The "Steel Shield" feature acts as a proactive layer of protection during money transfers. The system automatically scans and cross-checks recipient account information as soon as the user initiates a transfer. If it detects anomalies, such as discrepancies in personal data, matches with warning lists from authorities or the managing bank, or flags suspicious transaction history, the system alerts the user before the transaction is completed.

The solution is currently applied to Napas 24/7 fast money transfers, a popular channel for individual users. The bank states the feature provides real-time alerts without disrupting the user experience, empowering customers to assess risks and decide whether to proceed with transactions.

|

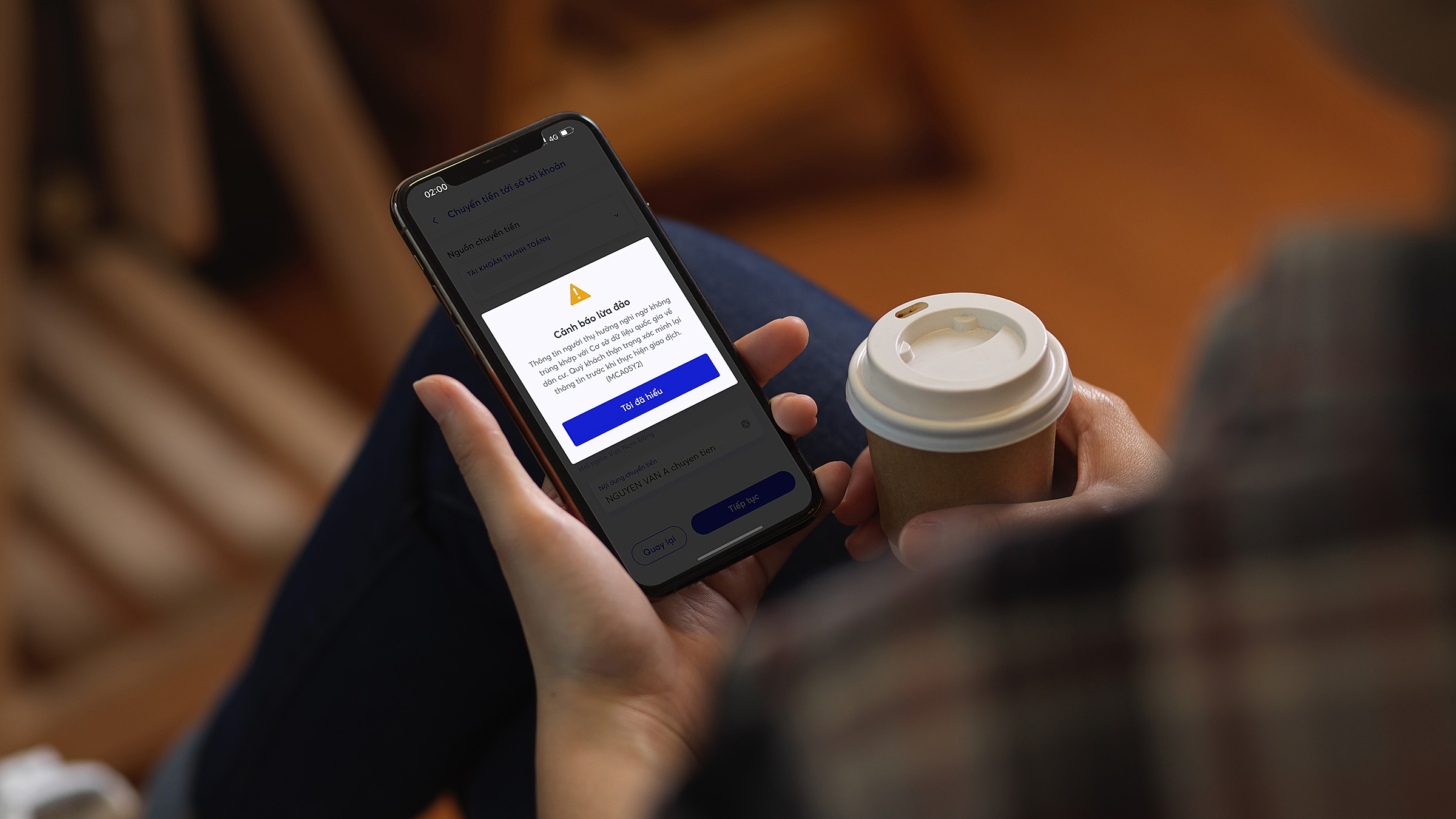

Users will receive alerts when the bank detects suspicious transaction accounts. Photo: MB |

According to an MB representative, "Steel Shield" is part of a broader effort to enhance financial safety for customers. The bank has previously implemented several technology solutions to bolster security, including the "MB Reimburses Lost Money" program, which compensates for transaction-related losses, and App Protection, a suite of solutions that provides early warnings for malware, unusual activities, and suspicious destination accounts.

The development of this solution aligns with Circular 17/2024 issued by the State Bank of Vietnam regarding the management and use of payment accounts. MB is one of the first five major banks selected for the pilot implementation of this Circular. MB is also a member of the Fraud Prevention Information Network, a real-time data sharing system connecting credit institutions and authorities to exchange information on suspicious accounts.

At the Banking Digital Transformation Conference held in 5/2025, Vu Thanh Trung, Deputy Chairman of MB's Board of Directors, affirmed the bank's goal of becoming a sustainable digital financial group, collaborating with authorities to ensure national financial security. With Steel Shield and the interconnected network, MB not only strengthens its customer protection but also contributes to the overall industry's defense against fraud.

Experts believe that using technology to monitor accounts with signs of fraud is essential given the rise in cybercrime. However, in addition to preventive measures from banks, users also need to be vigilant, cautious about sharing personal information, and proactive in checking alerts before making transactions.

Minh Ngoc