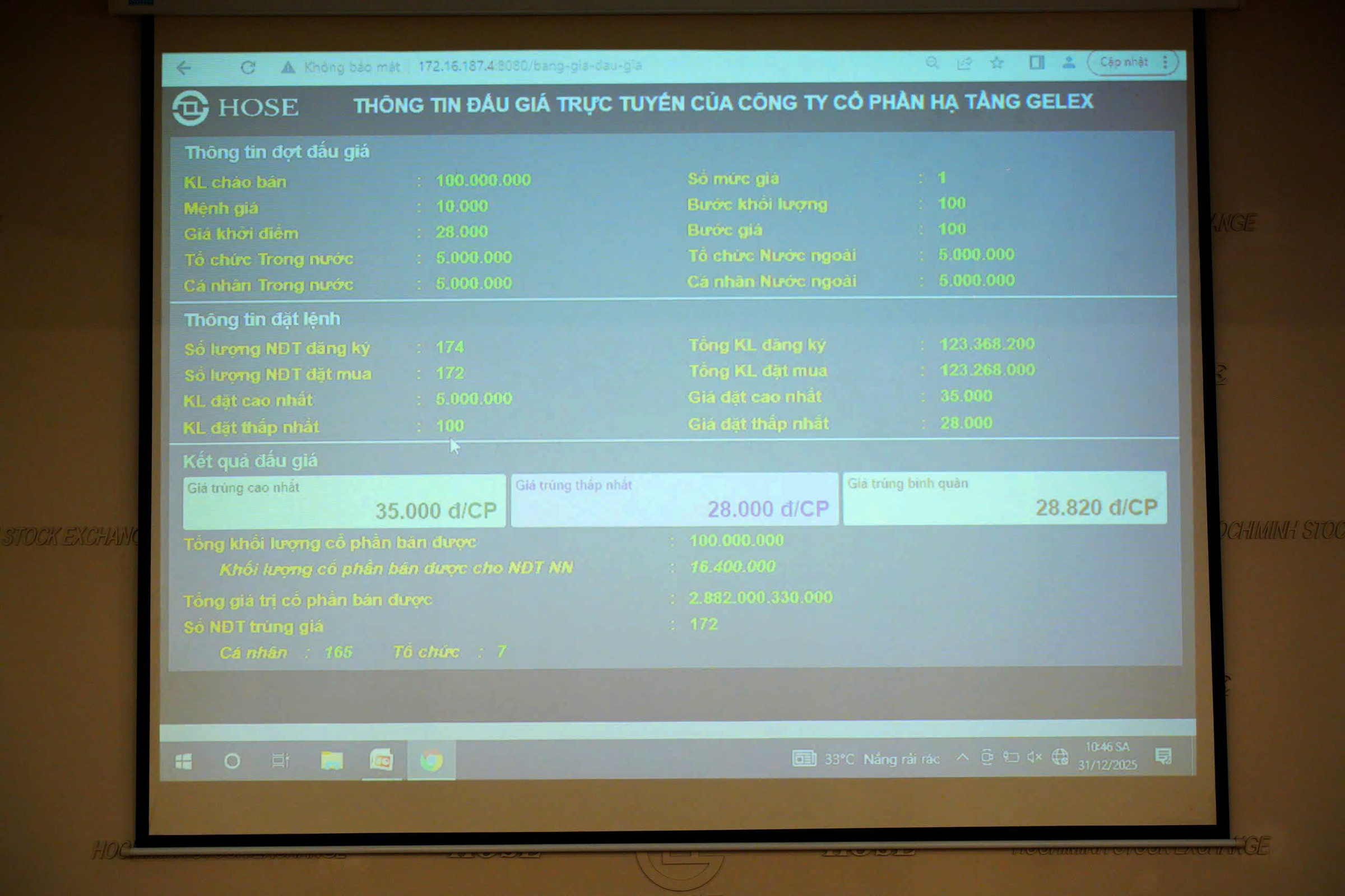

Starting at 28,000 VND per share, the auction attracted 172 valid investors: 165 domestic individual investors, three domestic organizations, and four foreign organizations. Total bids exceeded the offering, reaching over 123,2 million shares. The highest bid was 35,000 VND per share.

|

The auction on the morning of 31/12. Photo: Ha Tang Gelex |

Ultimately, 100 million shares were allocated among the 172 investors, with 16,4 million shares sold to foreign investors. Successful bid prices ranged from 28,000 to 35,000 VND, resulting in an average winning price of 28,820 VND per share. Ha Tang Gelex garnered a total of 2,882 billion VND from this auction.

This valuation places Ha Tang Gelex's enterprise value at approximately 25,640 billion VND. The company plans to officially list its shares on HoSE in February 2026, aiming to expand its presence in the capital market.

|

Auction results. Photo: Ha Tang Gelex |

The company stated that the capital raised from the auction will be used to increase the charter capital of Titan Hai Phong Joint Stock Company and to supplement equity for the investment, construction, and business infrastructure project of Tran Duong - Hoa Binh Industrial Park (Area A, phase 1) in Hai Phong. Additionally, it will support financial restructuring efforts.

Ha Tang Gelex is one of two subsidiaries of Gelex Group, alongside Gelex Electric (stock code GEE). The company manages capital across real estate, building materials, and utility infrastructure sectors, including energy and clean water. It also holds ownership and investments in entities such as Viglacera, Long Son Petroleum Industrial Park, Song Da Clean Water, and Titan Hai Phong.

Regarding business results, Ha Tang Gelex's total assets reached 41,396 billion VND by the end of QIII/2025. Net revenue for the first nine months of the year was 9,999 billion VND, a 13,3% increase year-on-year. Pre-tax profit reached 1,356 billion VND, marking a 55,5% rise.

For 2025, the company aims for 15,445 billion VND in revenue and 1,925 billion VND in pre-tax profit. After nine months, it had achieved 64,8% and 70,4% of these annual targets, respectively.

According to Ha Tang Gelex leadership, the company benefits from a strong asset portfolio, solid financial foundation, stable cash flow, and proven management and M&A capabilities.

Minh Ngoc