A study by McKinsey & Company found that 71% of consumers desire personalized interactions from businesses that suit their specific context and needs, with 76% expressing disappointment if these expectations are not met. In the finance and insurance sector, where decisions are tied to health and long-term futures, personalization is becoming a new standard in customer experience.

Against this backdrop, leveraging the data platform of the Techcombank ecosystem, Techcom Life focuses on enhancing personalized insurance experiences, with technology at its core. Artificial intelligence applications assist the company in analyzing and updating customer profiles, thereby improving consultation accuracy, shortening processing times, and simplifying the insurance enrollment process. The application of technology also contributes to improving assessment quality, strengthening risk management, and providing a more seamless experience for users.

According to a company representative, each individual has varying health conditions, needs, and life circumstances, requiring flexible adjustments in advice and support to match.

|

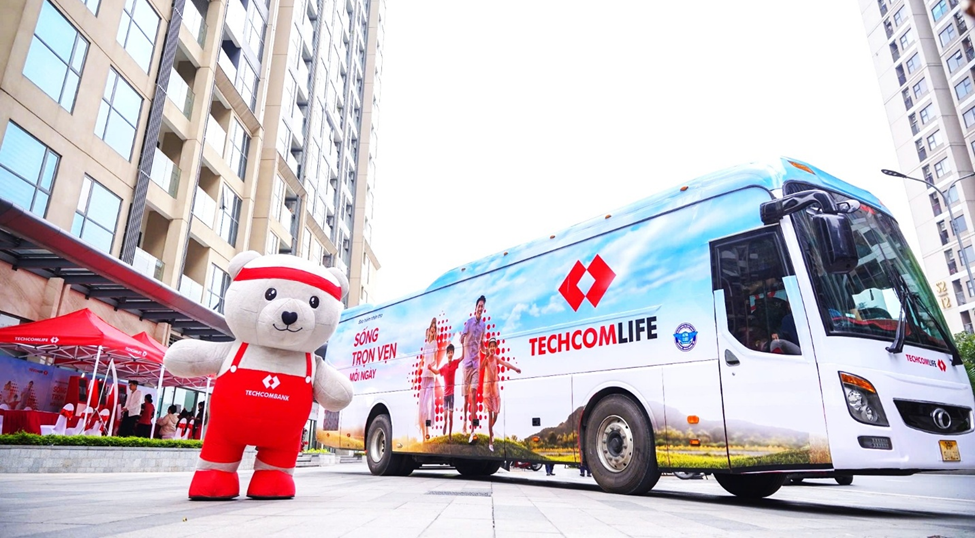

The "Journey to a Full Life Every Day" mobile event launched by Techcom Life from 2/2 - 10/2. *Photo: Techcom Life* |

At the "Journey to a Full Life Every Day" event series, launched by Techcom Life at several pilot Techcombank branches in Hanoi from 2/2 - 10/2, customers could experience AI-powered health check activities. This allowed them to assess basic indicators, identify potential risks early, and better understand their current health status.

Additionally, customers received one-on-one health consultations with a team of doctors, clarifying their health indicators and receiving lifestyle-appropriate recommendations. Based on this personal health information, financial experts further assisted customers in developing health and financial protection plans through life insurance solutions. These activities were connected within a unified journey, ensuring a seamless and uninterrupted experience.

|

Customers receiving consultations with doctors. *Photo: Techcom Life* |

Mukesh Pilania, Chairman of the Board of Directors at Techcom Life, stated that with the vision "Reinventing Insurance - Empowering Future Autonomy", the company aims to redesign the entire customer experience journey, from initial contact and consultation to claims and post-sales care. This is to provide customers with a simpler, faster, and more personalized insurance experience.

"The 'Journey to a Full Life Every Day' event series is part of Techcom Life's long-term strategy, where technology, medical expertise, and financial advisory are connected within a unified ecosystem, delivering a fast, seamless, and personalized experience to customers", Mukesh added.

|

Customers participating in the "Journey to a Full Life Every Day" event. *Photo: Techcom Life* |

After participating in the event, Nguyen Thu Diep shared that in about 20 minutes, she was able to complete various activities, from health checks and consultations with doctors to learning about suitable financial and insurance solutions. "Everything was clearly guided and convenient", she remarked.

As the need for healthcare and financial security becomes increasingly intertwined, Techcom Life defines its role not merely as an insurance solution provider, but also as a partner to customers in long-term health and financial planning. By shaping the insurance experience to be personalized, transparent, and convenient, the company aims to help each individual and family be more proactive in protecting their health, managing finances, and improving their quality of life.

Established by Techcombank, Techcom Life provides life and health insurance solutions for individuals and families in Vietnam. The company is committed to developing modern, transparent products focused on meeting three core needs: health protection, strengthening financial foundations, and improving quality of life, thereby contributing to the sustainable development of the domestic life insurance market.

Minh Ngoc