The product applies to apartments with or without automatic fire suppression systems. In case of an incident, PVI Insurance will cover repair costs or compensate for structural damage and assets like electronics, furniture, and valuables, as per the contract. A key benefit not always offered is temporary housing cost assistance if the apartment becomes uninhabitable.

|

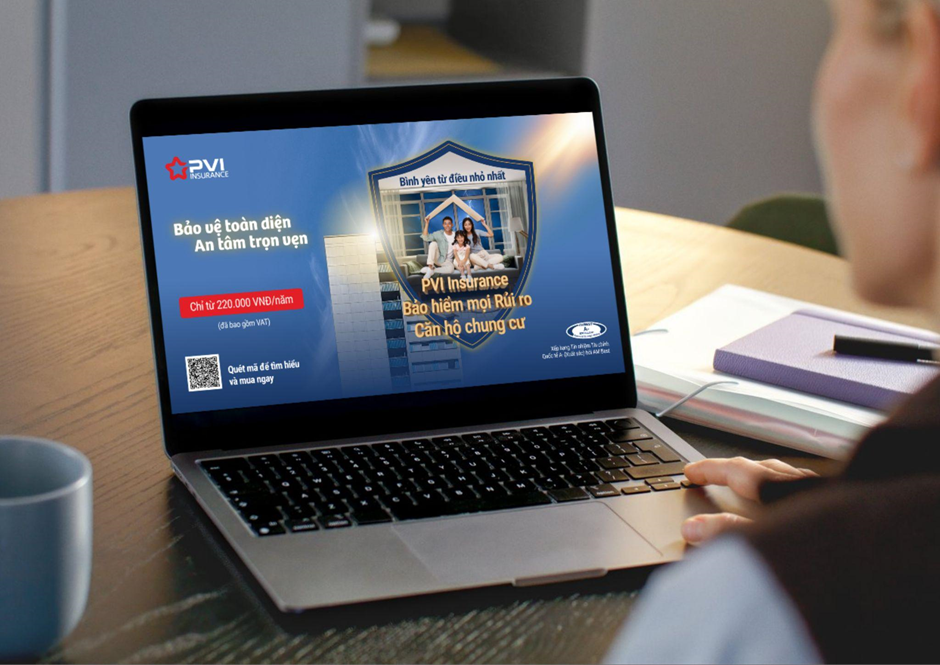

PVI Insurance's "Comprehensive Apartment Insurance" starts at 220,000 VND annually. Photo: PVI Insurance |

PVI Insurance's "Comprehensive Apartment Insurance" starts at 220,000 VND annually. Photo: PVI Insurance

A PVI Insurance representative stated the streamlined participation and claims process makes it user-friendly. Beyond financial coverage, policyholders receive continuous support from specialists, ensuring their claims are handled thoroughly and according to regulations.

Recent years have seen a rise in apartment fires across major cities, resulting in significant property damage and loss of life. Statistics show over 4,000 fires occurred nationwide in 2024, causing over 1,700 billion VND in damages. In response, the government issued Decree 105, mandating fire and special peril insurance for apartments and collective housing five stories or higher, or with a total floor area of 1,000 m2 or more, effective 1/7.

|

Fires pose a serious risk, leading to substantial property damage and loss of life. Photo: Mai Huong |

Fires pose a serious risk, leading to substantial property damage and loss of life. Photo: Mai Huong

Experts emphasize insurance is not just a legal requirement but a financial tool for proactive risk management. Amid rapid urbanization, increased fire risks, and stricter regulations, insurance helps residents comply with the law and safeguards their homes.

Minh Ngoc