The trade agreement, reached on 15/1, will reduce US import tariffs on most Taiwanese products from 20% to 15%. Chip manufacturers such as TSMC, which have already expanded production in the US, will benefit from reduced tariffs on semiconductor products or related manufacturing equipment imported into the country. Some products in this sector will even be exempt from tariffs.

The US Department of Commerce stated that generic drugs, aircraft components, and "unavailable natural resources" will face 0% tariffs. Automotive components, logs, lumber, and wood products will be subject to a maximum 15% tariff. US officials reportedly assured Taiwan that it would not be treated less favorably than other partners if chip tariffs are raised in the future.

|

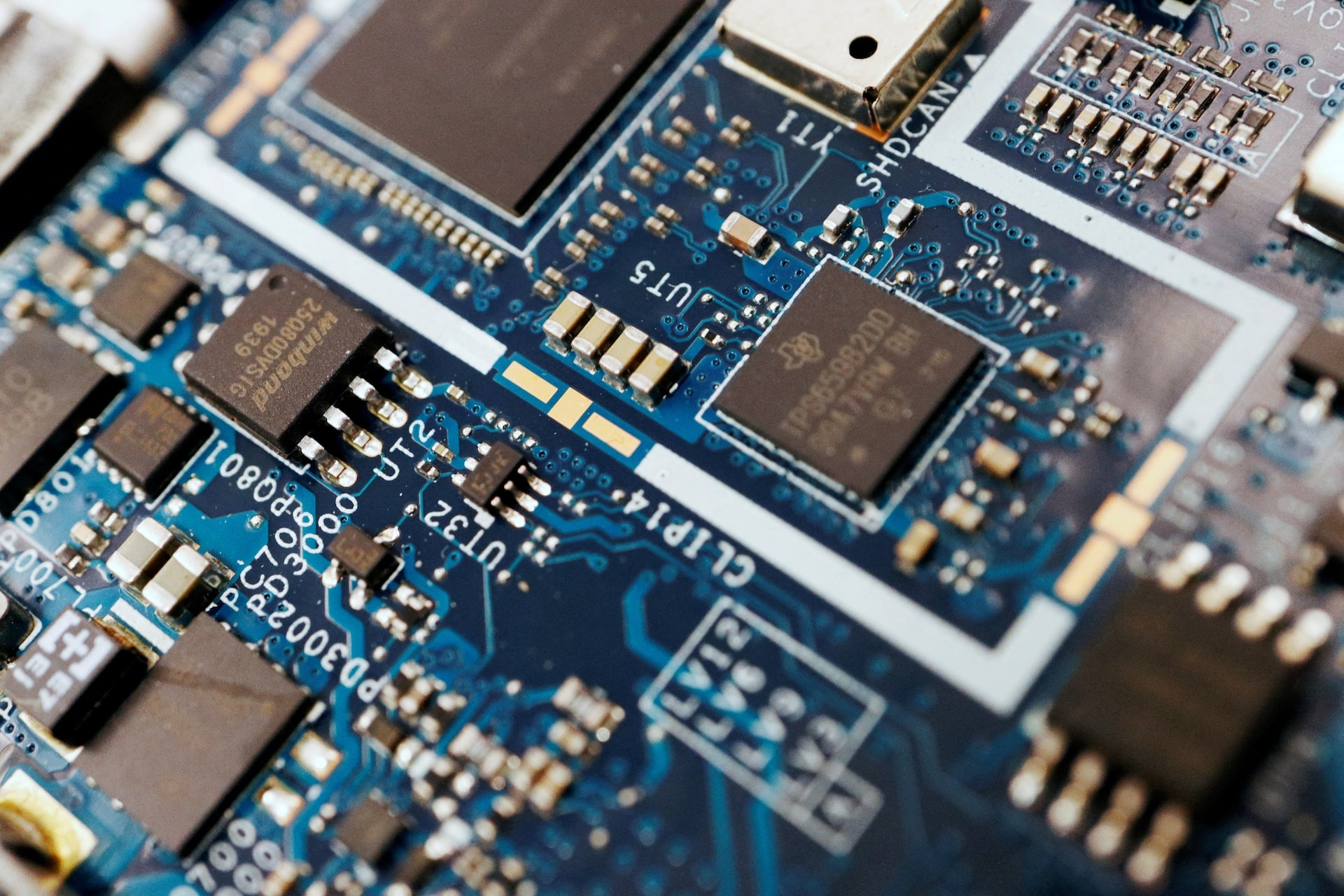

Semiconductor chip on a computer circuit board. *Photo: Reuters* |

In return, Taiwanese companies will invest 250 billion USD to boost semiconductor, energy, and artificial intelligence production in the US. This figure includes TSMC's 100 billion USD investment pledge last year. Numerous other deals are also anticipated.

In an interview with CNBC on 15/1, US Secretary of Commerce Howard Lutnick stated that their goal is to relocate 40% of Taiwan's chip supply chain and production to the US. He warned that if businesses do not establish factories there, import tariffs will likely be 100%.

The increase in chip production is expected to generate additional orders for major TSMC suppliers such as ASML, Lam Research, and Applied Materials. The agreement is also anticipated to boost operations for smaller suppliers in the chemical and materials sectors, including Sumitomo Corp and Qnity Electronics.

Shares of chipmaker Nvidia, which relies on TSMC's manufacturing operations, rose more than 2% during the 15/1 trading session. Meanwhile, Intel's stock saw a slight decline.

Washington has recently grown increasingly concerned about its reliance on foreign-manufactured chips. On 14/1, US President Donald Trump signed a document imposing a 25% import tariff on certain high-end AI chips, such as Nvidia's H200 and AMD's MI325X. However, this tariff wave was narrow in scope and exempted many products.

On 15/1, TSMC also announced a 35% increase in its Q4/2025 profit, exceeding analyst forecasts. CEO C.C. Wei stated that the company is seeking permits in Arizona to begin construction on its 4th factory and its first advanced packaging facility.

By Ha Thu (Reuters)