number of liquid, well-performing, and representative stocks to form a portfolio.

P-Notes capital flows often focus on large-cap, highly liquid stocks that significantly impact the index. "The fact that VN30 stocks such as SSI, HPG, FPT, SHB, and VPB have been heavily net bought by foreign investors recently is an indicator of the appearance of P-Notes," Minh shared. The Yuanta Securities expert said SSI and HPG were two priority stocks for this capital flow in the past.

For example, in early 12/2022, foreign investors spent 1,425 billion dong net buying HPG shares, nearly 600 billion dong acquiring SSI, and a series of VN30 stocks like VIC, MSN, VRE, and VCB. This was the time when experts identified the emergence of P-Notes in the market.

Minh shared that P-Notes favor markets "with unique stories." "For example, the fact that the Vietnamese stock market is being considered for an upgrade is a story to attract this capital flow," he explained.

Currently, FTSE Russell, a global index provider and rating agency, classifies the Vietnamese stock market as a "frontier market" and is monitoring it for a potential upgrade. Many experts believe Vietnam could be upgraded to an "emerging market" in September of this year.

However, Minh noted that this capital flow is characterized by "quick buying and quick selling." Despite this, he believes P-Notes may continue to invest in Vietnamese stocks from now until September, the market upgrade review period.

|

Investors monitor stock prices at a securities exchange in TP HCM. Photo: Quynh Tran |

In addition to P-Notes, Minh suggests that the upgrade story is another factor driving foreign net buying of Vietnamese stocks. "Before the upgrade period, several stock markets like Pakistan and China attracted foreign investment."

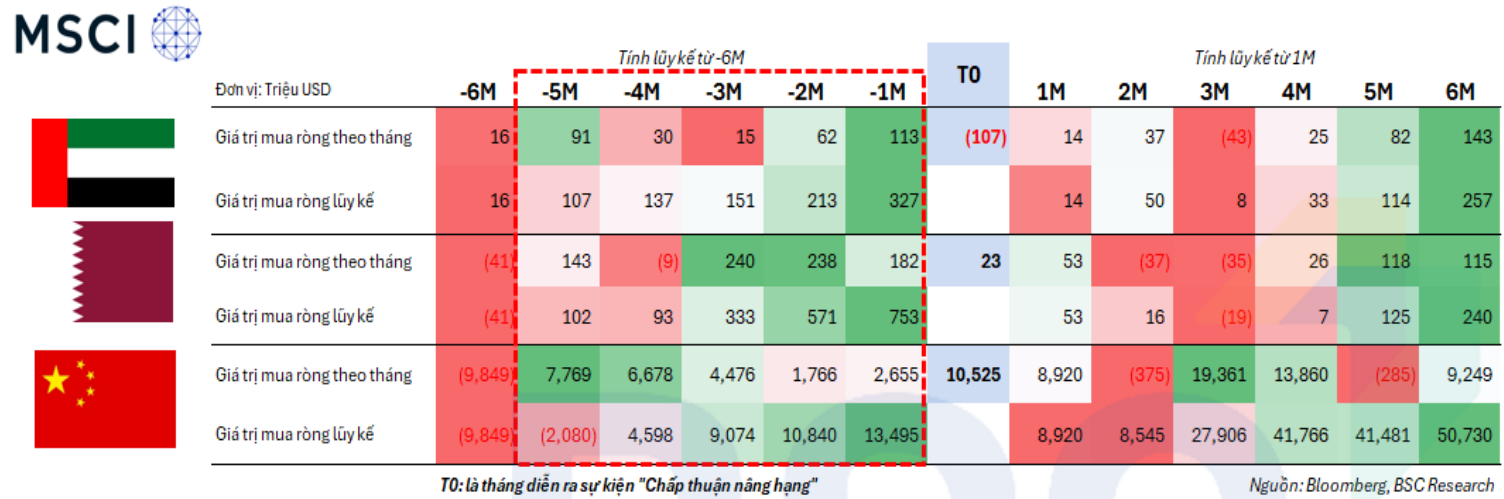

BIDV Securities (BSC) shares Minh's view. According to their data, foreign investors net bought 327 million USD in Pakistan before its market upgrade was approved. A similar trend occurred in China, with foreign investors buying over 13 billion USD. This group will likely continue to buy stocks in the announcement month and gradually reduce afterward.

|

Net buying volume of foreign investors before market upgrades. Photo: BSC |

BSC predicts further net buying by foreign investors during the upgrade transition month. After this period, foreign investors are expected to shift towards net selling for the next two months.

Trong Hieu