Agribank will serve as the lead coordinator for the syndicated loan, collaborating with participating banks to evaluate the financial plan, allocate credit limits, and finalize loan terms. This central role underscores Agribank's commitment to national infrastructure development.

The Ring Road 4 - Hanoi Capital Region project is a significant infrastructure undertaking. It spans approximately 113.5 km, traversing Hanoi and the provinces of Hung Yen and Bac Ninh. With a total investment exceeding 85,000 billion dong, the project is divided into three component projects. Component project three, focusing on expressway construction, is being implemented under a public-private partnership (PPP) model, with a total investment exceeding 53,553 billion dong.

For component project three, the funding structure includes 44% State budget capital and 56% capital mobilized by investors. The total capital mobilized by investors amounts to 29,944 billion dong, with 25,453 billion dong arranged as credit by a consortium of banks. Agribank leads this consortium, providing 15,453 billion dong, which accounts for 60% of the total bank-arranged credit. Other key participants include Military Commercial Joint Stock Bank (MB) with 5,000 billion dong (20%), Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) with 3,000 billion dong (12%), and Vietnam Modern One Member Limited Liability Bank (MBV) with 2,000 billion dong (8%).

|

Representatives of units attending the signing ceremony for the capital financing contract for the Ring Road 4 - Hanoi Capital Region investment and construction project on 12/1. Photo: Agribank |

Representatives of units attending the signing ceremony for the capital financing contract for the Ring Road 4 - Hanoi Capital Region investment and construction project on 12/1. Photo: Agribank

Construction for component project three began on 6/9/2025. The collaboration between the investor consortium and the banks is considered a crucial factor in ensuring the project's financial viability and timely implementation.

Upon completion, the road is expected to alleviate congestion in the inner-city area, connect urban, industrial, and logistics zones, and integrate with radial expressways. This will form a comprehensive "backbone" transportation infrastructure system for the entire region, facilitating economic growth and connectivity.

|

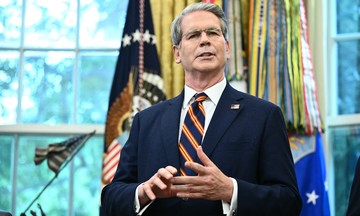

Deputy Prime Minister Ho Duc Phoc speaking at the cooperation signing ceremony. Photo: Agribank |

Deputy Prime Minister Ho Duc Phoc speaking at the cooperation signing ceremony. Photo: Agribank

Speaking at the ceremony, Deputy Prime Minister Ho Duc Phoc expressed his hope that, with the combined experience of the investors and commercial banks, the Ring Road 4 - Hanoi Capital Region project will be completed on schedule. He emphasized that the project must meet quality requirements and contribute significantly to the socio-economic development of the Hanoi Capital Region and the country.

To Huy Vu, Chairman of the Board of Members of Agribank, highlighted the importance of the banks' joint capital financing. He stated that this approach not only supplements financial resources but also leverages their risk management experience and understanding of large-scale infrastructure projects. This collective effort demonstrates the banking system's responsibility and determination towards key national projects.

|

To Huy Vu, Chairman of the Board of Members of Agribank, speaking at the ceremony. Photo: Agribank |

To Huy Vu, Chairman of the Board of Members of Agribank, speaking at the ceremony. Photo: Agribank

Beyond its role as lead capital arranger, Agribank Insurance is also a participant in the insurance consortium for component project three. This involvement aims to support risk management throughout project implementation, protect the capital of commercial banks, and reinforce confidence for the investor to potentially exceed the project schedule.

An Agribank representative shared that "these activities demonstrate Agribank's potential and commitment to supporting the strategic goals of the Party, State, and Government in implementing key national and local projects."

Agribank's robust financial position supports its involvement in such large-scale initiatives. By the end of 2025, Agribank's total assets reached nearly 2.7 million billion dong, with mobilized capital around 2.4 million billion dong and outstanding loans close to 2 million billion dong. Over the past year, the bank launched numerous preferential credit programs totaling nearly 700 billion dong, primarily focusing on priority sectors and projects related to public investment, infrastructure, and energy.

Minh Ngoc