The conference is annually organized by the National Payment Corporation of Vietnam (Napas) to evaluate operational results and outline development strategies for the next phase.

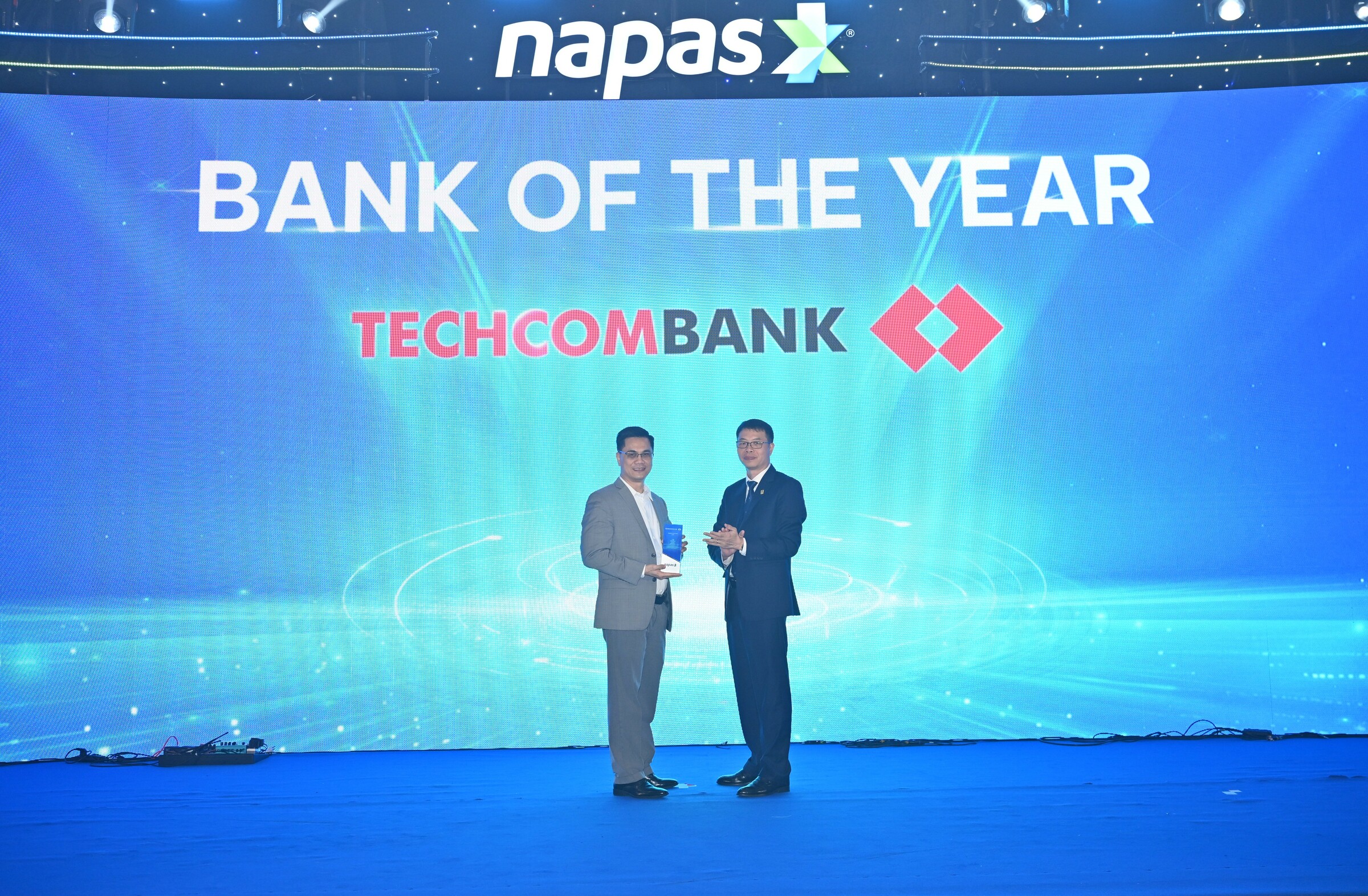

At the event, Napas held an awards ceremony honoring 18 banks for their outstanding contributions in 2025. Among them, Techcombank received the Bank of the Year award; Vietcombank, MB, and Sacombank were recognized as exemplary banks.

|

The chairman of the board of directors of Napas presents an award to a Techcombank representative. *Photo: Napas* |

In the service development award category, Agribank led in Napas card payment transactions at both online and offline acceptance points. Techcombank and Eximbank were recognized for their notable contributions to promoting the Napas 247 fast money transfer service.

Regarding the payment acceptance network, NCB was honored as the bank with the best VietQRPay coverage; Agribank topped the list for ATM network investment efficiency; while HDBank led in both POS and online payment acceptance network categories.

In card development, Vietcombank, MB, and Agribank were the three banks with the most outstanding Napas card issuance and service development rates. OCB and Woori Bank were recognized for their active card user bases. Vikki Bank led the market in the number of Napas - MasterCard co-branded cards, while OCB was at the forefront of Napas credit card usage trends.

Many banks were also recognized in the innovation category, including: BVBank, NCB, BIDV, Vietcombank, VIB, Nam A Bank, SHB, Sacombank, MB, and VRB. Finally, the award for the most dynamic banks in cooperation and project implementation with Napas went to: BIDV, Agribank, VietinBank, MB, and NCB.

|

The general director of Napas presents awards to representatives from Vietcombank, MB, and Sacombank. *Photo: Napas* |

Within the conference framework, Napas and its member units also discussed the domestic economic landscape and prominent trends in the electronic payment market. Following government directives, innovation and digital transformation continue to be the foundation for promoting the digital economy, with payment activities playing a crucial infrastructure role in increasing transaction efficiency and supporting the circulation of goods and services.

A Napas representative stated that the electronic payment sector will continue to grow, but this will be accompanied by higher demands for safety, security, and the ability to process large-scale transactions. In response to this trend, the company announced its focus on technology development and improving operational quality to meet the increasing transaction needs of users and businesses.

In 2025, the Napas system recorded a 23,7% growth in transaction volume and 8,7% in value compared to 2024, processing over 32 million transactions daily on average. The fast money transfer service via VietQR codes continued its strong expansion, with nearly 90 million mobile banking accounts using QR scanning. For the first 10 months of the year alone, VietQR transactions increased by over 52% in volume and 85% in value year-on-year. The system's continuous operation rate reached 99,997%.

|

Representatives from units participating in the 2025 Member Organization Conference. *Photo: Napas* |

During the year, the company also implemented several technical projects, such as upgrading money transfer and QR service standards, launching a digital payment platform, and deploying Tap and Pay on Android and Apple Pay for iOS devices. VietQRPay and VietQRGlobal services were standardized to meet domestic and cross-border transaction needs. The system has completed QR payment connections with Thailand, Cambodia, and Laos, and will expand to China in early 12/2025 through cooperation with UnionPay. Napas stated it will continue to expand connections to Singapore, South Korea, Japan, India, and other countries, aiming to build a seamless payment network with reasonable costs.

Alongside service expansion, Napas strengthened fraud prevention solutions to ensure transaction safety. A risk transaction alert tool has been deployed to member organizations based on data from the State Bank's SIMO system and the Ministry of Public Security. Concurrently, Napas also collaborated with the Vietnam Banks' Association to issue a fraud handling handbook, assisting banks in detecting and managing unusual transactions, thereby promoting secure transactions within the digital payment environment.

Speaking at the conference, Nguyen Quang Hung, chairman of the board of directors of Napas, affirmed that the company remains committed to ensuring a stable, secure, and continuous payment infrastructure, while also innovating to meet the increasingly diverse transaction needs of individuals and businesses.

"The positive results in 2025 were achieved thanks to the cooperation of our member organizations. Moving forward, Napas hopes to continue this collaboration to jointly build a safe, modern, and connected digital payment system that reaches regional prominence, serving the people and businesses of Vietnam in the best possible way," a Napas representative shared.

Looking ahead to 2026, Napas aims to expand key services such as: VietQRPay, VietQRGlobal, and Tap and Pay; promote cross-border payment connections with regional markets; and enhance technology application to ensure system security and improve user experience.

Minh Ngoc