The competition for securities brokerage market share on the Ho Chi Minh City Stock Exchange (HoSE) remained fierce throughout 2025, with companies closely trailing each other. According to the latest statistics from HoSE, the 10 leading companies in the market collectively hold 68.4% of the market share for brokerage, fund certificates, and covered warrants.

VPS continued to hold the top spot with 15.95% market share. However, signs of losing momentum emerged as its share dropped by 2.3 percentage points compared to the previous year, extending a two-year decline. SSI, the company ranked immediately after, gained the most from this shift. SSI now commands 11.53% of the brokerage market share, an increase of nearly 2.4 percentage points from the previous year, reaching its highest level in five years.

The only position swap within the top 10 occurred between Vietcap and HSC. Both companies saw an increase in their brokerage market share year-on-year. Vietcap climbed to fourth place with 6.55%, while HSC moved down to fifth with 6.52%. The remaining positions were held by companies that were also present in the previous year's rankings: VNDirect, MBS, Mirae Asset, KIS, and VCBS.

Brokerage market share is calculated based on transaction value. Therefore, a larger market share typically translates to higher brokerage fee revenue. Securities companies also view market share as a measure of their ability to attract and retain clients, the quality of their services, and the advisory capabilities of their brokerage teams.

According to Le Vu Kim Tinh, Branch Director at Phu Hung Securities (PHS), the brokerage market share race has been intense since 2020. This metric consistently ranks as a primary objective for business units within securities firms, alongside profit, outstanding loan balances, and client base size.

"A securities company can gain market share in just a few quarters by reducing transaction fees or offering loan incentives," Tinh told VnExpress. "However, to change its position significantly in the rankings, a company needs several years to execute a long-term business strategy."

|

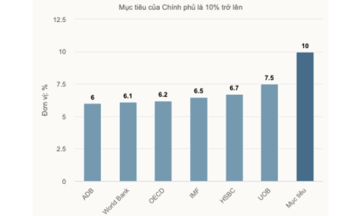

In recent years, many securities companies have set goals to improve their market share ranking. VPBankS aims to be among the top 2 in brokerage market share by 2030, despite its best performance to date being ninth in Q4/2025. Vietcap's leadership previously stated that if they could restart, they would have invested in the individual client segment earlier to maintain a top five market share. In the institutional client segment, they remain at the top with approximately 30%.

The strategy for most securities companies in the market share race involves increasing capital to fund margin lending at low interest rates. Companies consistently raise capital, ranging from several hundred billion to thousands of billions of dong, through initial public offerings, private placements, or syndicated loans from foreign financial institutions.

They also implement "zero fee" policies, often with conditions related to time or portfolio value. Regular livestreamed investment advisory workshops and meetings with listed companies are organized to attract capital from individual investors. Some companies also provide additional bonuses for their brokers.

"Beyond capital capacity, the quality of advisory services and trading infrastructure are key factors supporting market share expansion," an SSI executive stated. "As individual investors increasingly engage in active trading and capital rapidly shifts between sectors, the demand for real-time data, system stability, and decision-making tools becomes more critical."

Phuong Dong