The European Union (EU) and India recently signed a trade agreement, which significantly reduces import taxes on EU-manufactured automobiles to 10%, down from a previous high of 110%. This move is considered the largest market opening to date for the Indian automotive sector, potentially benefiting brands like Volkswagen and Renault.

However, analysts suggest the new agreement has only "partially opened the door." The Indian market is currently dominated by local manufacturers and Asian competitors, particularly Suzuki and Hyundai. Best-selling models like the Maruti Suzuki Wagon R are known for their affordability and compact size, even smaller than a Mini Cooper.

"This is just the beginning. European cars exported to India are primarily premium vehicles. For the mass-market segment, it remains very difficult," stated Stefan Bratzel, Director of Germany's CAM Automotive Research Institute. According to Bratzel, Suzuki and Hyundai possess a deeper understanding of the Indian market, where consumers prioritize inexpensive, durable, and reliable cars, while Volkswagen's offerings have historically been too costly.

|

A Mercedes car on a Mumbai street, India. Photo: VDownshift |

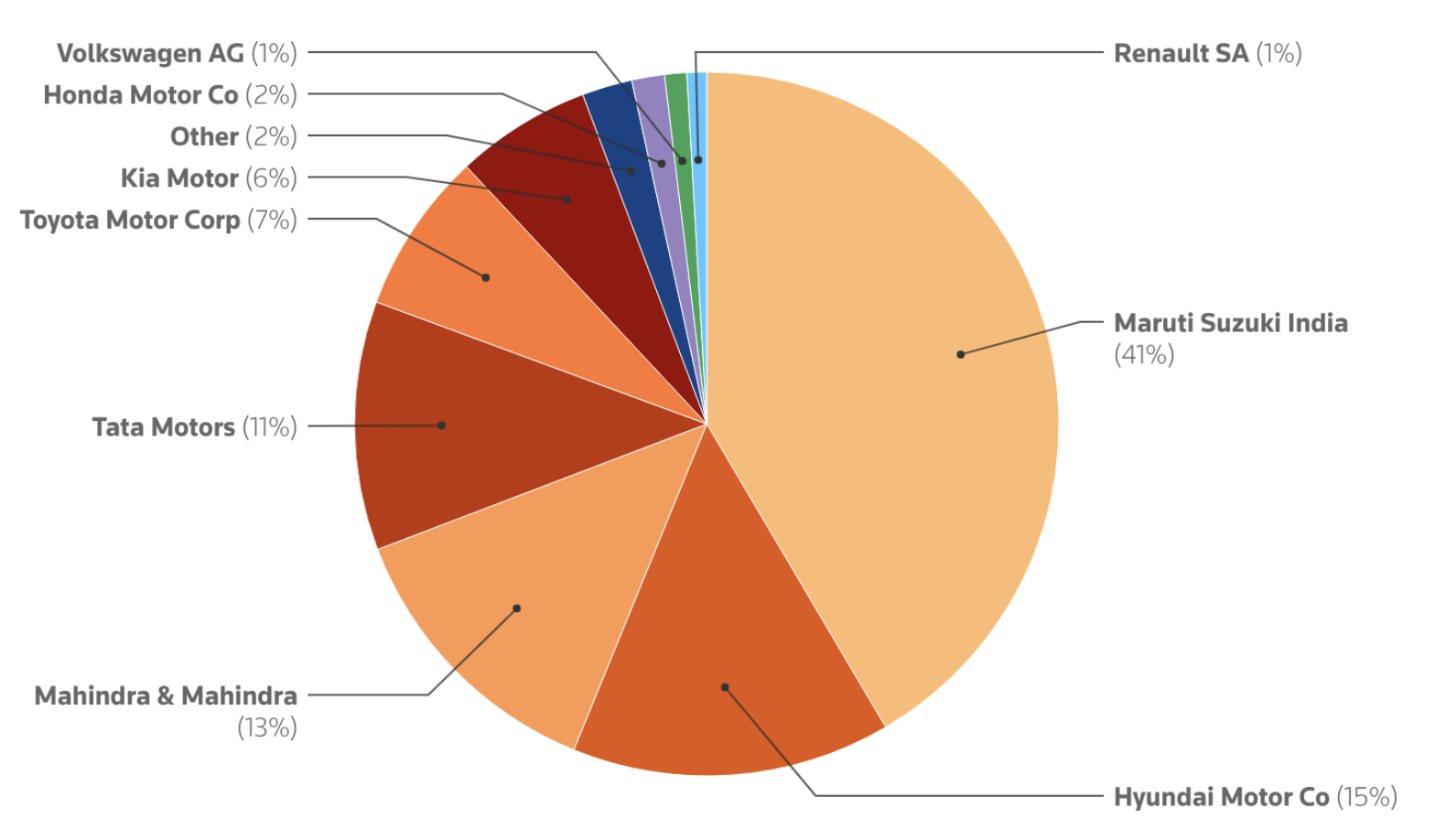

European car manufacturers have ample room for expansion, having lost market share over the past decade due to limited production presence and annual sales reaching only tens of thousands of units. According to Indian automotive industry data, European brands currently hold less than 3% of the market share. The market is largely controlled by Suzuki, alongside domestic manufacturers Mahindra and Tata, collectively holding approximately 66% of the total market.

India is the world's third-largest automobile market, trailing only the US and China, with annual sales of about 4,4 million vehicles. However, it is also one of the most protected markets, with import tariffs on automobiles previously ranging from 70% to 110%.

|

Automaker market share structure in India, as of 3/2025. Source: Reuters |

The German Association of the Automotive Industry (VDA) views the agreement as crucial for Germany's export-oriented economy. Leaders from Volkswagen, Mercedes, and BMW have all welcomed the deal.

"This agreement will help improve market access amidst increasing protectionism, even if not all barriers have been removed," said Hildegard Mueller, President of the VDA.

Volkswagen CEO Oliver Blume stated that the group would carefully review the agreement's details. Meanwhile, Renault brand CEO Fabrice Cambolive indicated that India would be elevated in the company's list of priorities. "This agreement reinforces our desire to invest across both continents, as Renault is both a European company and deeply connected to India," Cambolive told Reuters in Chennai.

High import duties in the US and intense competition in China are prompting many automakers to seek new growth drivers, including India. The country's automotive market is projected to expand by over 33%, reaching 6 million vehicles annually by 2030.

Sources from Reuters indicate that Prime Minister Narendra Modi's government has agreed to reduce tariffs on a limited number of imported cars from the EU, specifically those priced above 15,000 euro (nearly 18,000 USD). Rico Luman, an expert at the multinational financial group ING, believes the EU-India agreement could present a significant opportunity for European car manufacturers in the medium term.

Ho Tan (according to Reuters)