According to the 2025 Online Retail Platform Market Report by e-commerce data platform Metric, the gross merchandise value (GMV) across four major platforms—Shopee, Lazada, Tiki, and TikTok Shop—reached 429,700 billion VND (16 billion USD).

Of this total, Shopee and TikTok Shop together accounted for 97% of the market share, equivalent to over 400 trillion VND. When compared to Vietnam's overall retail sector size of 5,3 quadrillion VND last year, according to data from the General Statistics Office, transactions on these two platforms made up approximately 8%, an increase from 6,5% in 2024.

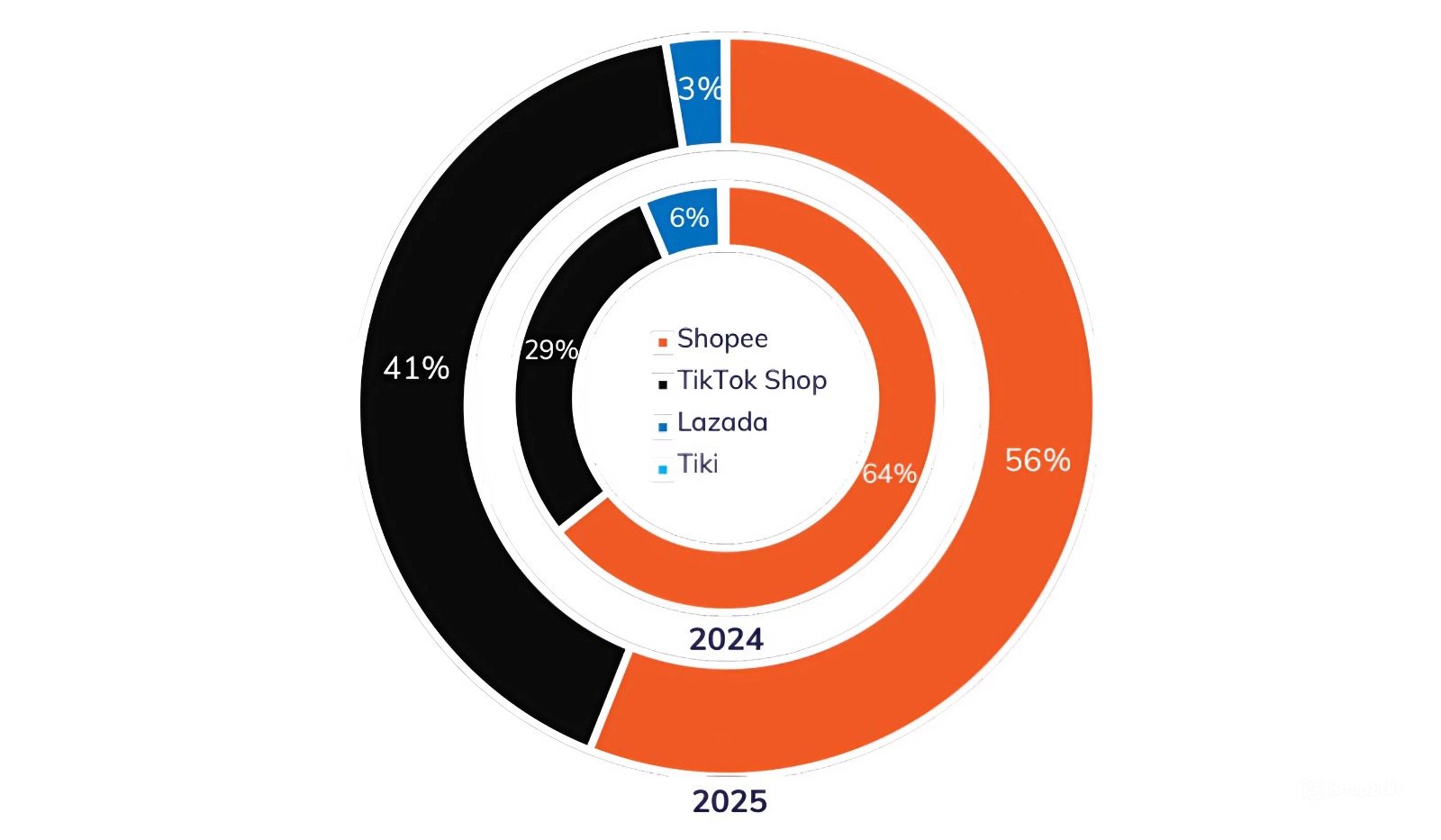

Shopee, often called the "orange platform", maintained its leading position with over 56% market share. However, its growth momentum showed signs of slowing down due to intense competition from TikTok Shop, which saw its market share expand to over 41% last year. Conversely, Lazada and Tiki experienced a reduction in their market shares, shrinking from 6% to 3%.

|

Market share of e-commerce platforms in 2024 and 2025. *Source: Metric*

Overall, across the four platforms, sales maintained high growth last year, increasing by nearly 35%. While this rate was a slight decrease compared to the 37,4% recorded in 2024, it remained four times higher than the general retail sector's growth of 8%.

Last year, Vietnamese consumers purchased over 3,6 billion products on Shopee, Lazada, Tiki, and TikTok Shop, marking an increase of over 15% compared to 2024. The most popular product categories were beauty items, home and living products, and women's fashion. Additionally, consumer goods and health products recorded high growth rates. Metric noted, "Overall, consumers continue to prioritize personal care and essential products."

Despite the significant increase in total market sales, the number of sellers (shops) across the four platforms decreased by nearly 7,5% last year, totaling 601,800 shops. This trend indicates intense competition in terms of quality and service, and reflects the effectiveness of enforcement efforts following crackdowns on counterfeit and low-quality goods by authorities.

Entering 2026, the market is likely to see further seller screening following the E-commerce Law's approval by the National Assembly on 10/12, which takes effect from 1/7. This law introduces specific regulations concerning the responsibilities of sellers, livestreamers, and platform operators.

The law also mandates the identification of sellers on e-commerce platforms via VNeID. This measure aims to assist in tracing sellers, curbing counterfeit goods and intellectual property infringement, and enhancing tax management. The government is currently developing implementation guidelines to ensure feasibility, avoid overlaps, and prevent new administrative procedures.

Vien Thong