For over a month, Hoang Phuong (TP HCM) has not logged into her securities account, despite actively trading small and mid-cap stocks almost weekly in July and August. This investor stated she perceived market risks from September, deciding to gradually withdraw capital and stay out, even as the VN-Index later peaked near 1,800 points.

"I still haven't dared to re-enter the market because this period is much harder for short-term trading; if not careful, one could fall into a bull trap", Phuong said, adding that many friends in her investment group share a similar sentiment.

|

Investors are observing an electronic price board at the headquarters of a securities company in TP HCM. *An Khuong*

Since late October, the total transaction value on the HoSE has consistently been below 30,000 ty dong, significantly lower than in previous active months. Many analysts consider this a clear indication that a cautious sentiment prevails, recommending investors limit short-term trading.

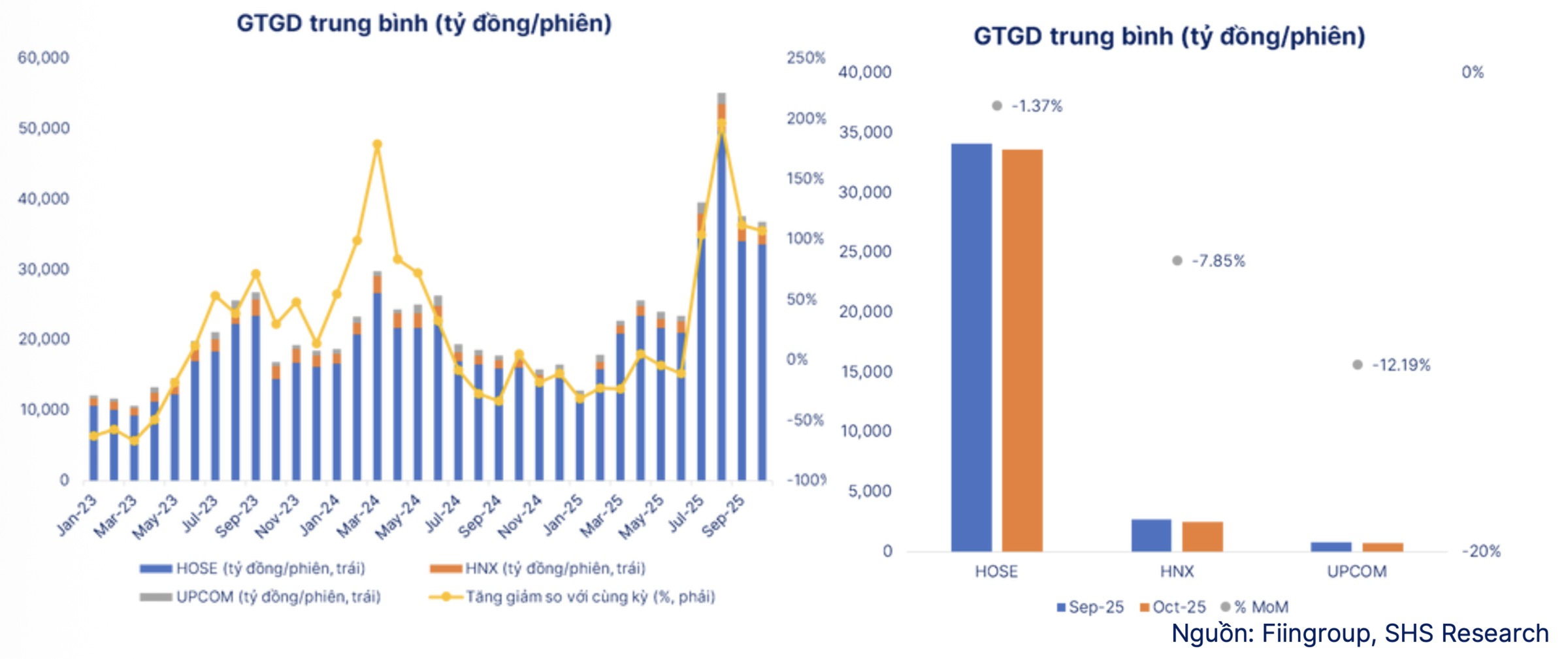

In its recent monthly strategy report, Saigon - Hanoi Securities (SHS) suggested that speculative cash flow in the stock market is declining. This is evident through liquidity and the performance of stock groups.

After peaking in August, which showed a sudden surge in speculative activity, liquidity has decreased for the second consecutive month. In October, the average daily transaction value across the entire market reached over 36,800 ty dong, a decrease of over 2% compared to September. On the HoSE, the average daily transaction value was over 33,600 ty dong, with an average of 1 ty shares, a sharp decline from the average of 1,67 ty shares per session in August.

Liquidity on the HNX also fell for the second consecutive month, with an average daily value of nearly 2,500 ty dong, a drop of 7,85%. Meanwhile, on UPCoM, the average daily transaction value decreased by over 12,2% to approximately 700 ty dong. These figures reflect a continued decline in speculative cash flow.

|

Liquidity has decreased for two consecutive months since the peak of speculative cash flow in August. *SHS*

Banking, real estate, and financial services are the three sectors with the highest average transaction values in the market, but their liquidity has also declined. The financial services sector saw approximately 6,256 ty dong traded daily, a decrease for the second consecutive month, and lower than the real estate sector (approximately 7,689 ty dong per session). According to SHS, this signifies speculative activity and expectations continuing to decrease in the market.

Regarding the performance of stock groups by capitalization, the least positive development in October was among mid-cap stocks, with the VNMID index falling by nearly 4,8%. This group is under strong selling pressure after a period of increase, characterized by heated short-term speculation and high margin debt ratios. Small-cap stocks also performed poorly, with the VNSML index dropping by 2,8%.

Large-cap stocks were the only group to record a slight increase, with the VN30 index accumulating nearly 1,2%. However, the main contribution came from prominent stocks in sectors like aviation, retail, or the Vingroup family.

Overall, SHS believes the market has diverged significantly in recent times, following two main directions. Firstly, stocks that experienced a period of rapid growth, similar to the VN-Index and with high leverage ratios, faced strong selling pressure. Concurrently, the market also saw good recovery, with improving cash flow and trends for stocks and stock groups that underwent a prolonged correction to price levels of 4-5/2025, a period of peak tariffs.

This trend, according to the analysis group, is expected to continue in November and through the end of the year as investors restructure their portfolios. "The general trend will be to sell and reduce the proportion of stocks and sectors that have seen rapid growth, surpassed fundamental valuation levels, and possess high speculative characteristics, in order to restructure into quality stocks at attractive prices with improving business results", the analysis group predicted.

Similarly, SGI Capital, manager of the open-ended fund The Ballad Fund, also believes the current environment supports long-term value investing. According to this analysis group, the "cheap money" cycle, which has lasted since 5/2023, is "reaching its final limits".

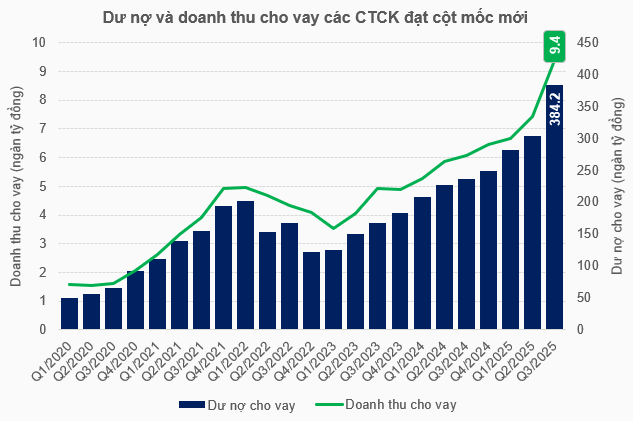

Previously, the record increase in new accounts opened, liquidity, and margin volume resulted from a prolonged low-interest-rate environment, as well as confidence and expectations for economic growth. By the end of Quarter III, the total margin debt in the market reached a record of approximately 384,200 ty dong.

"Similar to previous cycles, many individuals and businesses used various borrowed funds and short-term money to purchase stocks and other assets recently, and were forced to sell when the market experienced significant fluctuations", this analysis group commented.

|

Margin debt of securities companies reached a new record in Quarter III/2025. *SGI Capital Report*

Recently, deposit and lending interest rates have shown a tendency to rise again, starting to impact both cash flow and domestic investor sentiment, leading to a decrease in buying demand. This also puts strong pressure on interest-rate-sensitive stock groups such as banking, securities, and real estate.

Therefore, according to SGI Capital, the market will present opportunities if valuation levels decrease further. Currently, after a correction below 1,600 points, market valuations are no longer in an expensive range, mainly due to the cooling down of the banking sector. However, non-financial groups remain highly valued, especially stocks of large private corporations that have risen far beyond reasonable levels, and their attractive correlation no longer exists.

SGI Capital stated they are ready for this opportunity. The open-ended fund The Ballad Fund held 64,8% cash at the end of October. While not explicitly mentioning a disbursement decision, this will be available capital for the fund in anticipation of potential opportunities, as they assess.

In its summary report last week, Beta Securities (BSI) suggested that the current market, despite negative pressures, also holds attractive opportunities for those with long-term investment strategies. This analysis group recommended that investors prioritize observation, rational capital allocation, and risk management to leverage short-term fluctuations for long-term profit growth.

Tat Dat