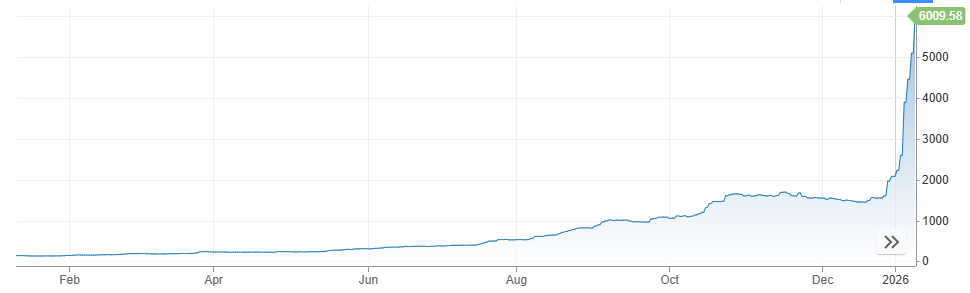

Venezuela's Indice Bursatil de Capitalizacion (IBC) closed at a record 6,009 points on 9/1. The index has surged over 130% since 3/1, when the US raided Venezuela and arrested President Nicolas Maduro.

|

Venezuelan stock market performance over the past year. *Chart: CNBC*

Analysts view this development as reflecting investor optimism that Venezuela's economy could stabilize after years of sanctions and default. They anticipate that a government restructuring might attract investment, revive oil production, and normalize relations with the US.

"While the situation remains volatile, we believe Venezuela is likely to maintain its current regime, but with adjusted actions. A more flexible Venezuela would allow the US to strengthen its regional position, ensuring access to the oil industry under favorable conditions," BMI stated.

"Investors are beginning to bet that Maduro's loss of power is a condition for the US to lift sanctions on Venezuela, paving the way for a restructuring agreement," said Anthony Simond, investment director at Aberdeen. Simond noted that investor demand is currently high, coming from emerging market fund managers to hedge funds.

However, strategists also caution that Venezuela's stock market is small, illiquid, and difficult for global investors to access. This means price fluctuations can be substantial; last year, the IBC index soared by 1,644%.

"The Venezuelan market has thin trading volume. Therefore, small changes in expectations can cause significant price volatility. This rally merely reflects expectations and speculative activity," commented Alice Blue, an integrated brokerage platform under TradingView.

Beyond stocks, investors are also channeling funds into government and state oil company bonds. Jeff Grills, head of emerging market debt at Aegon Asset Management, indicated that this interest primarily stems from expectations of potential debt restructuring. Venezuela defaulted on its bonds in 2017.

Grills warned that much of the current stock market rally is a news-driven response. He also noted that a change in leadership does not necessarily equate to comprehensive reform. Reuters reported that the South American nation's foreign debt currently stands at approximately 150-170 billion USD.

"Everything hinges on the debt restructuring process not getting derailed. If restructured, the stock market will be completely revalued," stated Eric Fine, portfolio manager at VanEck.

By Ha Thu (according to CNBC, Reuters)