According to VnExpress statistics on 26 open-ended equity funds, the average performance in 2025 reached 15,45%. Fund performance is calculated based on the growth of the net asset value (NAV) from the beginning to the end of the previous year.

The best-performing fund of the year was BVFED of Bao Viet Fund, with a rate of 35,7%. This product focuses on investing in VN30 basket stocks, aiming to maximize long-term returns for investors by combining capital growth and income streams from investment assets.

Following BVFED was DCDS of Dragon Capital, with a performance of 31,25% in 2025. This investment fund targets growth stocks and diverse financial assets. DCDS also has a history of more than 20 years of operation, with a flexible market-adaptive strategy.

Closely behind was MAGEF of Mirae Asset Vietnam, with 30,03%. This product focuses on listed stocks with strong growth potential and industry-leading companies, anticipating high returns with a corresponding level of risk.

However, no open-ended equity fund achieved performance superior to the VN-Index. The HoSE representative index closed 2025 at 1.784,5 points, increasing by nearly 518 points, equivalent to about 40,87% compared to the beginning of the year, marking its most active period since 2017.

Explaining this to VnExpress, Nguyen Thanh Trung, General Director of FinSuccess Investment Joint Stock Company, noted that 2025 was a year when the general index rose primarily due to a group of very large-cap stocks, not a year where corporate profits across the entire market increased uniformly. "In other words, the VN-Index surged, but profit opportunities did not spread widely", he stated.

Open-ended funds must adhere to strict risk management principles. They are required to diversify portfolios, limit the proportion of each stock, ensure liquidity for investors withdrawing capital, and cannot concentrate excessively on a few pillar stocks. These principles effectively protect investors during down years, but in a year when the market is driven by only a few key stocks, funds will struggle to keep pace with the index.

Experts believe that an open-ended fund not outperforming the VN-Index in a few years is entirely normal. The stock market is constantly changing, and each period rewards different strategies. In fact, during 2023-2024, many open-ended funds in Vietnam significantly outperformed the general index.

For FinSuccess, Mr. Trung does not consider outperforming the VN-Index in a unique year like 2025 to be the most important measure. Their focus is on capital preservation during poor market years and superior accumulation over a long cycle. According to him, that is the core value an open-ended fund should provide to investors.

In 2025, VIC of Vingroup contributed approximately 189,5 points to the general index, while VHM of Vinhomes contributed about 66,6 points. These two "Vin" group stocks accounted for nearly half (49,47%) of the total market increase. This is considered one of the largest point concentration phenomena in the history of the Vietnamese stock market. If VIC and VHM were excluded, the general index would have accumulated only about 20,65%.

Considering this reference, seven open-ended equity funds outperformed the index. In addition to the three representatives already mentioned, these include: BMFF of MB Capital, UVEEF of OUB, VCB-BCF of VCBF, and MBVF of MB Capital.

However, 19 open-ended equity funds still performed below the general index, even after excluding VIC and VHM. Some funds accumulated only 4-6% in the previous year.

In a recent report, Fmarket—an open-ended fund distribution platform with more than 320.000 users—suggested that instead of chasing short-term, localized surges, value-style funds continue to accumulate stocks of industry-leading companies, prioritizing risk management and maintaining portfolio structure. This strategy might result in lower fund performance than the VN-Index during some periods, but it ensures portfolio structure preservation and accumulation of quality assets to optimize investment efficiency when the market enters a broader growth cycle.

"Investing in open-ended funds is fundamentally a medium and long-term asset allocation strategy. The effectiveness of this strategy is usually evident when investors maintain the recommended holding period, especially when the portfolio is managed consistently throughout at least one economic cycle", Fmarket emphasized.

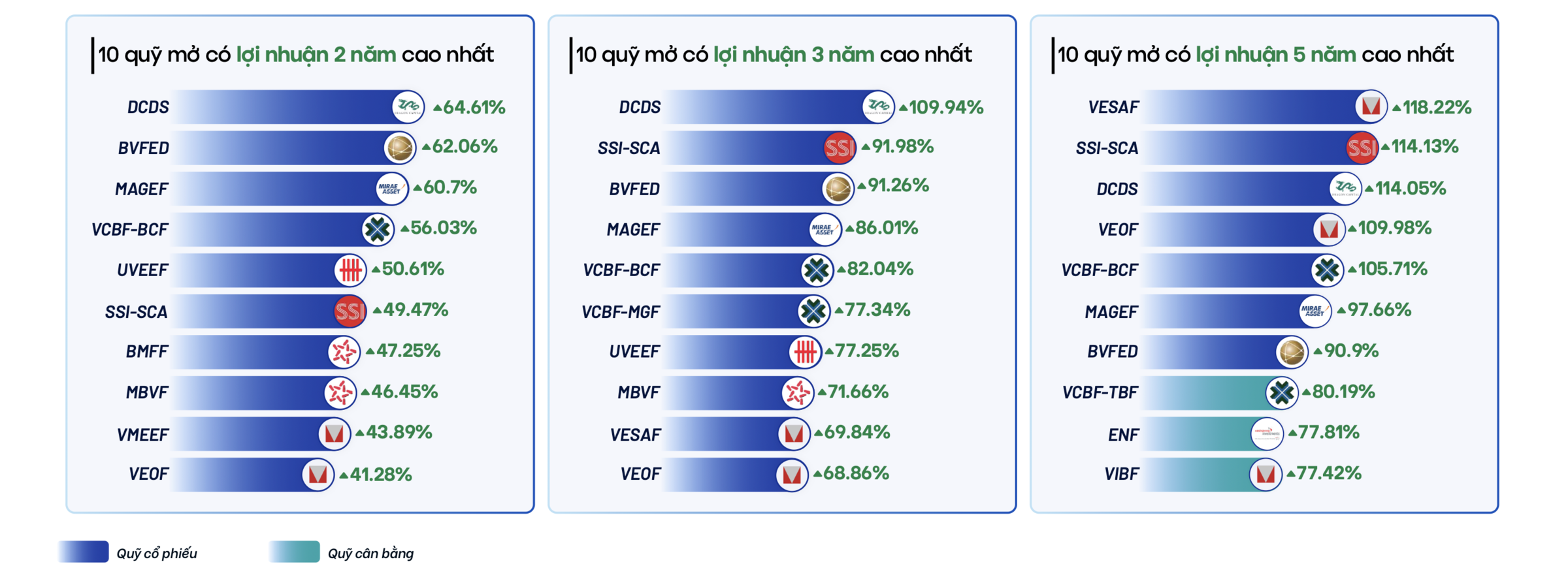

Performance data over 2-year, 3-year, and 5-year timeframes shows that funds with consistent strategies and high investment discipline can generate sustainable growth, despite short-term market volatility. Over a 5-year period, the top-performing fund group achieved an average annual return of about 15-22%. This reflects the funds' portfolio management capabilities, disciplined investment processes, and resilient adaptability across various market cycles.

|

The 10 open-ended funds with the highest returns in the market over 2-year, 3-year, and 5-year timeframes. Graphics: Fmarket |

The 10 open-ended funds with the highest returns in the market over 2-year, 3-year, and 5-year timeframes. Graphics: Fmarket

Tat Dat