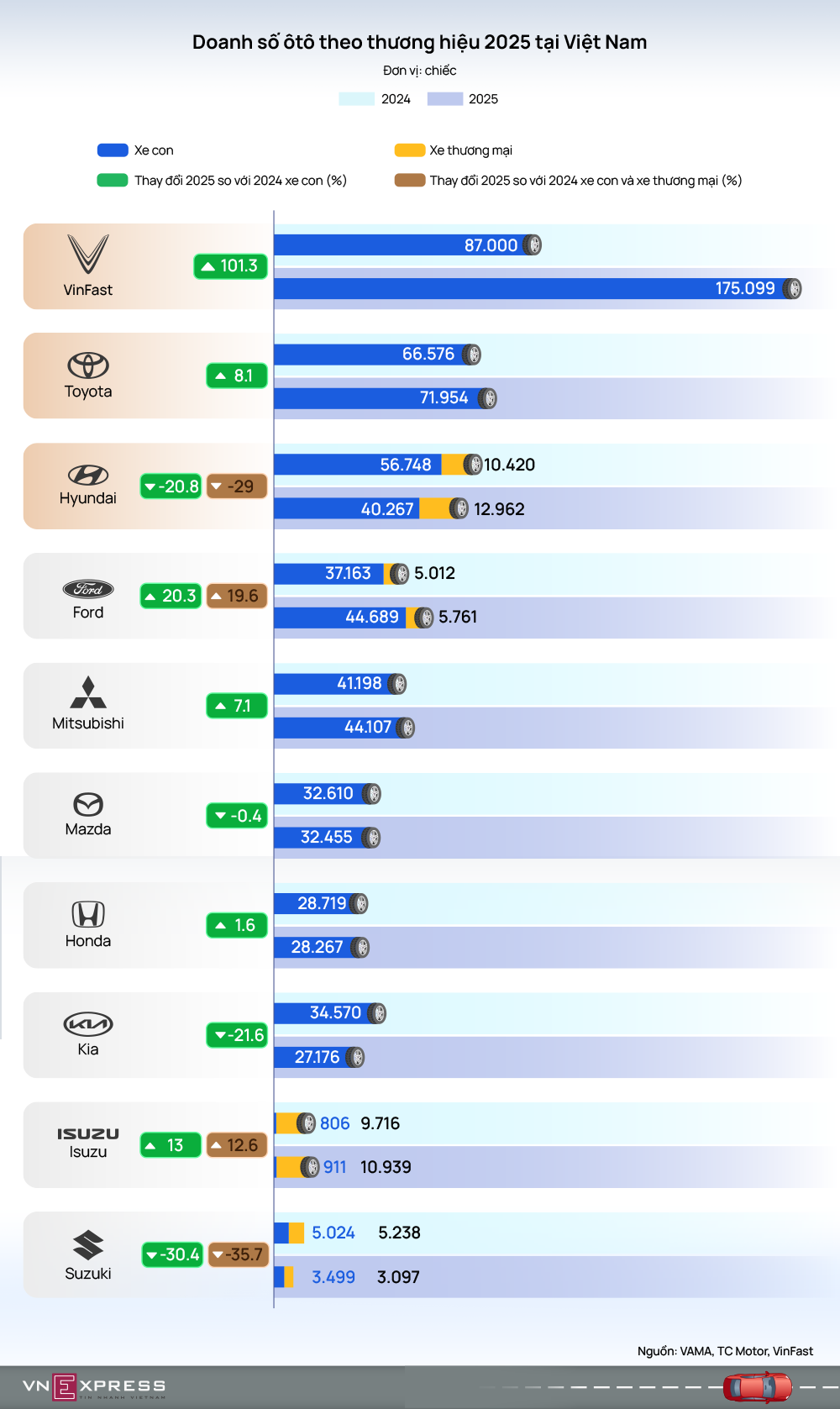

Mazda's sales in Vietnam remained largely flat over the past year. The total number of vehicles sold reached 32,455 units in 2025, a slight decrease of 146 units compared to 2024 (32,601 units), representing a decline of approximately 0.5%. While the overall market expanded, Mazda was among a few brands, including Kia and Hyundai, that experienced a decrease in sales. Sedan model sales continued their decline, while the high-clearance vehicle segment maintained its growth momentum, becoming the brand's sales backbone.

|

The new generation Mazda CX-5 is expected to be sold in Vietnam in 2026. *Ho Tan* |

Across the broader market, Mazda maintained its 6th position in sales for both 2024 and 2025. This ranking remained unchanged even as other brands saw significant fluctuations in production, with some achieving double-digit growth and others experiencing sharp declines. This stable ranking indicates a consistent performance for Mazda but also a lack of significant breakthrough over the past year. The CX-5 continued to be Mazda's flagship model, accounting for over half of its total sales in 2025. Conversely, the Mazda6 exited the Vietnamese market from mid-2025 following a sharp drop in sales.

Over the past two years, the Mazda CX-5 has played a decisive role in Mazda's business performance in Vietnam. CX-5 sales increased from 14,781 units in 2024 to 17,262 units in 2025, an increase of over 16%. This boosted its contribution from approximately 45% to over 53% of the brand's total sales.

This growth stems from its competitive pricing advantage within the C-segment crossover category, coupled with strong incentive strategies and a product lifecycle that remains appealing compared to rivals that have transitioned to new generations. As a result, the Mazda CX-5 maintained its segment-leading position in 2025, capturing approximately 29% of the market share, surpassing the Ford Territory, VinFast VF 7, and Hyundai Tucson. In 2026, a new generation Mazda CX-5 is expected to launch in Vietnam, featuring updates to its design, interior, and technology.

The Mazda2 was the Japanese brand's second best-selling model in 2025, with 5,465 units sold, a slight increase from 5,092 units in 2024. In the B-segment sedan and hatchback category, the Mazda2 ranked 4th in sales in 2025, holding approximately 14% of the market share, trailing the Toyota Vios, Honda City, and Hyundai Accent. Although not leading its segment, the Mazda2 maintained stable sales due to its accessible price, design appealing to various customer groups, low running costs, and suitability for urban or first-time car buyers.

The remaining Mazda models primarily recorded mixed performance compared to 2024. In the 2,000-3,000 unit sales group, the Mazda3 saw a significant decline from 4,958 units to 2,969 units, a decrease of nearly 40%. Despite this, it still led the C-segment sedan/hatchback category with a 47% market share amidst a shrinking segment. The CX-8 was a rare bright spot, increasing slightly from 2,693 to 2,864 units, though this growth was modest, and it remained behind the market-leading D-segment SUVs. Meanwhile, the CX-3 decreased from 2,745 to 2,202 units, even after transitioning to domestic assembly from mid-year.

|

At the lower end of Mazda's 2025 lineup, both the CX-30 and Mazda6 recorded a downward trend compared to the previous year. The CX-30 sold 1,637 units, a slight decrease from 1,715 units in 2024, accounting for approximately 16% of the B+-segment CUV market. It continued to face challenges against the segment-dominant Toyota Corolla Cross. Meanwhile, the Mazda6 experienced a sharp decline from 612 units to only 56 units, representing just 2% of the D-segment sedan market, before being officially discontinued and withdrawn from the Vietnamese market.

Ho Tan