In its newly released gold price outlook report, UOB stated that despite unusually high short-term volatility, gold remains a familiar safe-haven asset for key investor groups. However, the market needs time for speculative activity to subside, allowing prices to gradually stabilize and establish a new baseline, especially given selling pressure from "exhausted" investors who bought at high price levels.

Institutional investors are increasing their gold allocation to offset rising risks associated with the US dollar, amid growing concerns about de-dollarization and currency devaluation. Unpredictable geopolitical developments and global fiscal burdens further reinforce gold's role as a safe-haven asset. According to Heng Koon How, Head of Market Strategy, Global Economics and Market Research at UOB, central banks worldwide, particularly in emerging markets and Asia, will continue to increase their gold allocations. He noted, "Global central banks are forecast to be net buyers of gold on a large scale and will remain a significant source of market demand. They even welcome recent gold price corrections, as these present favorable opportunities to increase allocations."

The UOB expert predicts global gold prices in Quarter I this year will fluctuate around 4,800 USD an ounce, an increase of 400 USD compared to their own forecast a month ago. In Quarter II and Quarter III, the precious metal's price is predicted to reach 5,000 USD and 5,200 USD, subsequently trading around 5,400 USD in the last three months of the year.

Since the beginning of this year, the global precious metal market has experienced its most volatile period in history. Each ounce of gold traded around 4,300 USD at the start of the year, then continuously rose, surpassing 5,600 USD on 28/1. However, the euphoria was short-lived when news of President Donald Trump announcing his Federal Reserve Chair nominee triggered massive profit-taking. Gold prices saw their deepest single-session decline in 43 years, breaking through numerous psychological support levels and at one point dropping close to 4,700 USD, losing approximately 20% from its peak.

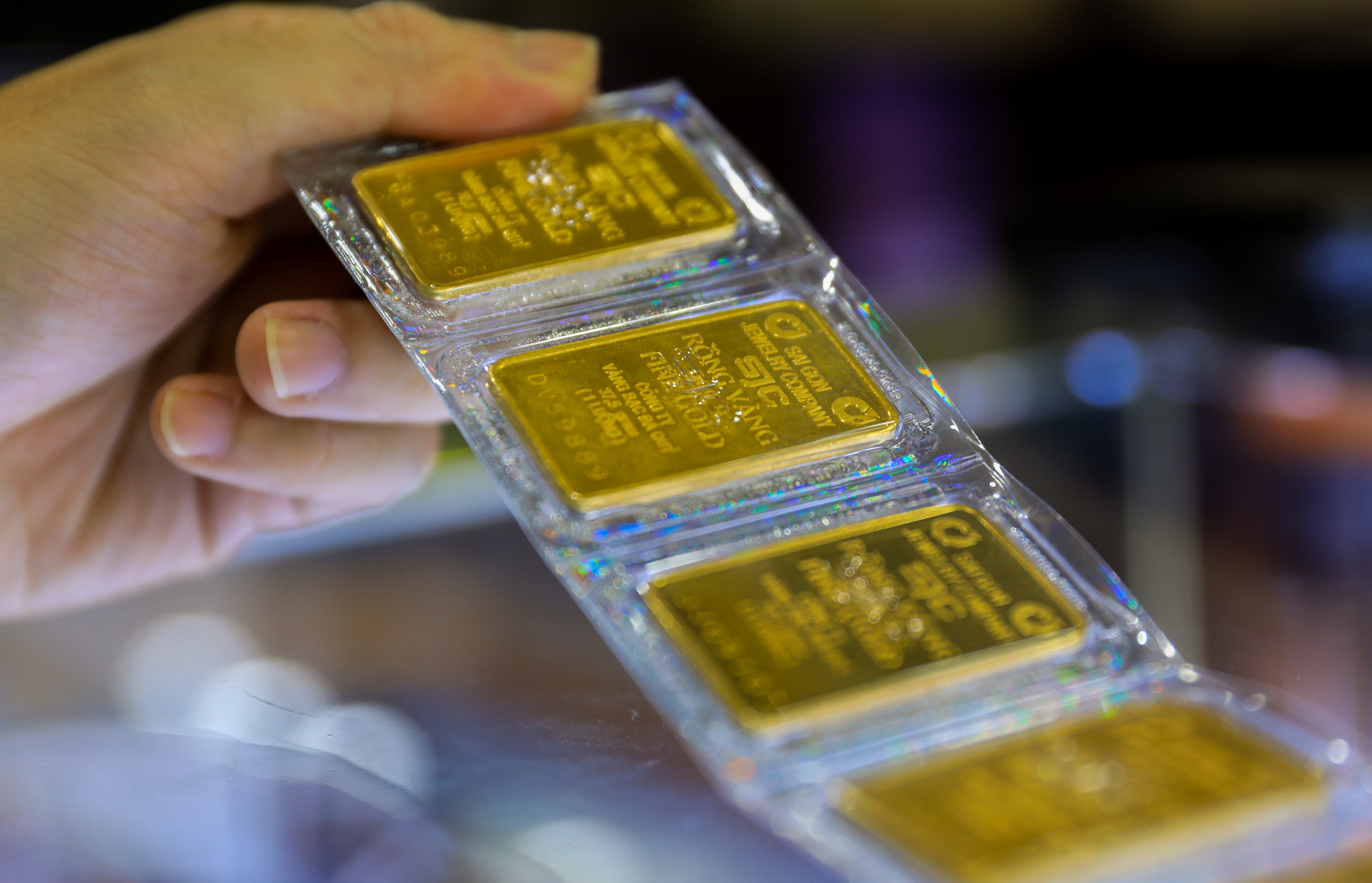

Domestic gold prices also followed the global trend. At the end of january, SJC gold bars reached a record 191.3 million VND per tael. Jewelry systems faced shortages as demand outstripped supply. A few days later, mirroring the global downturn, domestic gold slipped to 163-166 million VND per tael. As of late yesterday (9/2), domestic gold traded around 181 million VND, 24 million VND per tael higher than global prices when converted without taxes and fees.

|

SJC gold bars traded around 181 million VND per tael on 9/2. Photo: Quynh Tran |

SJC gold bars traded around 181 million VND per tael on 9/2. Photo: Quynh Tran

UOB is a Singaporean bank with offices and branches in 19 countries. It entered Vietnam in 1993 and currently has a charter capital of 10,000 ty VND, making it the second largest among 100% foreign-owned banks. Three years ago, it acquired Citibank Vietnam's retail banking division.

Phuong Dong