Developed on the Visa Flex Credential (VFC) platform, PayFlex empowers users to select their funding source for each transaction—either their checking account or credit card—using a single card. This feature offers cardholders smart financial control and maximizes benefits.

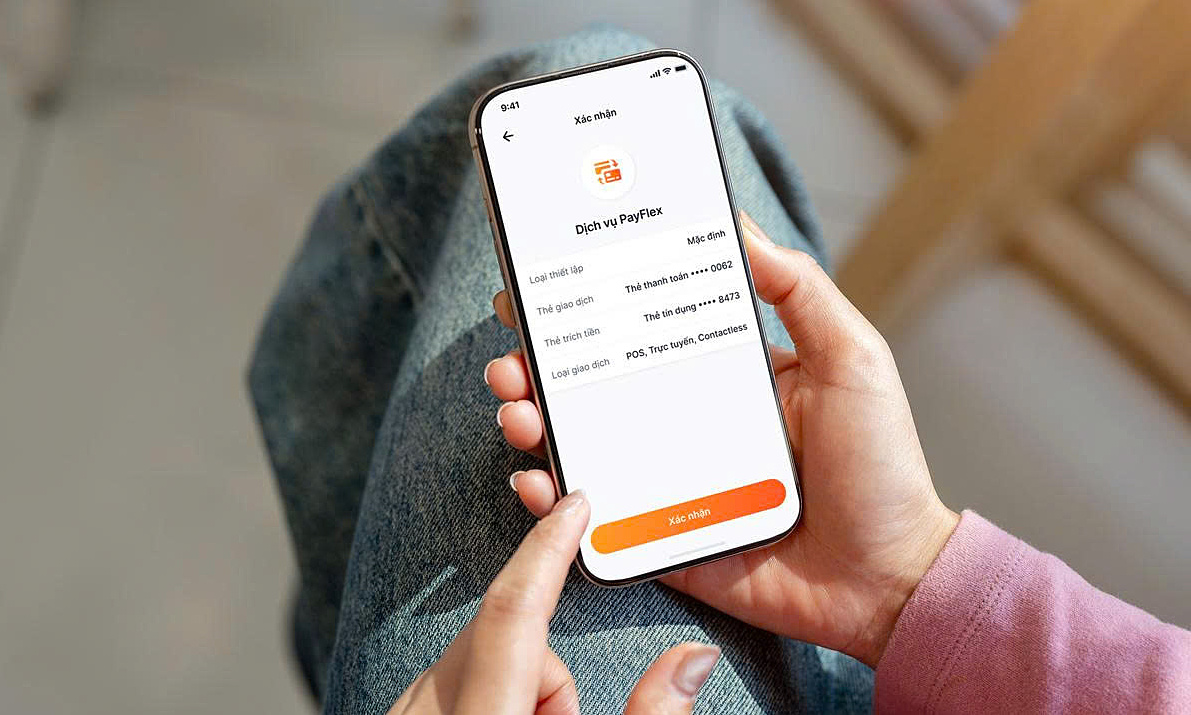

Integrated directly into the MyVIB app, PayFlex offers users easy setup and switching between funding sources with simple steps. According to a bank representative, this integration blurs the lines between card types, unifying them into a single spending tool. Cardholders no longer need to remember which card to use; they simply use the card set up through PayFlex.

|

PayFlex is seamlessly integrated into the MyVIB digital banking app. Photo: VIB |

PayFlex is seamlessly integrated into the MyVIB digital banking app. Photo: VIB

With this new feature, physical cards are no longer limited to fixed roles as credit or debit cards. Instead, they become versatile spending tools adaptable to various situations. Users can set their preferred payment source based on the transaction type, such as online shopping, international spending, contactless payments, or transaction value, optimizing cash flow and effectively managing personal budgets.

All VIB PayFlex transactions are secured by the latest technology from VIB and Visa, ensuring customer peace of mind. Using PayFlex also optimizes payment benefits and minimizes the risk of using the wrong card, especially at points of sale (POS), guaranteeing cardholders receive their desired benefits.

Along with the launch of PayFlex, VIB is offering credit cards to customers using Visa debit cards based on their spending history. Users can set up transaction funding sources on their existing physical cards, whether credit or debit, through the MyVIB app. The entire process is quick, eliminating the need for a new credit card, changing saved information on platforms, or remembering additional card details.

|

Customers explore PayFlex features. Photo: VIB |

Customers explore PayFlex features. Photo: VIB

The bank representative considers this a step forward from traditional "two-in-one" cards, which usually only allow funding source selection via a physical chip or pre-set defaults. Real-time control over funding sources through MyVIB offers financial flexibility, allowing cardholders to optimize cash flow and spending strategies. For example, customers can use their debit account for daily expenses for easy budget management and their credit account for larger transactions to take advantage of benefits, interest-free periods, or installment plans.

Tuong Nguyen, Deputy General Director and Head of Cards at VIB, stated the bank consistently applies technology to deliver superior financial solutions and enhance customer experiences. VIB PayFlex exemplifies this commitment. VIB is positioning itself as an innovator, leading the market by bringing globally proven payment solutions to domestic customers.

"We believe this feature will transform how customers manage daily spending, giving cardholders flexibility and financial control with just one card," said Tuong Nguyen.

Dang Tuyet Dung, Visa Country Manager for Vietnam and Laos, remarked that VIB's deployment of PayFlex on the VFC platform demonstrates the bank's vision and commitment to providing advanced payment solutions to Vietnamese users. This collaboration will promote cashless payments and enhance the financial experience for customers.

Hoang Dan

VIB is widely rolling out PayFlex to all customers with gifts worth up to 200,000 VND for the first users. Apply for a VIB Visa debit or credit card here.