Starting with SMS money transfer services in 2010, MoMo now operates hundreds of AI models every second, meeting diverse daily financial needs: from payments, shopping, education, and healthcare to online public services. Throughout its journey, the company has consistently pursued a goal: to build technology mastered by Vietnamese people and develop financial services that meet the practical needs of individuals and businesses.

Three phases of transformation

Over more than 15 years of operation, MoMo has undergone three significant phases of transformation, laying the foundation for a comprehensive digital financial ecosystem powered by AI. Each phase has been linked to changes in user behavior, technical requirements, and technological trends, thereby shaping the financial service ecosystem the company currently provides.

Phase 1, from 2010 to 2014, marked the shift from 2G SIMs to a mobile-first approach. In 2010, MoMo partnered with Vinaphone and Vietcombank to launch an electronic wallet via SMS, primarily serving migrant workers. However, limitations of 2G SIMs and user concerns about security made this model difficult to scale. By 2013, as smartphones became increasingly popular and banks promoted digitalization, the company shifted its focus to Android and iOS applications. This was a crucial turning point, allowing MoMo to adopt a mobile-first model and pave the way for its later digital financial ecosystem.

|

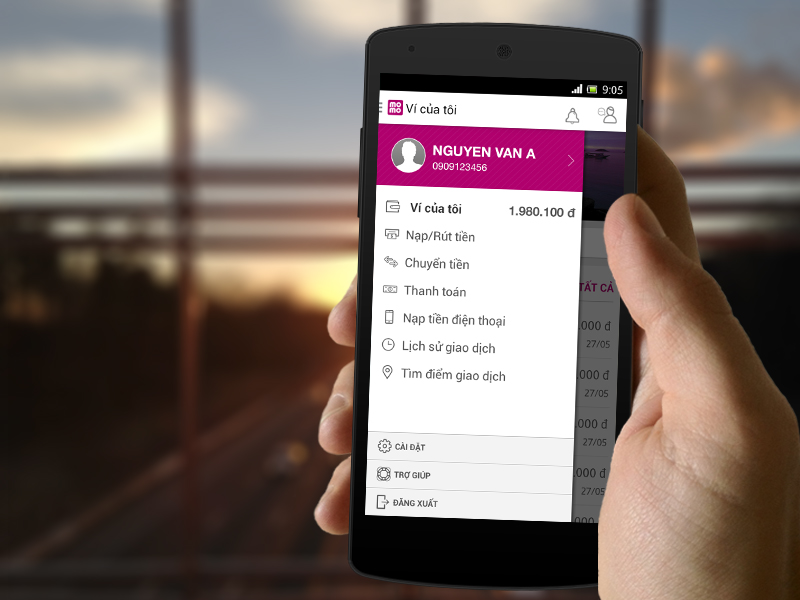

The MoMo app interface during its early shift to a mobile-first approach. Photo: MoMo |

From 2014 to 2019, the domestic fintech market experienced rapid growth, requiring payment platforms like MoMo to enhance security and stability standards. To build products suitable for Vietnamese people, the company chose to develop its entire platform internally instead of purchasing foreign solutions, becoming the first electronic wallet to achieve PCI DSS level one security certification.

On this self-developed platform, MoMo continued to standardize operations, implement static and dynamic QR codes, optimize its application, and expand bank connections. The capabilities of Vietnamese engineers were clearly demonstrated when the company became a payment partner in Vietnam for Uber, Google, and Apple, enabling digital service payments via electronic wallets instead of only credit cards. This event also helped the company attract foreign funds from Standard Chartered Private Equity, Goldman Sachs, and Warburg Pincus, providing the financial and technical foundation for its next phase of growth.

From 2020 to the present, following the Covid-19 pandemic, the demand for digital transactions and personal financial management surged. This required platforms to not only process payments but also provide comprehensive financial support for users' diverse needs. MoMo focused on enhancing operational capacity, increasing processing speed, and strengthening system security on a technology platform developed by Vietnamese engineers. Simultaneously, it refined its data model and applied AI in risk control and services.

This fintech also collaborates with banks and credit institutions to expand essential financial solutions such as post-paid wallets, micro-loans, insurance, savings, investment, and online public services in education, healthcare, and administration. The seamless integration of these services within one application helps users manage their daily financial needs simply, securely, and transparently.

|

MoMo applies AI across its entire platform and at a large scale. Photo: MoMo |

Nguyen Manh Tuong, Co-founder, Co-chairman of the Board of Directors, and Chief Executive Officer of MoMo Financial Technology Group, stated that over the past 15 years, MoMo has consistently aimed to help everyone easily access financial services and take control of their lives with technological support. Each step – from payments, micro-credit, and insurance to public services – stems from the real needs of individuals and businesses. To achieve this goal, the company focuses on foundational capabilities, collaborating closely with banks, financial institutions, and regulatory bodies to make the digital financial system increasingly secure, transparent, and accessible.

"In this new phase, we will continue to invest in core technology and AI, expand essential financial services, and contribute more to financial inclusion and national digital transformation", Mr. Tuong emphasized.

AI: a core foundation for the new phase

While expanding its service ecosystem, MoMo continues to invest heavily in core technology, particularly artificial intelligence, transforming itself into a leading financial technology group that applies AI.

Over 1,000 technology engineers, including more than 200 AI and data specialists, are developing and operating hundreds of models for various operations: from credit scoring and experience personalization to customer support and real-time fraud detection. On average, each transaction on MoMo is processed through 6-7 AI models, ensuring speed, accuracy, and security for tens of millions of users.

One notable model is AI credit scoring. With an understanding of the payment and spending behaviors of over 30 million users, MoMo can support banks and credit institutions in assessing users' financial capacity, especially for those without a credit history.

Additionally, AI fraud detection identifies anomalies in real-time using machine learning models, reducing fraud by over 30%. AI personalization optimizes the user experience at every touchpoint, from suggesting services, offers, and content to navigation and financial recommendations. With the AI assistant Moni, the platform analyzes real-time spending, allowing users to receive personalized savings suggestions and bill payment support. Meanwhile, AI customer care features a 24/7 chatbot that handles a large volume of requests, providing instant support.

When implementing these models, MoMo also maintains the highest safety standards: PCI DSS level one, ISO 27001:2022, ISO 27701:2019, and dynamic liveness eKYC.

Partnering to promote national digital transformation

A company representative stated that developing a comprehensive service ecosystem has also made MoMo a key link in the public sector's digital transformation process. The company is one of the important payment platforms for online public service infrastructure, supporting over 90% of public administrative services nationwide. On the National Public Service Portal, this platform accounts for approximately 25% of total cashless transactions and leads in many service categories, such as over 50% of university and college application fees. MoMo's system is widely deployed at nearly 9,000 educational institutions, over 200 hospitals, and for tax, fee, and charge services in 34 provinces and cities.

|

The VNeID connected platform contributes to the digitalization of public services. Photo: MoMo |

In the 2024-2025 period, MoMo will collaborate with VNeID to integrate electronic authentication and direct payments within the national identification application. This will help people process bills, fees, charges, and traffic fines quickly, securely, and transparently. The application also connects with CIC to provide a credit score lookup channel, supporting users without a credit history in accessing official financial services.

Concurrently, the company is enhancing its services for small and medium-sized enterprises through its member companies. These companies include: iPOS.vn, Nhanh.vn, and CV Securities (CVS), forming an ecosystem of solutions that supports over 500,000 small business owners.

These contributions have earned MoMo numerous prestigious awards, such as top 3 leading AI companies in Vietnam (AI4VN 2025) and the excellent digital payment solution for postpaid wallet (Better Choice Awards 2025). The company also received the leading electronic wallet brand in digital finance award (2024) and was named among the top 50 global fintechs by KPMG, recognizing its sustained investment in core technology, data, and user experience.

Hoang Dan