"It's all about increasing wages and bonuses right now; there's no other way," Thao stated, explaining the company's efforts to attract workers through higher brokerage fees, salaries, and incentives.

Thao's company, a lithium-ion battery manufacturer, recently expanded with a new factory, creating a need for about 150 technical and production staff. Despite a month of diverse recruitment efforts, including instant bonuses and TikTok livestreams, they filled only 40% of the positions. Notably, roles requiring skilled technicians, team leaders, and foreign language proficiency – positions typically in high demand – attracted almost no suitable candidates.

The company faces a 40% turnover rate within the first three days, necessitating recruitment of two or even three times the required number to offset losses. Even for a modest number of hires, competition is intense as numerous factories vie for workers during the year-end surge, she noted.

This scarcity of skilled and experienced labor is a recurring challenge in manufacturing during the final months of the year. As order volumes increase, companies are driven to offer higher salaries and bonuses to attract staff, a strategy that may prove unsustainable in the long run.

A recent labor and employment report from the TopCV platform indicates that nearly 70% of businesses are increasing recruitment, with 50% reporting a substantial rise. However, the rapid turnover among seasonal workers means 47% of companies are concerned about a lack of experienced candidates, and 42% fear a skills gap.

Bac Ninh has solidified its position as a northern "growth star," attracting 5.5 billion USD in foreign direct investment (FDI) by 2025, surpassing targets and ranking third nationally. The province hosts nearly 3,400 industrial projects, primarily in electronics, components, textiles, and logistics, employing around 830,000 workers, most of whom are from outside the province. With industrial land occupancy exceeding 55% and continuous factory expansions, labor shortages are common, peaking around the Lunar New Year (Tet) and at the start of the year.

To attract talent, companies are offering substantial immediate bonuses. For instance, individuals who apply directly or via internal referrals receive a 9 million VND bonus after four months of employment, with the referrer getting 4 million VND. This represents a 2.5-fold increase compared to the previous year. "Yet, our rates are only average; some businesses are offering even more generous incentives," Thao commented.

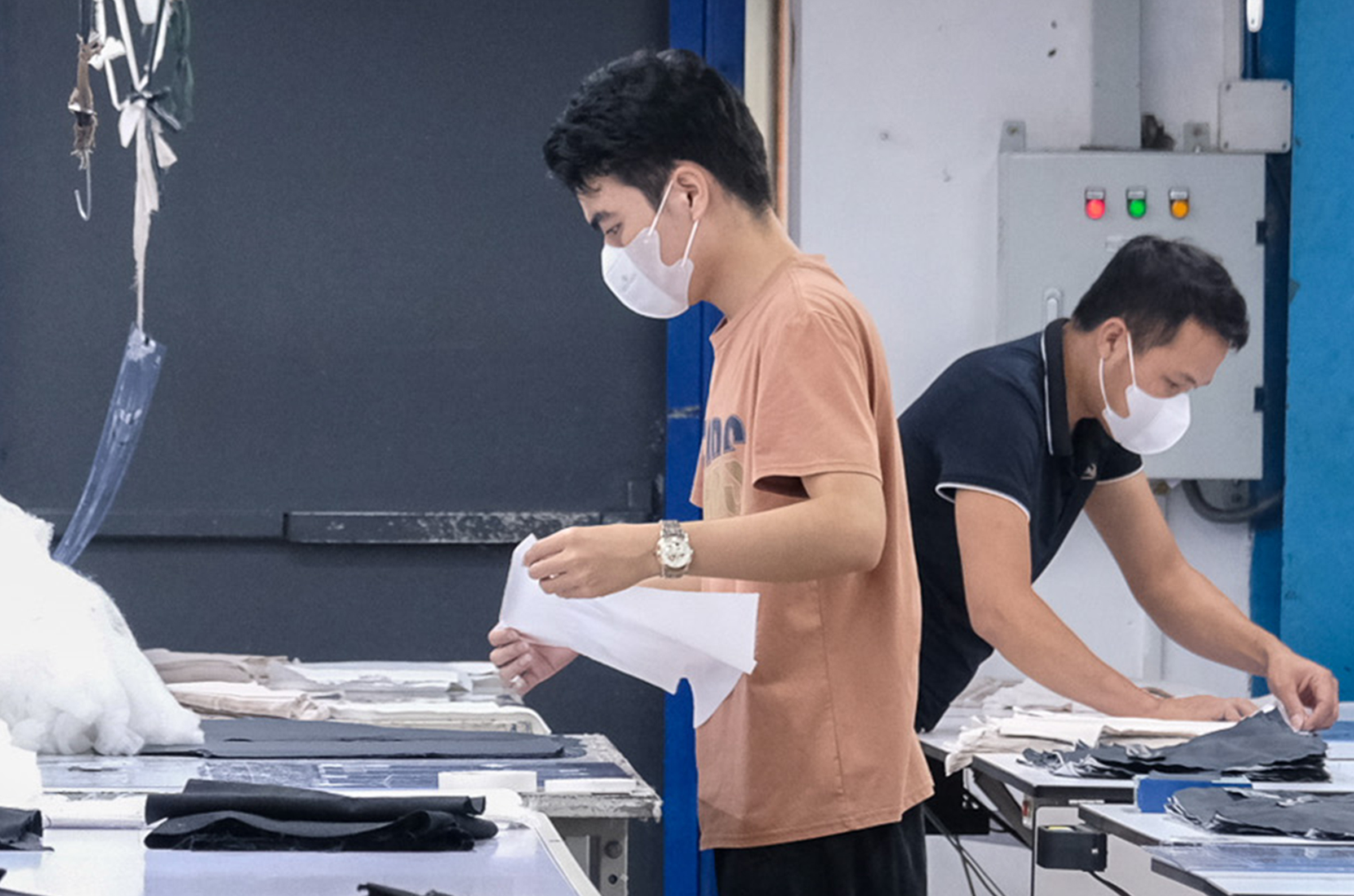

The garment industry faces a similar recruitment challenge. Crystal Martin Vietnam, which employs over 10,000 workers at Quang Chau Industrial Park, needs to hire thousands in the final two months of the year due to a surge in orders. Nguyen Van Chi, the trade union chairman, noted that despite continuous recruitment, suitable candidates are scarce. The industry demands meticulousness and dexterity, with training for new hires typically taking two to three months to reach proficiency. Furthermore, the garment sector seldom recruits individuals over 40, exacerbating the difficulty in finding new workers.

Chi's company previously recruited from northern mountainous villages. More recently, they launched livestream channels on Facebook and TikTok to directly address candidate inquiries, offer salary and bonus details, and provide gifts.

|

Workers on a sewing line in Bac Ninh. Photo: Quan Ha |

While recruitment bonuses attract new hires, they can sometimes cause resentment among long-term employees, Chi explained. To retain experienced staff, the company now offers an additional 5-8 million VND to workers with 5-10 years of service, up from the previous 2-3 million VND.

The Korean Chamber of Commerce (KOCHAM) has confirmed that Korean businesses face a shortage of manufacturing personnel, particularly skilled labor and middle management. The prevalence of job-hopping in provinces such as Bac Ninh, Thai Nguyen, and Hanoi is compelling companies to implement retention strategies and increase training investments.

"Competition for human resources will intensify as foreign direct investment (FDI) grows," predicted Ko Tae Yeon, Chairman of KOCHAM.

|

Workers applying for jobs at an electronics factory in Bac Giang (old) in early 2025. Photo: Gia Doan |

Doctor Pham Ngoc Toan, Deputy Director of the Institute of State Organizational Science and Labor at the Ministry of Home Affairs, characterized the labor shortage as seasonal and localized within major FDI zones, influenced by global market volatility. He also noted that the electronics and garment sectors continue to demand a substantial human workforce, even with technological advancements and AI support enhancing efficiency.

The competitive bonus system has positive immediate effects: it boosts income for new hires, retains long-term staff, stabilizes production, and stimulates local demand, he explained. However, in the long term, rising labor costs hinder domestic businesses' competitiveness. This trend could foster a segment of short-term job-hoppers who fail to acquire valuable skills and are quickly displaced by automation. Ultimately, it exacerbates skill stratification, leading to shortages of technicians, maintenance specialists, team leaders, and experienced personnel.

"Without skill adjustments or upgrades, the disparity between available labor skills and market demands will become a significant issue," he observed.

Drawing on 10 years of experience managing labor fluctuations, Thao stated her company actively recruits new staff but prioritizes retaining existing employees, particularly high-level technical personnel. Instead of allocating substantial funds to "job-hopping" groups, her company ensures a monthly income of 13-15 million VND and provides an additional 1.4 million VND monthly bonus for employees who complete a full year of service and meet performance targets.

"This approach ensures stability across both our established and newer production lines," she explained.

Hong Chieu