According to statistics from the National Cyber Security Association (NCA), damages from cybercrime in Vietnam in 2024 are estimated at nearly 19,000 billion VND. On average, one in every 220 smartphone users becomes a victim of online fraud. Forms of attack, such as data breaches, identity impersonation, account takeover, deepfake, and AI-powered scams, are growing in complexity, while requirements for eKYC, data governance, and information security are continuously tightened.

In this context, experts believe that for users to feel secure transacting on digital platforms daily, fintech companies must demonstrate responsible operational capabilities and proactive risk adaptation. Vietnam's efforts to promote electronic identification, apply AI in risk management, and sign the Hanoi Convention reflect increasing expectations for digital financial platforms to protect users.

As a fintech serving tens of millions of customers, MoMo recognized the challenge of "security in digital financial transactions" early on. In 2010, the platform was launched with the goal of helping Vietnamese people conduct basic financial transactions via mobile phones. In its initial phase, the company implemented a SIM-based e-wallet model, but its effectiveness did not meet expectations.

|

MoMo identifies security as key to building long-term user trust. *Photo: MoMo*

Through direct engagement with users, especially migrant workers, MoMo realized that customer needs extended beyond fast money transfers to include security, peace of mind, and trust in the transaction platform. At that time, the technological solutions provided by the company did not fully meet these requirements.

From this initial experience, the company established a consistent direction for its future development: in the digital finance sector, security is both a competitive advantage and a core foundation for building long-term user trust. Upon shifting to a mobile application, MoMo set the goal of ensuring user transactions are always secure, fast, and accurate. The fintech built a stable database and technology infrastructure capable of processing financial transactions for tens of millions of users daily. The company invested early in international security standards as a prerequisite for building long-term trust.

|

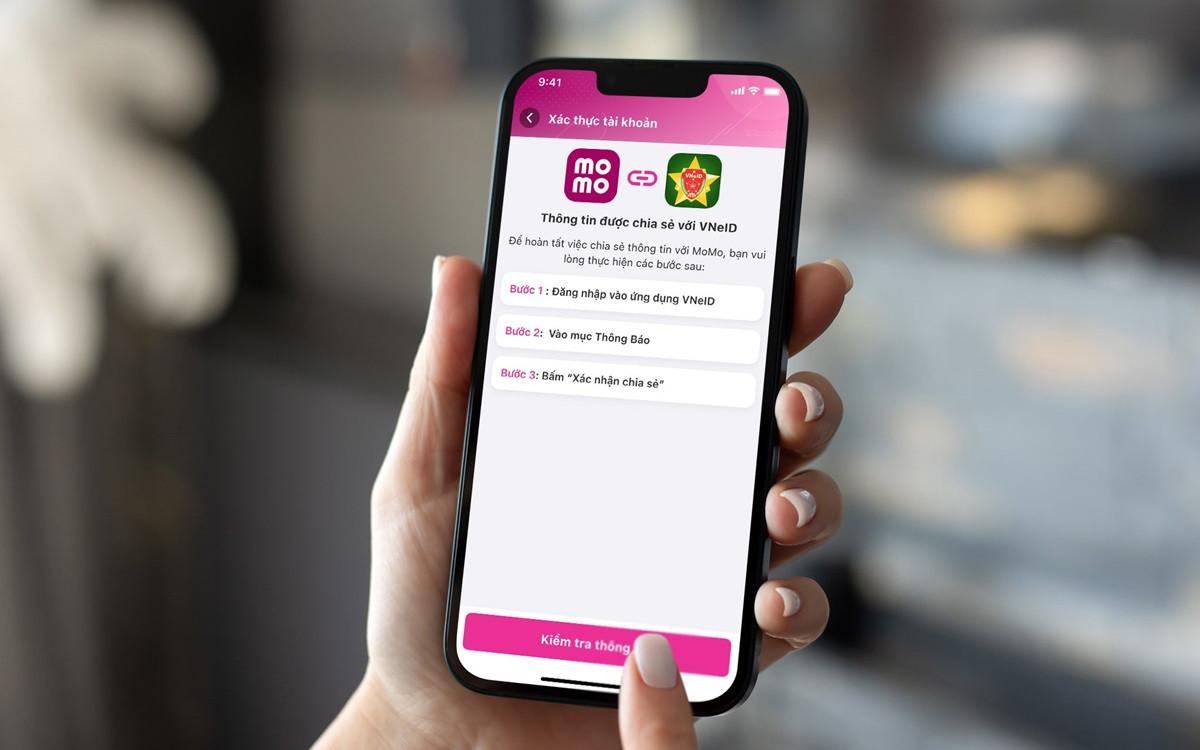

The platform integrates public service payments with VNeID. *Photo: MoMo*

During 2016-2017, when many businesses prioritized user growth, MoMo concentrated resources to achieve PCI DSS Level 1. From that foundation, the company continuously upgraded its operational standards and maintained PCI DSS certification for seven consecutive years, most recently version 4.0 in 2023. Concurrently, its information security management system is standardized according to ISO/IEC 27001:2022, and TLS/SSL transmission encryption helps protect data even when users connect on public WiFi networks.

These layers of standards form a strong backbone, enabling MoMo to connect with crucial national platforms: verifying customer identities via VNeID, becoming an official payment channel for the National Public Service Portal, and integrating with the State Bank's SIMO data system. Simultaneously, the platform is a key factor in partnering with hundreds of major entities, including 70 banks and financial institutions, and global brands such as Vietnam Airlines, Uber, Google, and Apple – all of which demand high security standards.

Amid increasing cybercrime, the platform proactively adjusts and upgrades its system to enhance user protection. Alongside the implementation of regulations such as Decision 2345 and Circular 40, the company has perfected biometric eKYC solutions, synchronizing authentication with national databases, contributing to increased transaction security. Furthermore, a partnership with iProov – a dynamic liveness technology provider from the United Kingdom – has helped MoMo boost the accuracy of its biometric barrier by distinguishing real people from AI-generated images or videos.

Real-time AI operational analysis plays a central role in MoMo's risk management system as its user base expands. In addition to processing transactions, this system analyzes hundreds of behavioral variables to detect unusual signs, thereby providing early and proactive warnings to users.

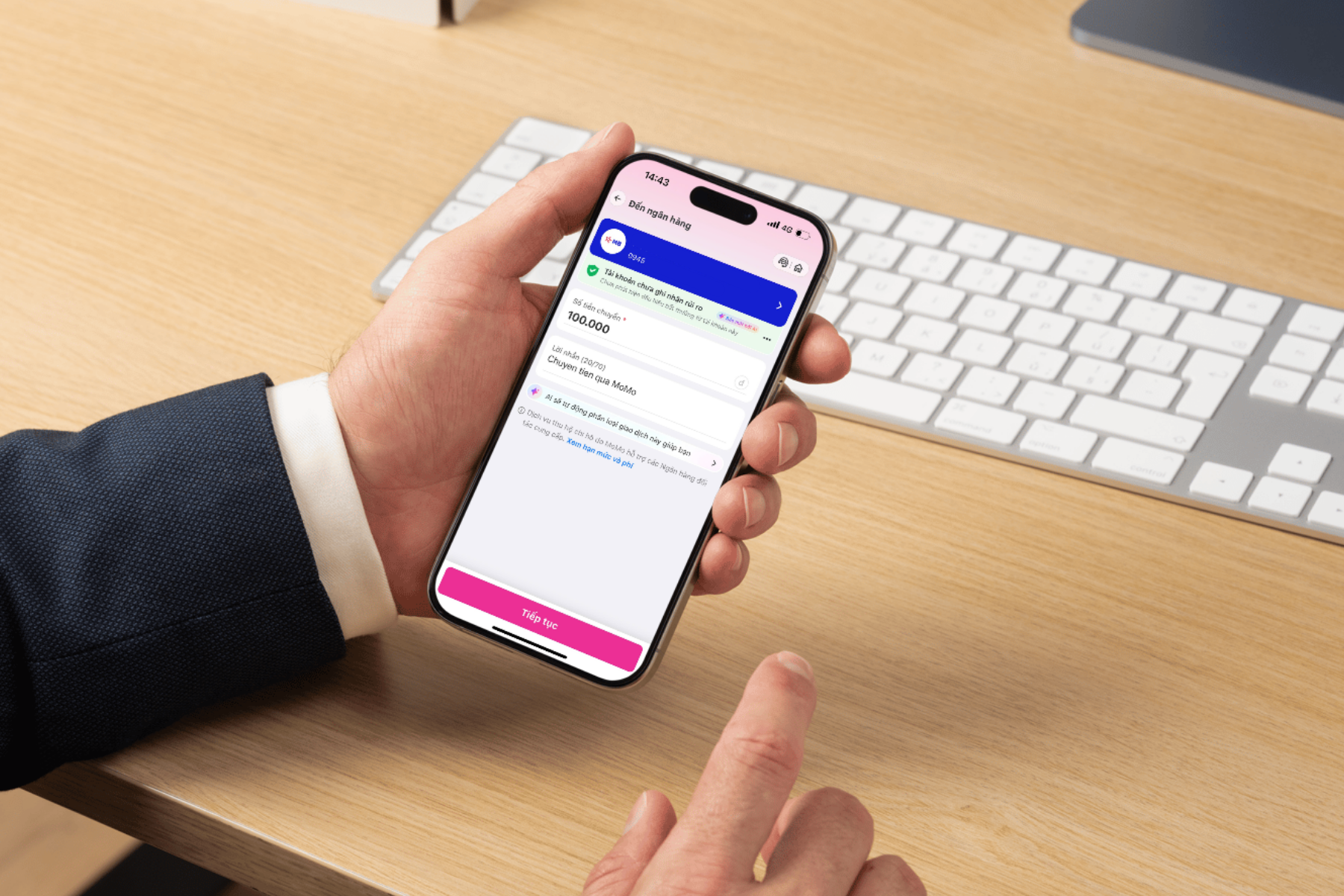

Notably, the AI Fraud Detection system automatically assesses the safety level of recipient accounts, based on official data from state management agencies combined with transaction history. The results are displayed across three clear warning levels: green for safe (account with no recorded risks), yellow for caution (account with potential risks), and red for danger (account with scam risk), empowering users to proactively identify risks before executing transactions.

|

Users pay for expenses via the platform. *Photo: MoMo*

A similar mechanism applies to the Vay nhanh product. If the system detects signs that a user might be manipulated during the loan application process, the transaction is temporarily paused, a warning is issued, and the user is guided to contact the support hotline. This solution is considered a crucial layer of protection for general customers, who are often vulnerable to financial scams.

Beyond technical solutions, MoMo focuses on building an "awareness barrier" for users. Through security information channels, along with in-app reporting and scam lookup features, more than 30 million users can self-check risk levels and proactively protect their accounts.

According to MoMo, consistently prioritizing security as a foundation, from the market's nascent stage to reaching a large scale, helps the platform gradually enter a new phase of digital finance development. In this phase, AI, data, and high operational standards are seen as factors shaping how Vietnamese people transact, pay, and access financial services in the future.

Hoang Dan