According to Decree 119/2024 regarding electronic toll collection, starting 1/10/2025, vehicles without electronic toll accounts will be unable to pass through electronic toll collection (ETC) lanes. This transition aims to connect payments with banks or e-wallets, expanding payment options for various transportation services beyond direct top-ups to toll accounts.

However, drivers have reported issues with apps like VETC and ePass, including limited payment gateways, strict requirements for matching bank information, and additional fees for certain international payment methods.

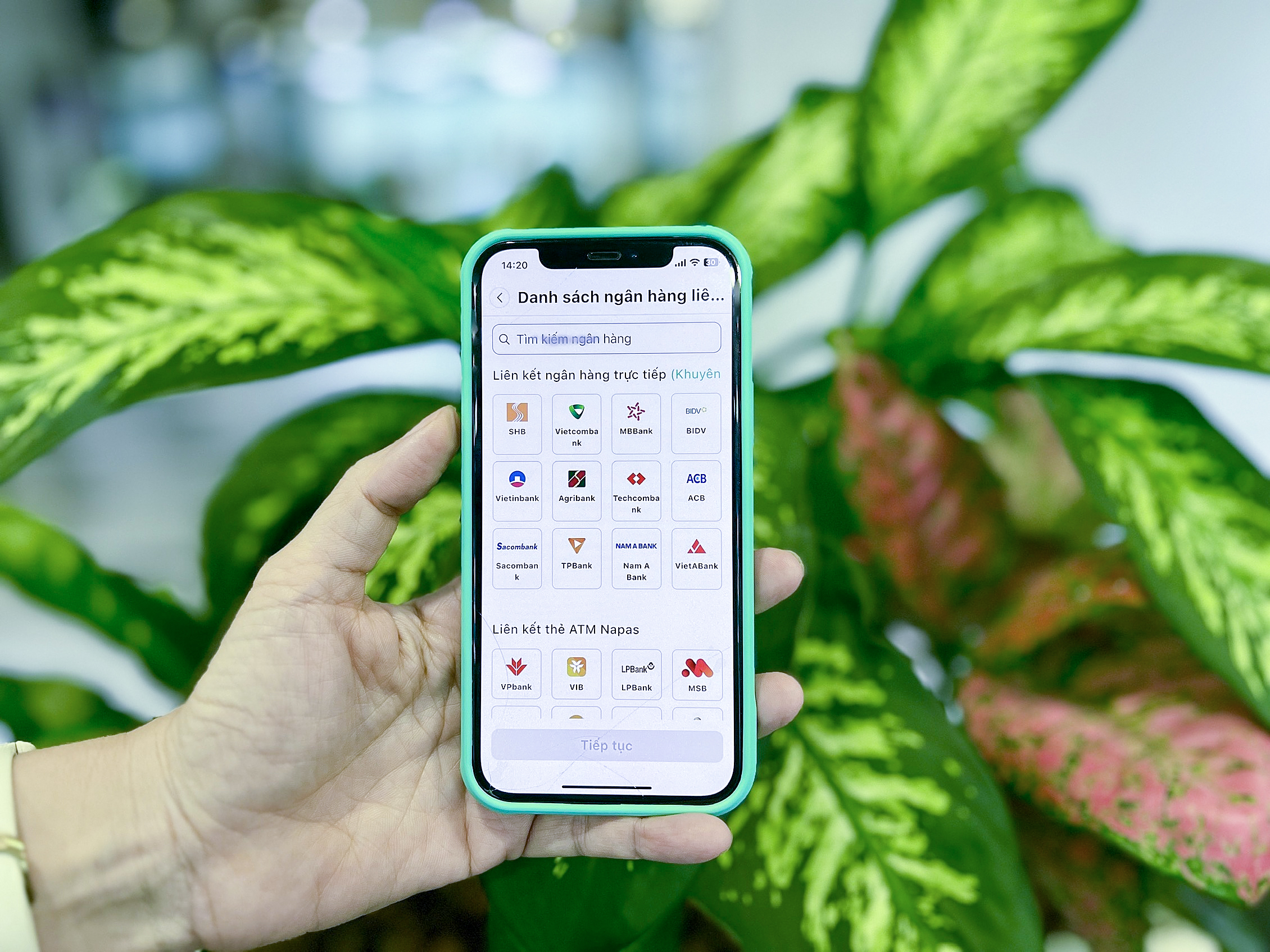

One major concern is the limited number of supported payment gateways. Not all banks directly link with VETC or ePass. VETC supports 12 banks through its app and 30 banks via ATM cards, while ePass (via Viettel Money) supports 41 banks. This means customers of unsupported banks must open new accounts to use the electronic toll collection system.

|

Screenshot of VETC app's bank linking setup. Photo: Minh Hy |

Screenshot of VETC app's bank linking setup. Photo: Minh Hy

Previously, drivers could transfer funds directly to the service provider's account, simply including their account code in the transaction details. This method offered greater flexibility and wasn't restricted by a list of supported banks.

Another inconvenience is the requirement for the vehicle owner's name to match the name on the electronic toll account. Both apps require the name, identification documents, and phone number to perfectly match the registered bank information. For example, if the wife is the registered owner, only her bank information can be linked; the husband cannot use his account to top up the toll account.

This presents a significant challenge for transport business owners. With the previous system, owners could ask drivers to top up their accounts for ETC payments. Now, owners must use their bank accounts for all vehicles. This can tie up substantial funds. For instance, an owner with 10 container trucks, each passing through a toll booth daily at a cost of 600,000-700,000 VND, would spend 6-7 million VND daily, requiring a consistently high account balance.

Even after linking a bank account, drivers still need to top up their electronic toll accounts. Direct deductions from bank accounts are not yet supported.

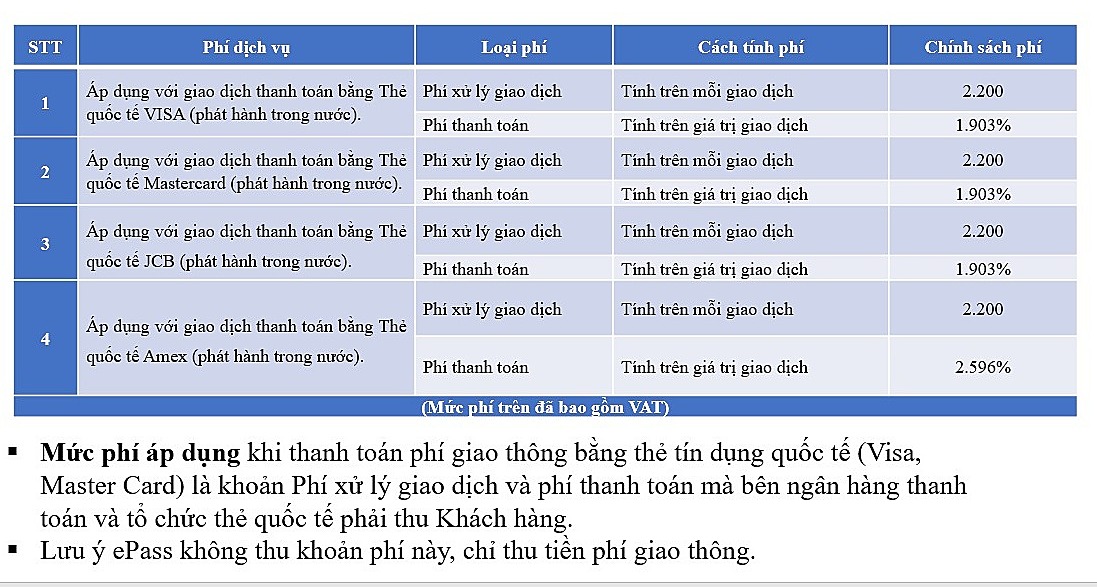

ePass allows users to link credit cards, eliminating the need for pre-loading funds. However, this incurs a 2,200 VND transaction fee and a 2-2.5% international payment fee (depending on the bank) per transaction.

For a 100,000 VND ETC fee, paying via ePass with a linked credit card adds:

: 2,200 VND transaction fee

: 1,903 VND international payment fee (1.903% of 100,000 VND)

This totals 4,103 VND in additional fees, bringing the total cost to 104,103 VND for a 100,000 VND toll.

|

Fee breakdown for credit card payments via ePass. Photo: ePass |

Fee breakdown for credit card payments via ePass. Photo: ePass

These limitations are problematic for many drivers, particularly those who use unsupported banks or need to top up accounts for rented or borrowed vehicles. Experts suggest that to achieve a successful transition, service providers should expand payment options, simplify linking procedures, reduce fees, and implement direct bank account deductions for a more user-friendly experience.

Ho Tan