Gary Winnick, born in 1947, rose to prominence during the late 1990s internet boom. His telecommunications empire, Global Crossing, was once valued at USD 50 billion.

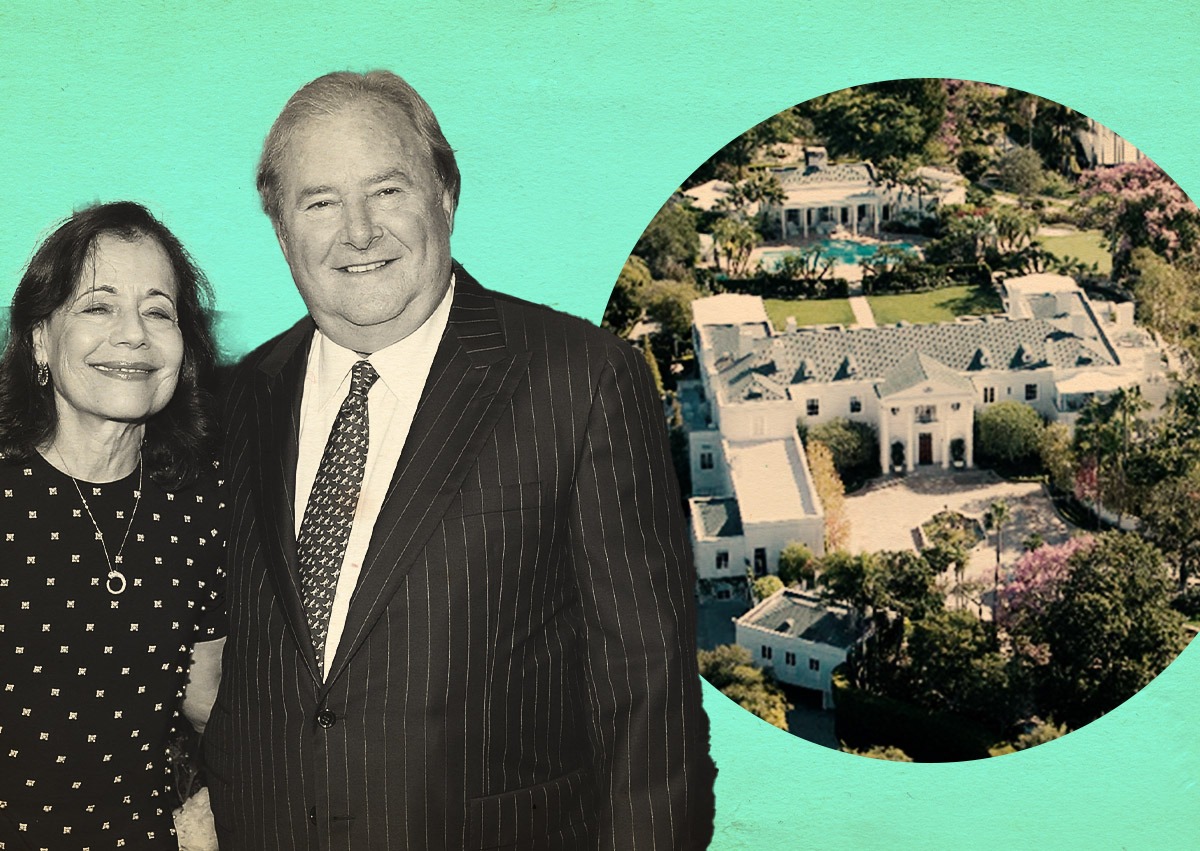

In 2000, Gary Winnick and his wife, Karen, made headlines when they acquired Casa Encantada, a legendary estate in Bel-Air, Los Angeles, for USD 94 million. This was the most expensive residential real estate transaction in the U.S. at the time. The Winnicks spared no expense, spending tens of millions USD and hiring hundreds of artisans to transform the over 3,700 square meter estate into a museum filled with antiques and artworks.

|

The Casa Encantada estate was once listed for USD 250 million. Photo: Simon Berlyn |

Their collection expanded to include artworks, a home in Malibu, and an apartment in New York. He lived as if money would never stop flowing into his pockets.

However, Winnick's financial foundation began to crumble when the dot-com bubble burst. In 2002, Global Crossing went bankrupt. Although Winnick managed to sell shares and retain substantial assets, his "money printing machine" had stopped.

As his business declined, Winnick's spending habits remained unchanged. He continued to socialize with the elite and maintain a generous image. To sustain his lavish lifestyle, Winnick began borrowing. By 2023, the family's debts had swelled to approximately USD 155 million with high interest rates.

On 4/11/2023, Gary Winnick passed away at age 76. His passing also lifted the veil on the family's dire financial situation.

|

Karen Winnick and her husband, with the Casa Encantada estate. Photo: The Real Deal |

Karen Winnick, his 79-year-old widow, was shocked to discover she had not only lost her husband but was also about to lose everything. In a desperate legal battle to retain her home, she stated she had no idea her husband had mortgaged all their assets.

Not only the iconic Casa Encantada estate, but also artworks, furniture, antiques, and most painfully, her wedding ring, had been collateralized.

Currently, creditors are proceeding with foreclosure and auctioning the assets. Karen admits she is being pushed to be "nearly penniless" due to financial arrangements her husband concealed to maintain a facade of wealth until his death.

By Nhat Minh (New York Post, WSJ)