On 24/6, the VN-Index, Vietnam's benchmark stock market index, rose nearly 9 points to reach 1,366 points, its highest level since 4/2022.

|

Investors watch the electronic board at Rong Viet Securities JSC (District 1, Ho Chi Minh City). Photo: An Khuong |

Investors watch the electronic board at Rong Viet Securities JSC (District 1, Ho Chi Minh City). Photo: An Khuong

Do Bao Ngoc, deputy general director of Kien Thiet Securities JSC (CSI), told VnExpress that while the index has risen sharply, the gains have been concentrated in a few stocks.

He noted that stocks within the Vingroup conglomerate (VIC, VPL, VRE, VHM), along with banking stocks like TCB and STB, and real estate stocks like NVL and KDH, have largely driven the index's growth over the past two months. "Capital has been allocated across various sectors, but not the entire market, focusing instead on certain stocks," Ngoc said.

Despite the recent rally, experts believe opportunities still exist for investors who missed the initial surge, though the period of guaranteed gains has passed.

Nguyen The Minh, director of Yuanta Vietnam Securities' retail research and development division, believes the market's continued growth potential and the promise of certain sectors offer further opportunities. He points to Vietnam's strong economic fundamentals, with the government targeting 8% growth this year. Additionally, regulatory bodies are implementing policies and legal revisions to support business development, which should help sustain the stock market's upward trajectory despite external challenges.

Tran Thang Long, director of analysis at BSC Securities, is optimistic about the market due to its attractive valuation. The market's price-to-earnings (P/E) ratio is around 13, lower than the average of 15 in recent years.

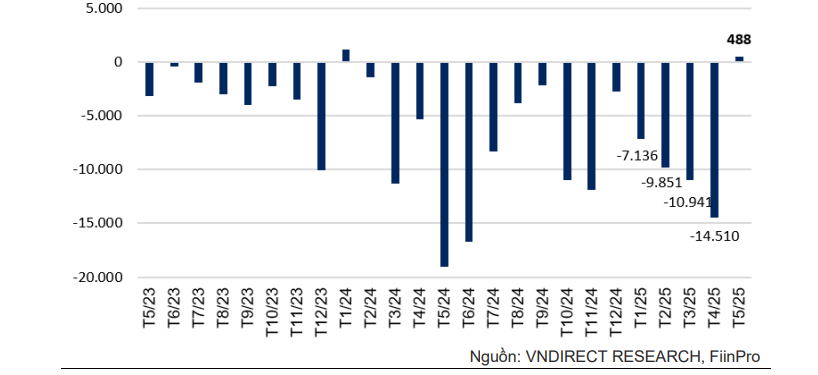

He also highlighted the return of foreign net buying in May, ending a 15-month streak of selling, as a factor boosting domestic investor confidence. Data from VNDirect Securities shows that foreign investors bought a net 488 billion VND in May 2025, ending a selling streak that began in January 2024.

|

Foreign trading value since 5/2023. Photo: VNDirect. |

Foreign trading value since 5/2023. Photo: VNDirect.

Long also noted that corporate profit growth in Quarter I remained strong. If post-negotiation tariffs remain within a reasonable range of 15% to 25%, listed companies' profits could increase by 14-15%. "This is very high compared to the general growth of businesses in other countries," he observed.

Ngoc believes the stock market could attract domestic investment due to low interest rates. Overnight interbank interest rates are currently at 1.67% per year, while one-week rates are at 2% per year. Ngoc considers these rates very low, indicating a surplus of funds within the banking system.

Experts suggest several noteworthy sectors for investors, including banking, real estate, retail, and construction materials. Ngoc notes that while many stocks in these sectors have rallied significantly, becoming market focal points, several others have remained flat, creating opportunities for investors.

Regarding the potential of banks, Minh believes their stocks could rise due to positive business results. He predicts that bank profits will continue to increase in Quarter II of this year and may even surge in Quarter III.

Securities companies like MBS and VCBS estimate that profits of several banks, including HDBank, VietinBank, VPBank, EximBank, and Sacombank, could see double-digit growth this quarter. VnExpress statistics show that since mid-April, while the VN-Index has increased by over 11%, some bank stocks like VCB, BID, MSB, and SSB have not seen corresponding gains and have even declined.

In the retail sector, Minh believes companies will benefit from authorities' efforts to combat counterfeit and low-quality goods. SSI Securities shares this view, predicting that consumers will increasingly turn to trusted retailers through modern trade channels due to concerns about product origin. Companies with modern distribution channels include FPT Retail, The Gioi Di Dong, and Masan Group's WinCommerce.

In real estate, some stocks like VIC, VHM, VRE, NVL, and DXG have outperformed the market. However, others like PDR and KDH have not kept pace with the VN-Index.

MB Securities (MBS) believes that provincial mergers, legal framework revisions, and the resolution of stalled projects will drive the real estate sector. MBS cites examples such as the approval of adjustments to the 1/5000 planning of Dong Nai's C4 subdivision and the 1/500 planning of the Aqua City project, as well as the approval of 148 pilot projects expanding the types of land for commercial housing in Hanoi.

Yuanta Securities points to another factor that could benefit real estate businesses in the second half of the year: mortgage rates have stabilized at a low 5.5-7.5% per year for 12-36 month terms. Even an increase of 0.5-1 percentage points is unlikely to significantly impact market sentiment.

Trong Hieu