Prime Minister Pham Minh Chinh has directed the State Bank of Vietnam (SBV) to accelerate efforts in researching and proposing the establishment of a national gold exchange, urging no further delays. This directive, issued in a dispatch on 8/2, also calls for the SBV to develop solutions for mobilizing foreign currency and gold bars held by the public.

The call to mobilize gold and foreign currency reflects a long-standing economic objective. According to World Gold Council (WGC) data released last year, Vietnam is among the region's top gold consumers, with an average annual consumption of about 55 tons. This figure exceeds Thailand's 48,8 tons and Indonesia's 47,3 tons. The WGC also noted Vietnam's leading growth in regional gold demand in 2022. Despite this high consumption, experts indicate that most of this gold remains in public hands, representing a significant resource yet to be converted into productive capital for the economy.

Experts largely agree that leveraging these gold resources requires a cautious, step-by-step approach rather than sudden administrative mandates. They suggest regulators prioritize refining legal and regulatory frameworks, standardizing gold-linked financial instruments, and developing robust trading, depository, and oversight infrastructure. Increased transparent communication is also crucial for building public trust. To shift the public's habit of holding gold bars, the State needs to introduce appealing, transparent, and easily tradable gold-backed financial products: such as Indian-style gold bonds, or digitized gold certificates guaranteed to be convertible into physical gold at any time.

|

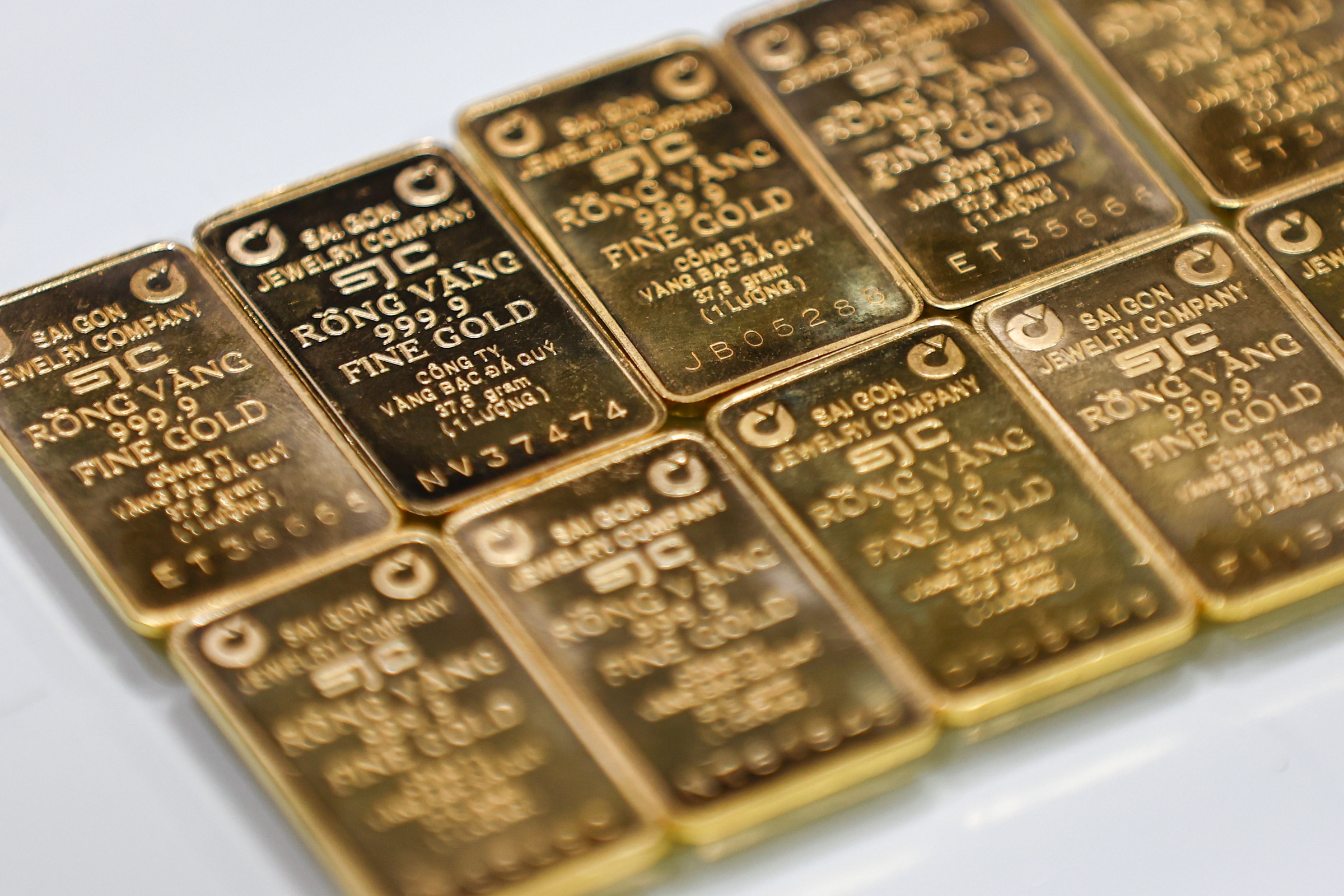

Gold bars at SJC headquarters in District 3, 3/2025. *Photo: Quynh Tran* |

These initiatives align with Vietnam's broader economic goals for this year, which include achieving two-digit growth, stabilizing the macroeconomy, and ensuring major economic balances. The prime minister's dispatch also outlined various solutions for managing monetary and fiscal policies to support these objectives.

The Ministry of Finance is tasked with implementing a reasonably expansive fiscal policy, closely coordinating with monetary policy. Its responsibilities include effectively mobilizing domestic and foreign resources, developing capital markets, attracting foreign direct investment (FDI), and creating medium- to long-term capital channels for the economy. The ministry will also pilot a digital asset exchange, officially launch an international financial center in February, and develop a carbon market. Additionally, it must provide solutions to help small and medium-sized enterprises (SMEs) access finance and complete the national single window for investment.

The State Bank of Vietnam (SBV) is mandated to proactively manage monetary policy, closely monitoring inflation, exchange rates, and interest rates to prevent market shocks. The banking sector must also ensure appropriate and transparent credit growth, directing capital towards production and priority sectors while effectively managing risks. Furthermore, the Ministry of Industry and Trade will enhance trade promotion, diversify markets, and boost exports. This ministry is also responsible for implementing solutions to ensure energy security, preventing electricity and fuel shortages in all circumstances.

Phuong Dung