The public spending and tax cut bill, also known as the "Big Beautiful Bill" (OBBBA), was passed by the US House of Representatives on 3/7 and signed into law by President Donald Trump on Independence Day (4/7).

As part of the OBBBA, the US debt ceiling of $36.1 trillion USD was raised by $5 trillion USD, easing concerns about a potential government default in the summer. Previously, analysts had estimated the "X-date" – the point at which the US Treasury would run out of money to pay its debts if the ceiling was not raised – to be in late August or early September.

In recent weeks, yields on some US Treasury bonds maturing in August have risen, indicating investor concern about the "X-date". "The enactment of this bill has removed some of the default risk, and yields on bonds maturing in August are expected to decline slightly," said Vinny Bleau, capital markets director at Raymond James.

|

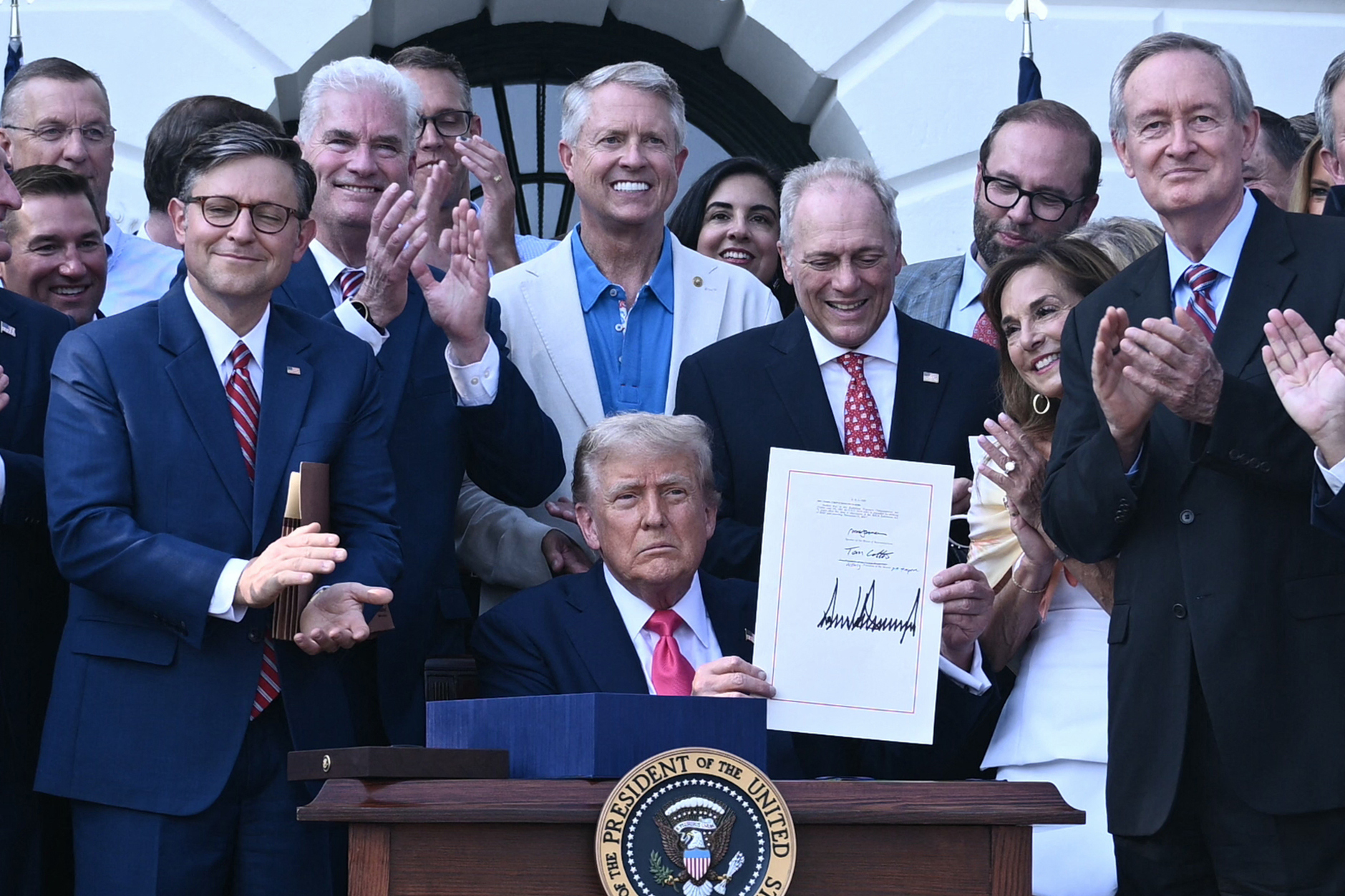

US President Donald Trump displays his signature on the "Big Beautiful Bill" during a ceremony at the White House on 4/7. Photo: AFP |

US President Donald Trump displays his signature on the "Big Beautiful Bill" during a ceremony at the White House on 4/7. Photo: AFP

However, in the long term, the OBBBA is largely seen as bad news for the bond market and US fiscal health. Analysts estimate that it will add about $3.4 trillion USD to the national debt over the next decade. This raises concerns about a surge in the supply of US Treasury bonds while demand from investors, especially international ones, is declining. This has been a major factor affecting financial markets recently.

"The 'Big Beautiful Bill' raises structural concerns about US government bonds, particularly the persistent budget deficit, high public debt, and inflation risks," said Mike Medeiros, macro strategist at Wellington Management.

BlackRock has warned that foreign investors are becoming less enthusiastic about US Treasury bonds. Demand for the approximately $500 billion USD in bonds issued each week is declining, which could push yields even higher.

"We have repeatedly warned about the perilous state of the national debt. If left unchecked, it could become the biggest risk to the US's special position in global financial markets," BlackRock's investment management team stated.

According to the Congressional Budget Office (CBO), the OBBBA could result in a $4.5 trillion USD budget shortfall, a $1.2 trillion USD reduction in spending, and approximately 10.9 million people losing Medicaid coverage over the next decade. However, the law could also stimulate economic growth by allowing businesses to fully deduct the cost of equipment investments, research and development, along with other tax incentives.

The problem is that some investors are concerned that the debt burden could limit the economic stimulus effect. Campe Goodman, a portfolio manager at Wellington Management, expects the law to boost US GDP growth by 0.5% next year but believes the market is being too complacent about the risk of higher long-term yields.

Ellen Hazen, chief strategist at F.L. Putnam Investment Management, believes the "Big Beautiful Bill" will boost corporate profit growth, a key factor supporting stock prices. "However, it could also keep bond yields high for an extended period, making many fixed-income investments less attractive," she added.

The yield on the 10-year US Treasury bond rose last week after several declines, partly due to investor unease about the upcoming fiscal situation. Andrew Brenner, head of international bonds at National Alliance Capital Markets, suggested that this sell-off is a sign that investors are reacting to loose US fiscal policy.

"These people want to see the government make real deficit cuts. In their view, Mr. Trump and Congress haven't done enough," Brenner said.

However, the overall bond market reaction has been fairly cautious following the OBBBA's enactment. This is partly because the market has already factored in the widening budget deficit since Mr. Trump returned to the White House in January. Therefore, the main concern for investors now is growth signals.

In fact, many experts also believe that raising the debt ceiling is not a dominant factor in the stock market. "It's not a market driver right now," said Robert Pavlik, senior portfolio manager at Dakota Wealth.

The S&P 500 closed at a record high on 2/7, thanks to a surge in technology stocks and progress in US trade deals. Recent economic data shows signs of slowing down, making expectations of a Federal Reserve (Fed) rate cut this year clearer, thereby supporting sentiment in both the stock and bond markets.

Phien An (Reuters)