|

A VietinBank transaction counter. |

|

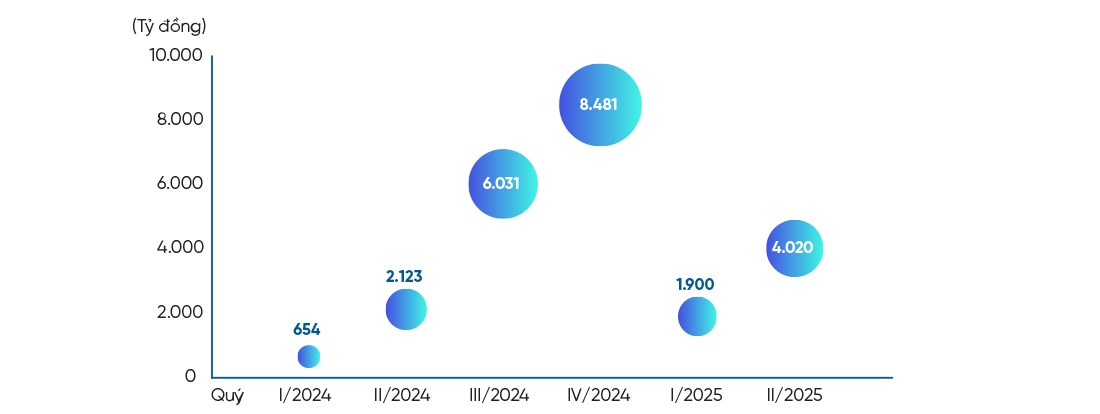

Chart showing the growth of online disbursement at VietinBank. |

|

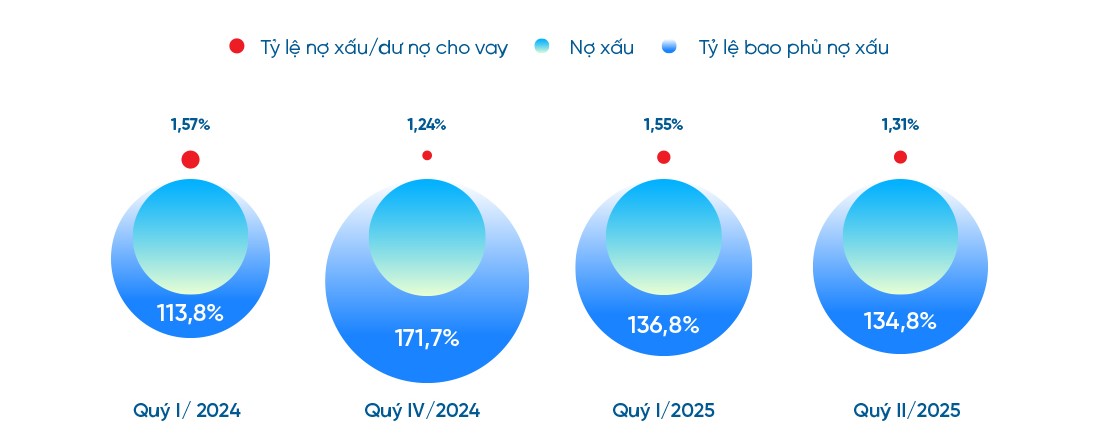

Chart showing the progress of NPL recovery at VietinBank. |

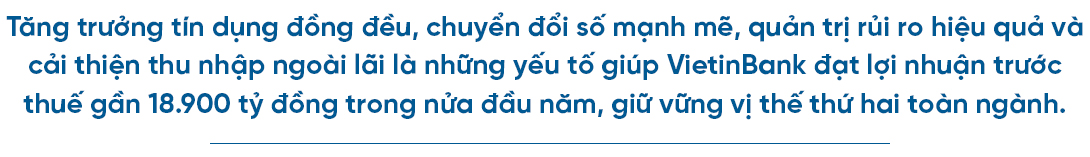

According to the financial report, by the end of June, VietinBank's outstanding loans reached nearly 1.9 quadrillion VND, a 10.3% increase compared to the beginning of the year. This is the highest growth rate among the Big 4 banks and surpasses the industry average of 9.9%. Credit has been allocated evenly, focusing on production and business activities, enabling the bank to control risks and optimize capital costs.

|

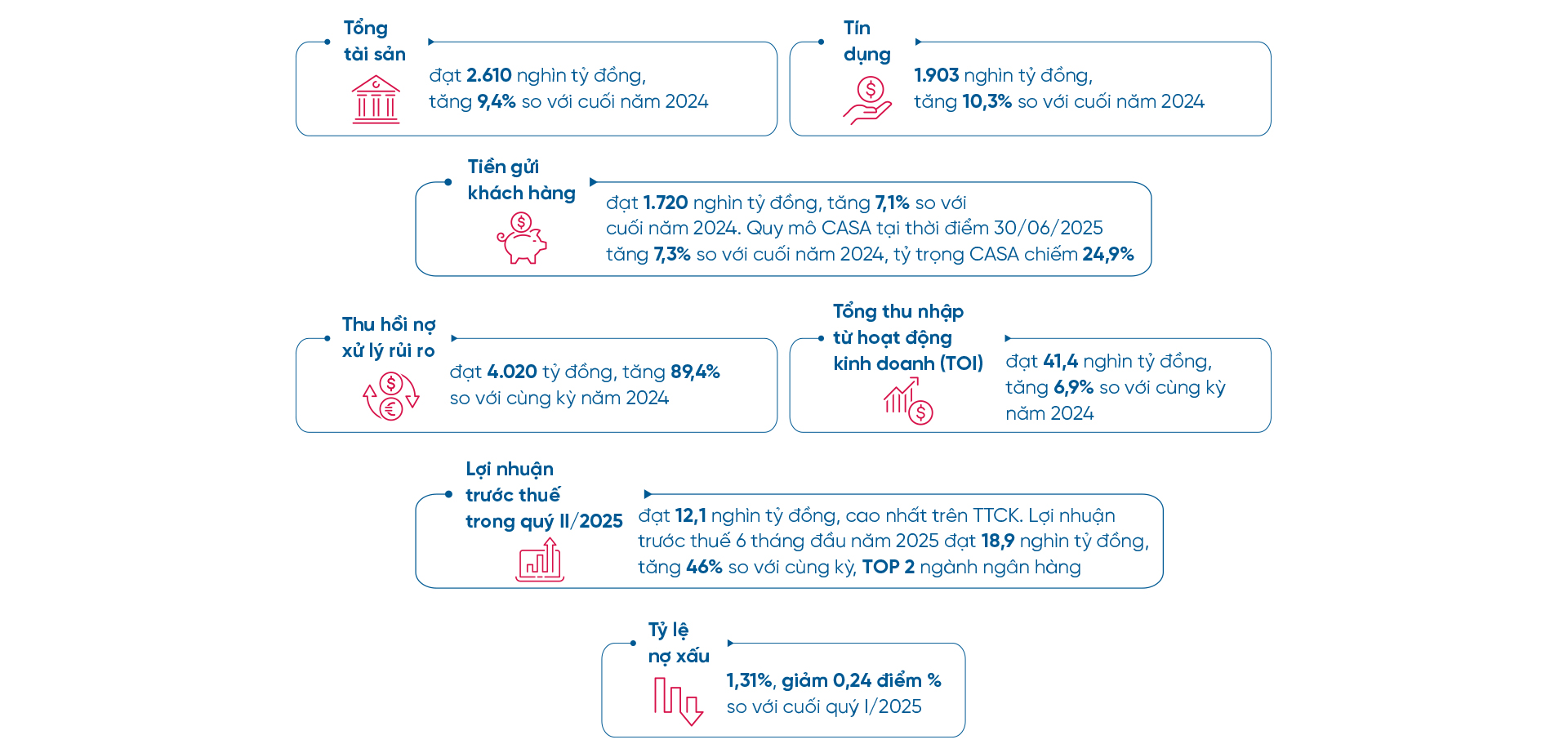

Chart of the bank's NPL and NPL coverage ratios. |

VietinBank's flexible capital allocation strategy has allowed it to adapt to market fluctuations while maintaining profit growth amid a slight decrease in net interest margin (NIM) in Quarter II. Priority sectors include energy, agriculture, electronic components, transportation, industrial zone real estate, and textiles.

|

Some key business results of VietinBank in Quarter II and the first 6 months of the year. |

|

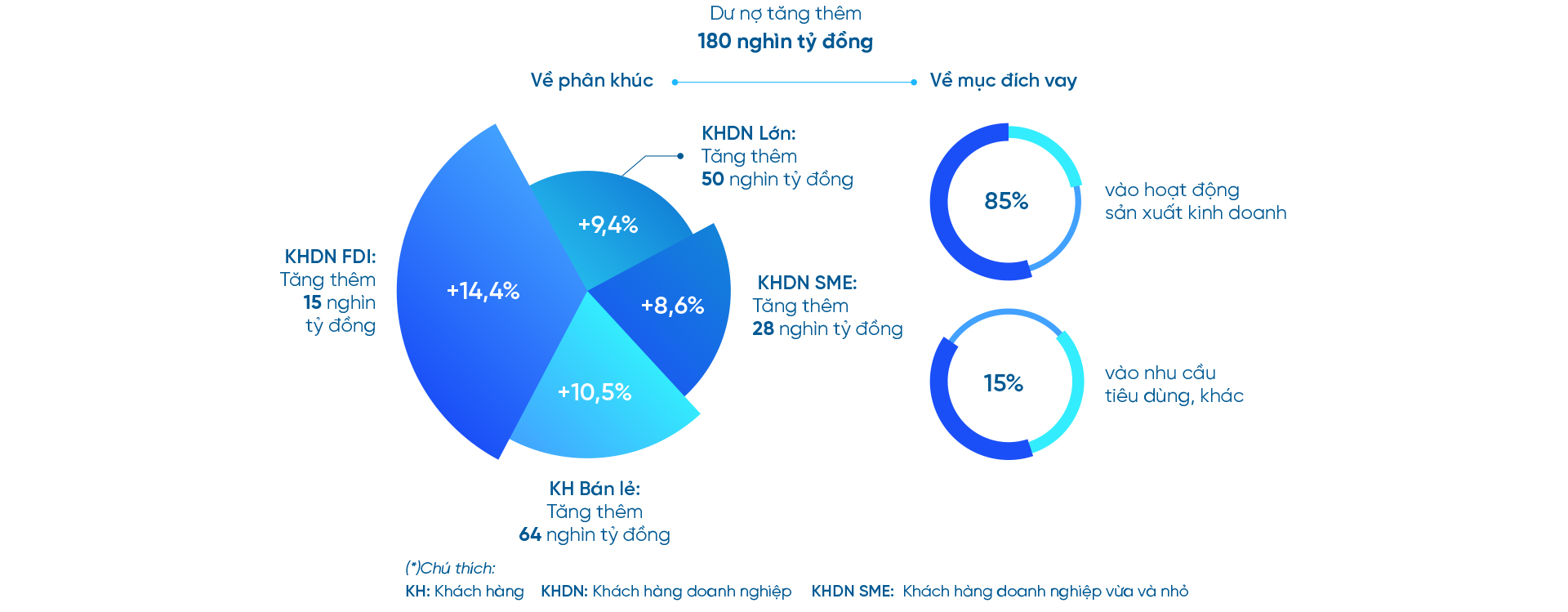

One factor supporting VietinBank's outstanding loan growth is the expansion of technology applications in loan processes, especially online lending for various customer segments.

VietinBank's production and business loan products are now fully deployed on a digital platform, from loan applications and approvals to disbursement and repayment schedule management. This is facilitated through the VietinBank iPay app for individual customers and VietinBank eFast for corporate clients.

|

Launched in 5/2024, the online loan channel quickly recorded positive results. In the first 6 months, the bank processed 90,000 loans, with a total disbursement of 120 trillion VND. Over the next 6 months, this figure tripled to 300,000 loans, reaching 450 trillion VND in disbursement. Online disbursement now accounts for 50% of the bank's total disbursement, marking a significant shift from traditional over-the-counter transactions to the digital environment.

Digitizing processes brings benefits to both customers and the bank. Customers experience faster disbursement times of just 2-5 minutes without needing to visit a branch, and they can manage their entire loan via the app. For the bank, processing time is optimized, labor productivity increases, operating costs decrease, and market competitiveness is strengthened.

According to a VietinBank representative, these are not just technical improvements but also a qualitative shift in production and business loan products. They move the traditional model onto a modern, transparent, and personalized digital banking platform based on user behavior.

|

In the first half of this year, VietinBank continued to implement synchronous solutions for non-performing loan (NPL) recovery, building on the results achieved in 2024. The bank considers this a central task in credit management, focusing on monitoring customers' cash flow and financial-business status. They also coordinate with relevant parties to develop suitable repayment plans.

|

Collateral handling is carried out in accordance with legal regulations to maximize recovery value. Flexible and decisive solutions are implemented, enhancing debt recovery and sustainably reducing credit risk.

In the first 6 months of the year, bad debt recovery reached 4.02 trillion VND, an 89.4% increase compared to the same period in 2024. According to a VietinBank representative, bad debts and NPLs are controlled early, with long-term treatment plans in place to maintain stable recovery results in the coming years.

|

In the first half of 2025, VietinBank recorded positive results in credit risk control. In Quarter II alone, the NPL ratio was 1.31%, a decrease of 0.24 percentage points compared to the end of Quarter I; the NPL coverage ratio reached nearly 135%. The cost of provisioning decreased by 62% year-on-year, significantly contributing to the bank's pre-tax profit growth.

|

To achieve these results, VietinBank has implemented several synchronized solutions. The bank continued to improve its risk management model according to Basel II standards and proactively researched Basel III. They integrated risk management into business planning, capital allocation, and finance, enhancing resilience and proactive responses to market fluctuations.

Furthermore, debt quality control was implemented system-wide, from headquarters to branches. VietinBank reviewed its authorization mechanisms, target assignment, and credit appraisal processes. They also strengthened coordination between the debt control department and business units, especially in retail.

Notably, VietinBank promoted technology application in credit management, particularly the early warning system (EWS) model. This combines statistics and artificial intelligence (AI) with risk measurement tools throughout the credit cycle. These measures help the bank maintain stable credit quality, reduce provisioning pressure, and create a foundation for sustainable growth.

|

In addition to its core business activities, VietinBank has seen a marked improvement in non-interest income, particularly from trading and securities investment. In Quarter II/2025, profit from trading securities reached 213.2 billion VND, an 8.6-fold increase compared to the same period last year. Investment securities also shifted from a loss to a profit, reflecting effective portfolio management and the ability to seize market opportunities.

This improvement contributed to an 18% increase in VietinBank's total non-interest income in the first 6 months of 2025, reducing the bank's dependence on net interest income and contributing to sustainable profit growth.

Thanks to its prudent credit strategy, diversified revenue sources, and digital transformation, VietinBank earned 12.1 trillion VND in Quarter II, an 80% increase year-on-year. This made it the bank with the highest pre-tax profit in the industry and the highest among listed companies on the stock market. Pre-tax profit for the first 6 months of 2025 reached 18.9 trillion VND, a 46% increase over the same period, maintaining its position in the top 2 of the banking sector.

|

|

Content: Ngoc Le | Design: Thai Hung | Photo: VietinBank