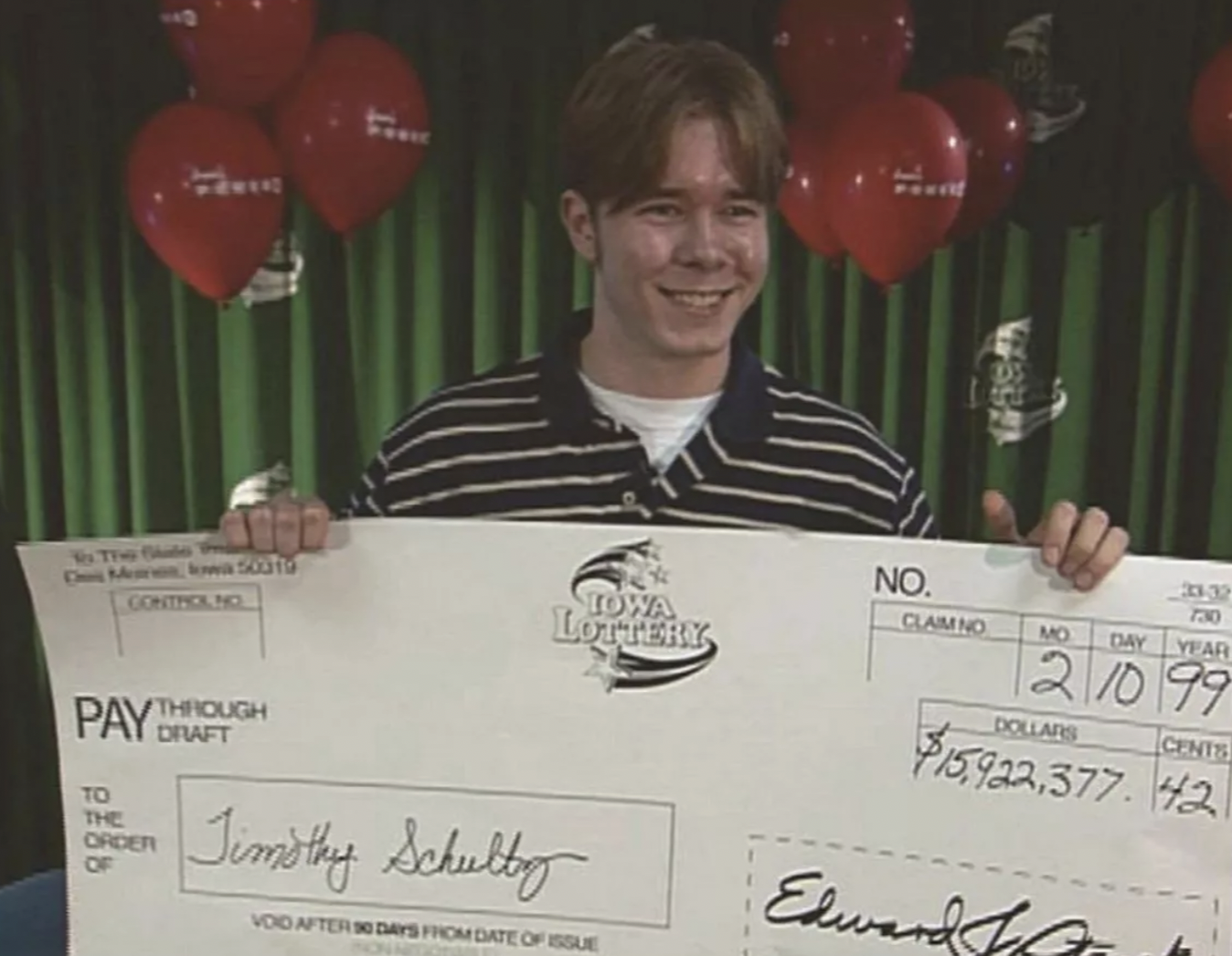

In 1999, Timothy Schultz, living in Iowa, was a poor student working at a gas station to cover tuition. His life changed overnight when a Powerball ticket he bought at work won the 28 million USD jackpot.

From a young man struggling with debt, Schultz suddenly retired at age 21. "I felt like I was holding a magic wand; anything was possible. But I also knew many people went bankrupt just a few years after winning the lottery", he recalled.

|

Timothy Schultz won the lottery in 1999. Photo: BI |

This clear-headedness stemmed from an incident immediately after receiving the prize. Schultz was sued by a colleague who demanded a share of the winnings, claiming to have contributed to the ticket purchase. Although he successfully defended his prize after a legal dispute, this experience taught him a crucial lesson: the necessity of legal safeguards and financial clarity.

Upon receiving the money, instead of spending, Schultz established a financial management team comprising a lawyer, a tax advisor, and an investment specialist.

The lawyer helped him handle legal procedures to protect his identity and assets. The tax advisor analyzed payment options (lump sum or annuity) to optimize his obligations to the state. Meanwhile, the financial specialist helped him build a secure investment portfolio including stocks, bonds, and funds.

"This was a pivotal decision that kept me from repeating the mistakes of many other lottery winners", Schultz said.

According to the National Endowment for Financial Education, a financial education organization in the US, about 70% of lottery winners in the US lose all their money within a few years due to a lack of management planning.

Schultz chose a lifestyle of "making money work" rather than spending on depreciating assets. The first item he bought was just a game console—something he had always dreamed of but never dared to purchase. Later, he bought a common car and a modest house. Most of the winnings were kept in long-term investment accounts. Every major expense had to answer the question: "Does this dip into the principal?".

The biggest challenge for the young man then was learning to say "no". After news of his win became public, Schultz received countless letters from strangers asking for money for medical treatment or to pay off debts. Friends and relatives automatically assumed he was a "walking ATM", constantly expecting him to pay for meals or shared trips.

"Many people bluntly told me that since I had money and didn't have to work, I had a responsibility to share it", he recounted.

To maintain relationships while preserving his assets, Schultz and his advisors established strict financial principles: only providing support within a pre-determined budget. Thanks to this boundary, he escaped the endless cycle of lending and gifting money.

|

Timothy Schultz speaking on the Lottery, Dreams, and Fortune podcast. Photo: NY Post |

Over 25 years later, his cautious strategy has paid off. In his 40s, Timothy Schultz continues to live comfortably thanks to investment returns. Not needing to work for a living, he dedicates his time to journalism, producing podcasts, and developing a YouTube channel that interviews other lottery winners.

"My only regret is not buying Bitcoin early, but the security has given me peace of mind", the millionaire in his 40s shared. For him, the greatest victory was not the jackpot itself, but overcoming temptation to preserve his fortune for a quarter century.

Ngoc Ngan (According to Business Insider)