A "black swan event" is a negative or unpredictable occurrence that is considered highly improbable. According to Douglas Matheson, senior director of Credit Risk Management and Compliance at HSBC Vietnam, while these events are rare, they seem to be happening more often.

In recent years, several events have been classified as "black swan events": the 2019 US-China trade war, the 2020 Covid-19 outbreak, the 2021 Suez Canal blockage, the Russia-Ukraine conflict beginning in 2022, and the 2023 US banking crisis.

Each event caused business disruptions, highlighting the urgent need for risk management and resilience-building. This year, the latest "black swan event" emerged in 4/2025 with the announcement of retaliatory tariffs by the US.

According to the HSBC Global Trade Pulse survey, while the final tariff rates and implementation timeline remain unclear, businesses are already feeling the impact. 80% of Vietnamese businesses surveyed reported increased costs, and 75% anticipate this situation to persist in the medium term. Many are considering shifting their target markets and increasing data analysis to adapt. 76% are optimistic that challenges will foster innovation.

|

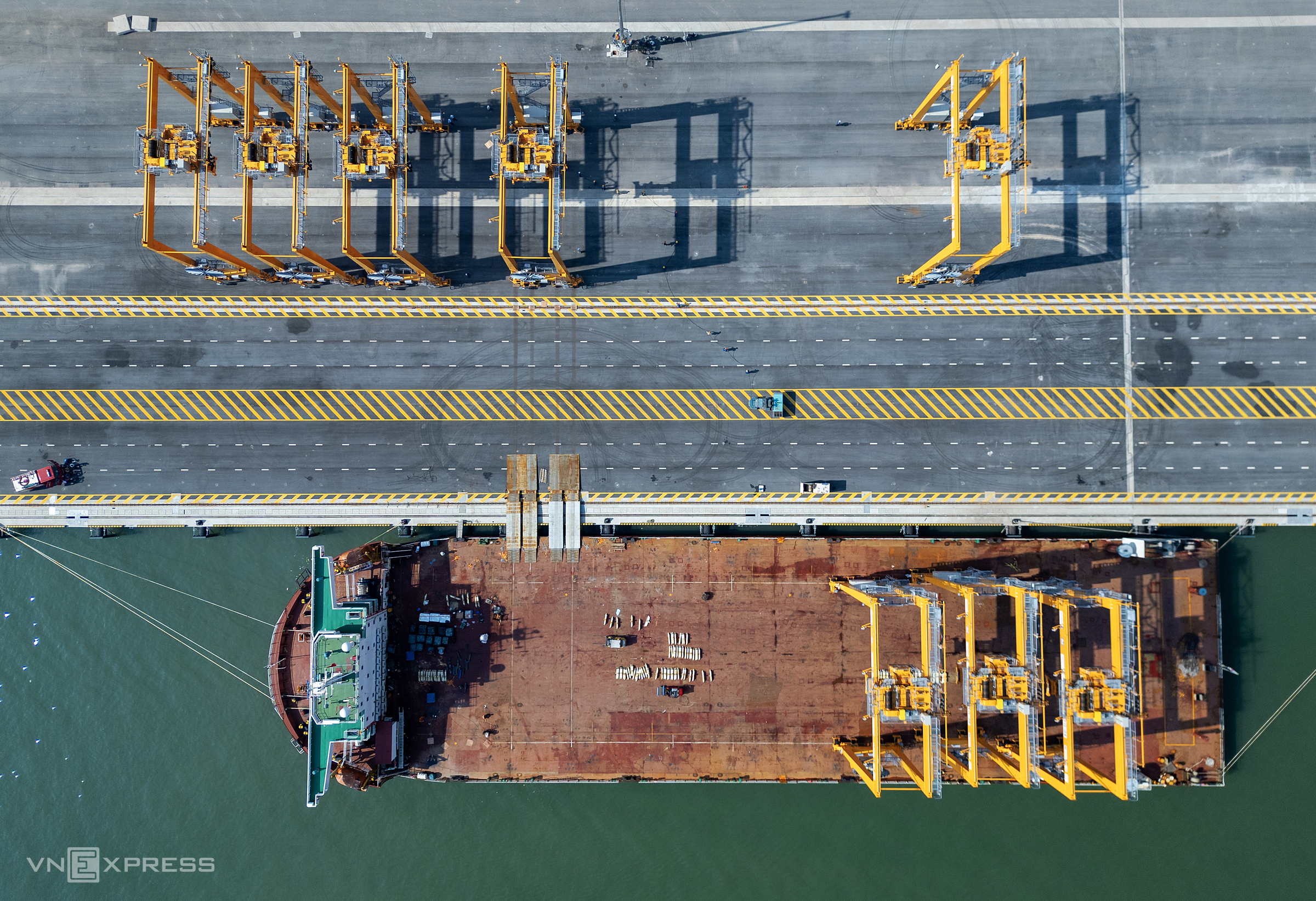

Lach Huyen Port Cluster, Hai Phong, 20/1. Photo Le Tan |

In these volatile times, Douglas Matheson recommends businesses focus on three key risks to enhance their resilience and adaptability.

Counterparty risk: Increasingly globalized supply chains are inherently more vulnerable. A weak link, such as a financially struggling supplier, a logistics partner facing legal issues, or a buyer delaying payment, can disrupt operations. Additionally, trade disputes can escalate in an increasingly uncertain world.

Matheson suggests companies monitor several levels of risk: assessing the counterparty's risk profile, understanding the local laws of the buyer's jurisdiction, and identifying potential risks arising from longer trade terms.

Counterparty credit risk should be considered and integrated into the operations of multiple departments, from finance and strategy to business development, not just limited to back-office procedures.

Businesses should also pay attention to "incoterms," the standard trade rules developed by the International Chamber of Commerce (ICC). These rules define the division of risks and responsibilities between the seller and buyer, such as who pays for shipping, bears the risk of damage or loss of goods, and handles customs clearance.

While fundamental, incoterms can be essential risk management tools. For example, choosing between FOB (Free on Board) or CIF (Cost, Insurance, and Freight) delivery can shift responsibility for shipping risks and the scope of cargo insurance, providing a buffer against tariff impacts.

Re-examining traditional trade instruments like letters of credit or bills of exchange can significantly reduce the risk of non-payment. When discussing trade finance with banks, businesses can explore further risk mitigation tools and unlock working capital.

Foreign exchange risk: While counterparty risk often develops gradually, foreign exchange risk can strike like an earthquake: suddenly, shockingly, and potentially devastatingly. Currency fluctuations can erode profit margins and disrupt forecasts.

In 2022, the Japanese yen plummeted to a 38-year low against the USD, losing over 25% of its value in just a few months, due to the Bank of Japan's (BOJ) persistent monetary easing while the US Federal Reserve raised interest rates. Even the Chinese yuan depreciated in 4/2023, reaching its lowest point since 2023.

Without preventative measures, Matheson warns, currency fluctuations can cause significant and sudden profit swings. For companies with tight margins or long contract cycles, these fluctuations can be the difference between profit and loss.

According to HSBC's 2024 Business Risk Management Survey, 47% of corporate financial managers admitted to being unprepared, rating foreign exchange risk higher than supply chain (35%) or climate (34%) risks. Over 40% of surveyed businesses experienced reduced earnings due to a lack of foreign exchange risk hedging.

Forward foreign exchange transactions, contracts at a predetermined future exchange rate, are the most common currency hedging tools, fixing the exchange rate at the time of the transaction regardless of payment terms. "It's crucial for CFOs to review their company's entire foreign exchange strategy," Matheson recommends.

Governance risk: Governance risk fundamentally relates to the integrity and robustness of decision-making structures. According to Matheson, clear segregation of duties, dual approval systems, and audit trails are crucial for internal control. Critical thinking is also essential at all levels.

While organizations increasingly prioritize data, intuition and experience still offer the advantage of detecting issues that algorithms might miss. Diversity of experience or background, whether in management or on the board of directors, can bring valuable critical perspectives and suggestions.

Rotation of key control personnel, regular scenario testing, and rigorous independent audits contribute to a more comprehensive risk management culture. Businesses should also encourage employees to provide feedback, ask questions about inconsistencies, and voice concerns without fear of reprisal.

According to the HSBC expert, volatility has become the norm in today's world. "For business leaders, the question isn't whether the next disruption will occur, but whether your organization can identify and adapt in a timely manner to address the risks it brings," he notes.

Therefore, the risk management mindset needs to shift from reactive and siloed operations to a proactive and integrated approach. Potential risks and mitigation strategies should be discussed at all levels of the organization. While innovation should be encouraged, there must also be a clear awareness of the potential downsides.

Dy Tung