Nearly 150 countries agreed to the adjustment, according to an announcement by the Organization for Economic Cooperation and Development (OECD) on 5/1. The exemption for US-headquartered multinational corporations was finalized after negotiations between President Donald Trump's administration and other G7 members.

OECD Secretary-General Mathias Cormann called the agreement with the US a "landmark decision in international tax cooperation," stating it "increases tax certainty, reduces complexity, and protects the tax base."

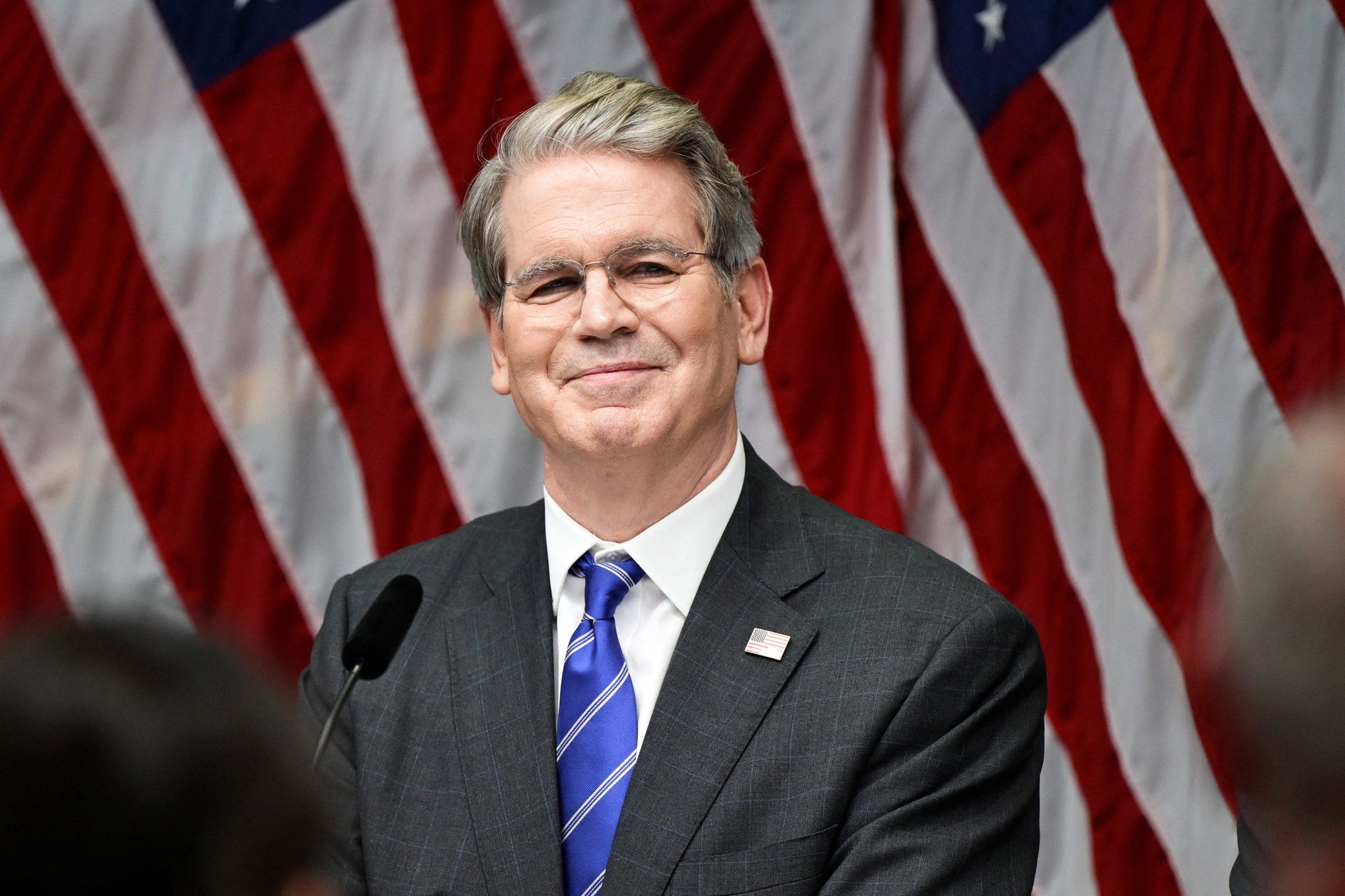

US Treasury Secretary Scott Bessent hailed it as a "historic victory for protecting US sovereignty, workers, and businesses from extraterritorial imposition."

|

US Treasury Secretary Scott Bessent at an event on 29/7/2025. Photo: Reuters |

The global minimum tax, an OECD-backed initiative, aims to end tax rate competition among nations and ensure large corporations contribute fairly to national budgets. It allows countries where products or services are consumed to tax large companies, even without a direct physical presence.

Nearly 140 countries finalized the agreement in 10/2021. It applies to companies with revenues of 750 million euros or more, setting a global minimum tax rate of 15%. The European Union, the UK, and many other countries have already implemented it.

Former US Treasury Secretary Janet Yellen was a key proponent of the 2021 global minimum tax. However, the US Congress never passed measures for the country to comply. On 20/1/2025, upon returning to the White House, Trump signed a memorandum declaring the global minimum tax agreement invalid in the US.

According to AP, exempting US corporations from the global minimum tax significantly weakens the agreement. The original idea aimed to prevent multinational corporations, including Apple and Nike, from using accounting and legal tactics to shift profits to "tax havens" with low or zero tax rates.

These tax havens often include locations like Bermuda and the Cayman Islands, where companies conduct little to no actual business. Some tax transparency advocacy organizations criticized the OECD's revised plan.

"This agreement risks eroding nearly a decade of global progress on corporate taxation, simply to allow the largest and most profitable US companies to continue reporting profits in tax havens," commented Zorka Milin, Policy Director at the FACT Coalition.

Conversely, Republican lawmakers in the US Congress welcomed the agreement's completion with the OECD. Senate Finance Committee Chairman Mike Crapo and House Ways and Means Committee Chairman Jason Smith issued a joint statement: "Today marks another important milestone in putting America first and reversing the Biden administration's unilateral concession on global taxation."

Phi An (according to AP)